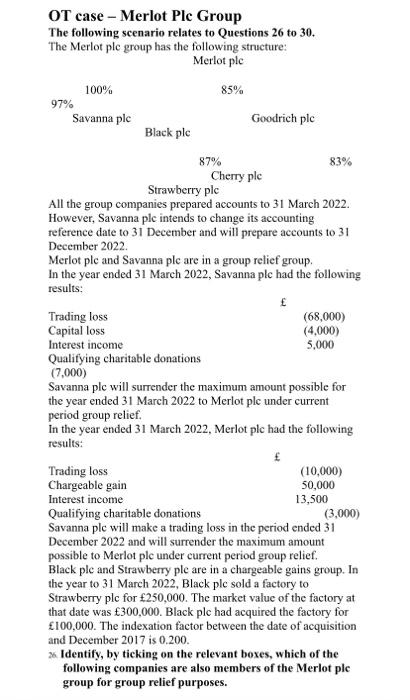

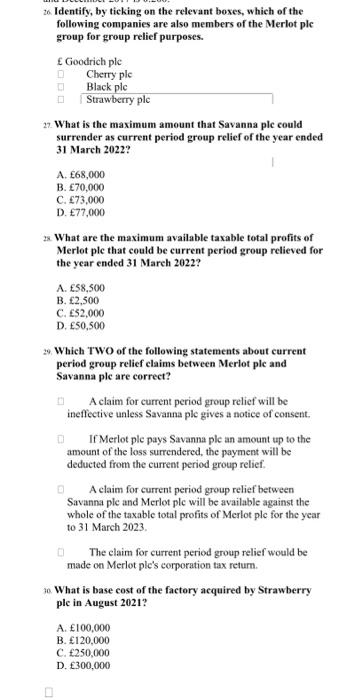

OT case - Merlot Plc Group The following scenario relates to Questions 26 to 30 . The Merlot ple group has the following structure: Merlot plc 20. Identify, by ticking on the relevant bexes, which of the following companies are also members of the Merlot ple group for group relief purposes. E Goodrich ple Cherry ple Black ple Strawberry ple 27. What is the maximum amount that Savanna ple could surrender as current period group relief of the year ended 31 March 2022? A. 68,000 B. 70,000 C.73,000 D. 77,000 28 What are the maximum available taxable total profits of Merlot ple that could be current period group relieved for the year ended 31 March 2022? A. 58,500 B. 2,500 C,c52,000 D. 50,500 29. Which TWO of the following statements about current period group relief claims between Merlot ple and Savanna ple are correct? A claim for current period group relief will be ineffective unless Savarna ple gives a notice of consent. If Merlot ple pays Savanna ple an amount up to the amount of the loss surrendered, the payment will be deducted from the current period group relief. A claim for current period group relief between Savanna ple and Merlot ple will be available against the whole of the taxable total profits of Merlot ple for the year to 31 March 2023. The claim for current period group relief would be made on Merlot ple's corporation tax return. 10. What is base cost of the factory acquired by Strawberry ple in August 2021? A. 100,000 B. 120,000 C. 250,000 D. 300,000 OT case - Merlot Plc Group The following scenario relates to Questions 26 to 30 . The Merlot ple group has the following structure: Merlot plc 20. Identify, by ticking on the relevant bexes, which of the following companies are also members of the Merlot ple group for group relief purposes. E Goodrich ple Cherry ple Black ple Strawberry ple 27. What is the maximum amount that Savanna ple could surrender as current period group relief of the year ended 31 March 2022? A. 68,000 B. 70,000 C.73,000 D. 77,000 28 What are the maximum available taxable total profits of Merlot ple that could be current period group relieved for the year ended 31 March 2022? A. 58,500 B. 2,500 C,c52,000 D. 50,500 29. Which TWO of the following statements about current period group relief claims between Merlot ple and Savanna ple are correct? A claim for current period group relief will be ineffective unless Savarna ple gives a notice of consent. If Merlot ple pays Savanna ple an amount up to the amount of the loss surrendered, the payment will be deducted from the current period group relief. A claim for current period group relief between Savanna ple and Merlot ple will be available against the whole of the taxable total profits of Merlot ple for the year to 31 March 2023. The claim for current period group relief would be made on Merlot ple's corporation tax return. 10. What is base cost of the factory acquired by Strawberry ple in August 2021? A. 100,000 B. 120,000 C. 250,000 D. 300,000