Answered step by step

Verified Expert Solution

Question

1 Approved Answer

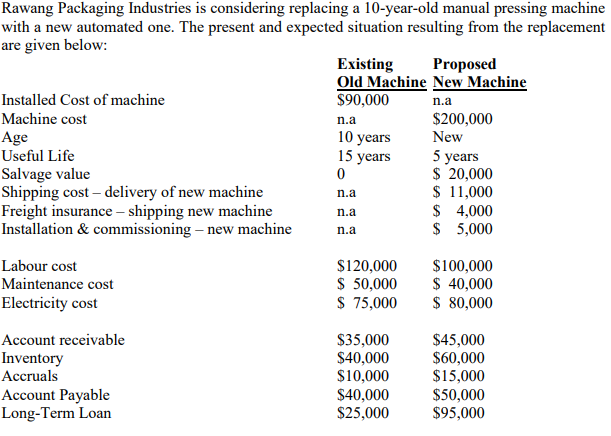

Other information available are: 1. Incremental increase in sales is expected to be $40,000 yearly for the next 5 years. 2. Depreciation is based on

Other information available are: 1. Incremental increase in sales is expected to be $40,000 yearly for the next 5 years.

2. Depreciation is based on a straight-line method.

3. The existing old machine can be sold today for $20,000 and will be worthless at the end of its useful life.

4. Tax rate is 25%

5. Risk-adjusted hurdle rate = 13.50%

Using NPV and IRR criteria, determine whether the company should proceed with the replacement?

n.a Rawang Packaging Industries is considering replacing a 10-year-old manual pressing machine with a new automated one. The present and expected situation resulting from the replacement are given below: Existing Proposed Old Machine New Machine Installed Cost of machine $90,000 Machine cost n.a $200,000 Age 10 years New Useful Life 15 years 5 years Salvage value 0 $ 20,000 Shipping cost delivery of new machine $ 11,000 Freight insurance - shipping new machine $ 4,000 Installation & commissioning - new machine $ 5,000 n.a n.a n.a Labour cost Maintenance cost Electricity cost $120,000 $ 50,000 $ 75,000 $100,000 $ 40,000 $ 80,000 Account receivable Inventory Accruals Account Payable Long-Term Loan $35,000 $40,000 $10,000 $40,000 $25,000 $45,000 $60,000 $15,000 $50,000 $95,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started