Answered step by step

Verified Expert Solution

Question

1 Approved Answer

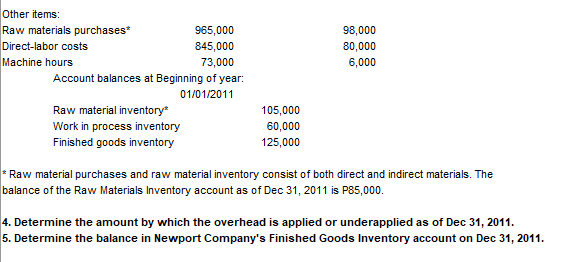

Other items: Raw materials purchases* Direct-labor costs Machine hours 965,000 845,000 73,000 98,000 80,000 6,000 Account balances at Beginning of year: 01/01/2011 Raw material

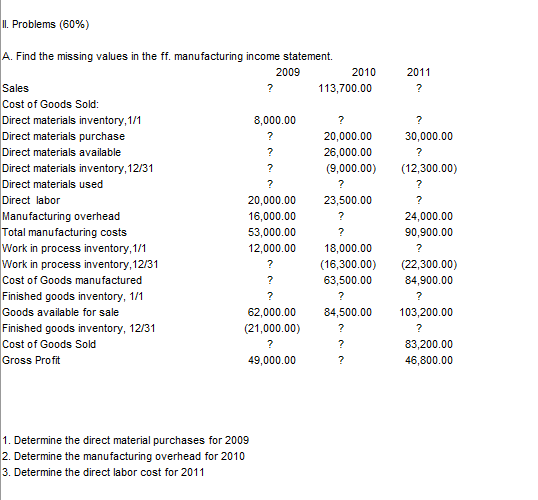

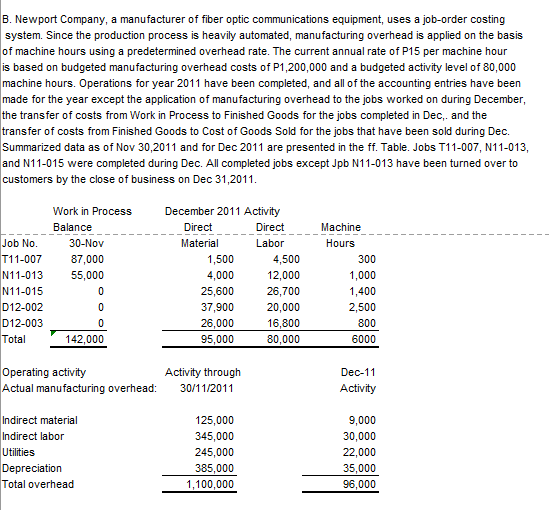

Other items: Raw materials purchases* Direct-labor costs Machine hours 965,000 845,000 73,000 98,000 80,000 6,000 Account balances at Beginning of year: 01/01/2011 Raw material inventory* Work in process inventory Finished goods inventory 105,000 60,000 125,000 * Raw material purchases and raw material inventory consist of both direct and indirect materials. The balance of the Raw Materials Inventory account as of Dec 31, 2011 is P85,000. 4. Determine the amount by which the overhead is applied or underapplied as of Dec 31, 2011. 5. Determine the balance in Newport Company's Finished Goods Inventory account on Dec 31, 2011. II. Problems (60%) A. Find the missing values in the ff. manufacturing income statement. Sales 2009 ? 2010 2011 113,700.00 ? Cost of Goods Sold: Direct materials inventory, 1/1 8,000.00 ? ? Direct materials purchase ? 20,000.00 30,000.00 Direct materials available ? 26,000.00 ? Direct materials inventory, 12/31 ? (9,000.00) (12,300.00) Direct materials used ? ? ? Direct labor 20,000.00 23,500.00 ? Manufacturing overhead 16,000.00 ? 24,000.00 Total manufacturing costs 53,000.00 ? 90,900.00 Work in process inventory, 1/1 12,000.00 18,000.00 ? Work in process inventory, 12/31 Cost of Goods manufactured Finished goods inventory, 1/1 Goods available for sale ? (16,300.00) (22,300.00) ? 63,500.00 84,900.00 ? ? ? 62,000.00 84,500.00 103,200.00 Finished goods inventory, 12/31 Cost of Goods Sold (21,000.00) ? ? ? ? 83,200.00 Gross Profit 49,000.00 ? 46,800.00 1. Determine the direct material purchases for 2009 2. Determine the manufacturing overhead for 2010 3. Determine the direct labor cost for 2011 B. Newport Company, a manufacturer of fiber optic communications equipment, uses a job-order costing system. Since the production process is heavily automated, manufacturing overhead is applied on the basis of machine hours using a predetermined overhead rate. The current annual rate of P15 per machine hour is based on budgeted manufacturing overhead costs of P1,200,000 and a budgeted activity level of 80,000 machine hours. Operations for year 2011 have been completed, and all of the accounting entries have been made for the year except the application of manufacturing overhead to the jobs worked on during December, the transfer of costs from Work in Process to Finished Goods for the jobs completed in Dec,. and the transfer of costs from Finished Goods to Cost of Goods Sold for the jobs that have been sold during Dec. Summarized data as of Nov 30,2011 and for Dec 2011 are presented in the ff. Table. Jobs T11-007, N11-013, and N11-015 were completed during Dec. All completed jobs except Jpb N11-013 have been turned over to customers by the close of business on Dec 31,2011. Work in Process Balance December 2011 Activity Direct Direct Machine Job No. 30-Nov Material Labor Hours T11-007 87,000 1,500 4,500 300 N11-013 55,000 4,000 12,000 1,000 N11-015 0 25,600 26,700 1,400 D12-002 0 37,900 20,000 2,500 D12-003 0 26,000 16,800 800 Total 142,000 95,000 80,000 6000 Operating activity Activity through Dec-11 Actual manufacturing overhead: 30/11/2011 Activity Indirect material 125,000 9,000 Indirect labor 345,000 30,000 Utilities 245,000 22,000 Depreciation 385,000 35,000 Total overhead 1,100,000 96,000 C. The ff. relates to Job# 999, which is being carried out by DR to meet customer's order. Direct materials consumed Department | Department II Direct labor hours employed Direct labor rate per hour Production overhead per direct labor hour Administrative and other overhead Profit markup 10,000 6,000 800 400 8 10 8 8 20% of full production cost 25% of selling price 6. What is the selling price to the customer for Job 999? D. Unilab Pharmaceutical Company manufactures a tablet for allergy sufferers. All ingredients are added at the beginning of the Blending Operation. Conversion costs flow uniformly throughout the process. Tabulating and Coating are operations downstream from Blending. Information on the Blending Operation for October is as follows: Work in Process-Blending Operations October 1, balance (100,000 units, 40% complet for conversion costs) Completed and transferred 151,760 to Tabulating: Direct materials added(1,000,000 units) 1,310,000 Direct labor cost ? Units-? Costs-? Factory overhead(applied at 180% of 396,000 direct labor cost) October 31, balance(200,000 units, ? 70% complete for conversion costs) The October 1 balance consists of the ff. cost elements: Direct materials Direct labor Factory overhead Total costs 128,000 8,800 14,960 151,760 7. Using the FIFO method, compute the cost of completed and transferred to Tabulating operation. 8. Using the average method, compute the cost of completed and transferred to Tabulating operation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started