Question

Frank wants to retire in 20 years. He estimates he will need $200,000 today's dollars per year in addition to Social Security. He has already

Frank wants to retire in 20 years. He estimates he will need $200,000 today's dollars per year in addition to Social Security. He has already saved $2 million. How much MORE must he save if he anticipates living 30 years in retirement; inflation is 3%; and he can earn 6% on his investments?

other options;

$955,053

$1,625,911

$1,013,272

$844,873

My question, using the information provided, in the first question about the maximum that George can contribute to the account, I don't understand the fact that George's account received $4k in plan forfeiture. what does that mean and what is the amount that he can contribute?

And for the second question I'm not sure if it's the difference between the pv of the $200K per 30 years and fv of $2MM for 20 yrs

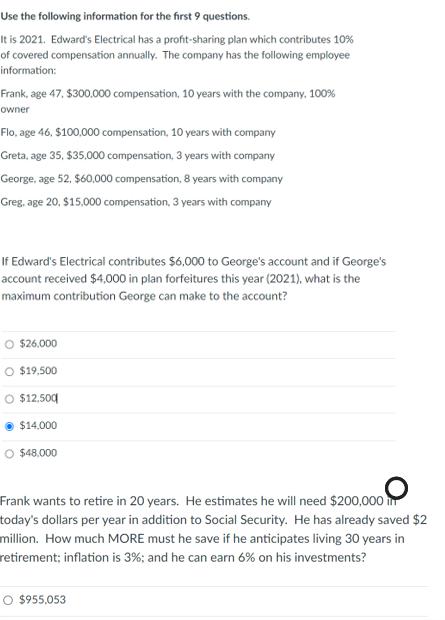

Use the following information for the first 9 questions. It is 2021. Edward's Electrical has a profit-sharing plan which contributes 10% of covered compensation annually. The company has the following employee information: Frank, age 47. $300,000 compensation, 10 years with the company, 100% owner Flo, age 46, $100,000 compensation, 10 years with company Greta, age 35, $35,000 compensation, 3 years with company George, age 52, $60,000 compensation, 8 years with company Greg, age 20, $15,000 compensation, 3 years with company If Edward's Electrical contributes $6,000 to George's account and if George's account received $4,000 in plan forfeitures this year (2021), what is the maximum contribution George can make to the account? $26.000 O $19.500 $12,500 $14.000 O $48.000 Frank wants to retire in 20 years. He estimates he will need $200,000 today's dollars per year in addition to Social Security. He has already saved $2 million. How much MORE must he save if he anticipates living 30 years in retirement; inflation is 3%; and he can earn 6% on his investments? $955,053

Step by Step Solution

3.67 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Plan forfeitures are the funds that remain in a participants account when they leave the co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started