Answered step by step

Verified Expert Solution

Question

1 Approved Answer

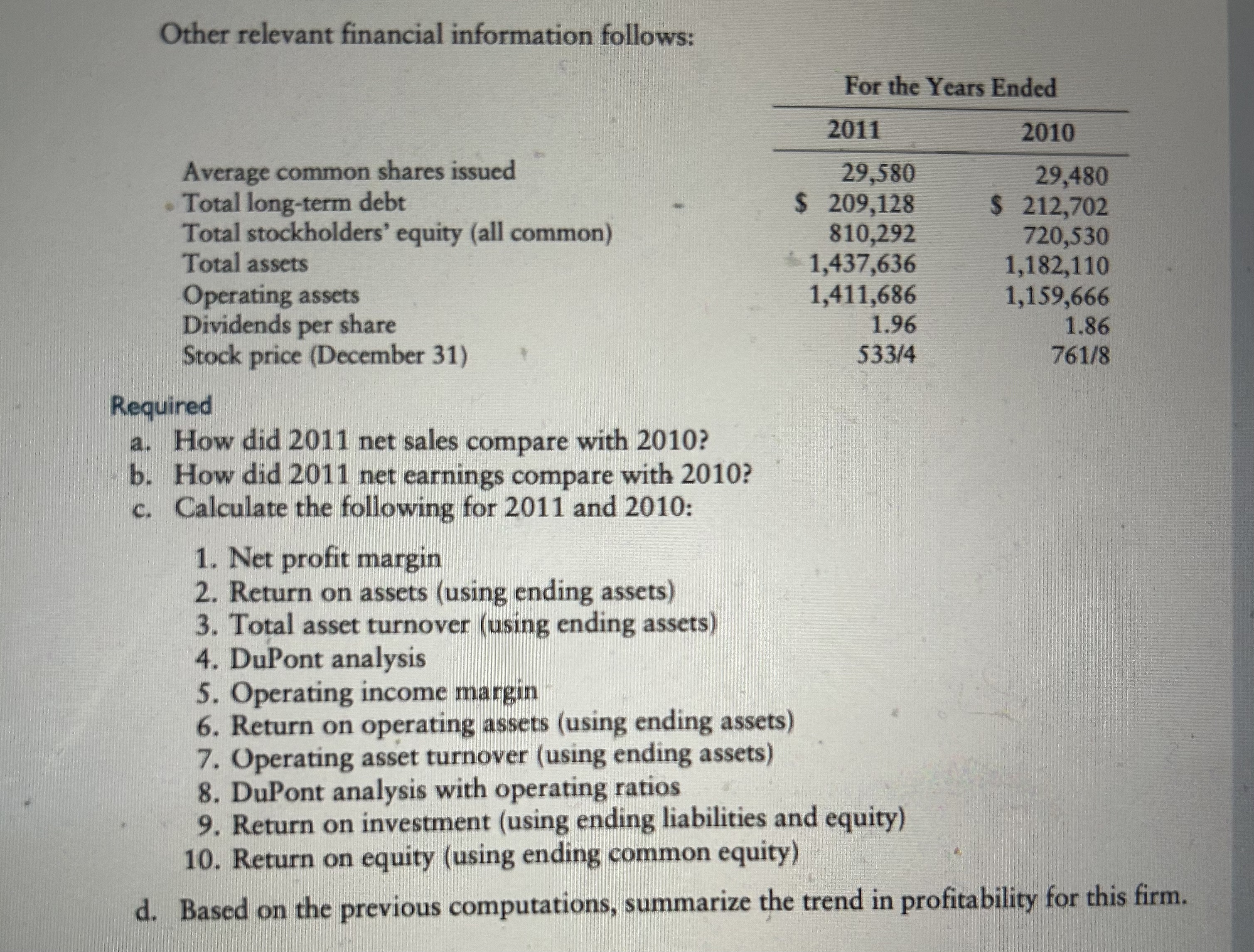

Other relevant financial information follows: For the Years Ended 2011 29,580 2010 29,480 Average common shares issued Total long-term debt Total stockholders' equity (all

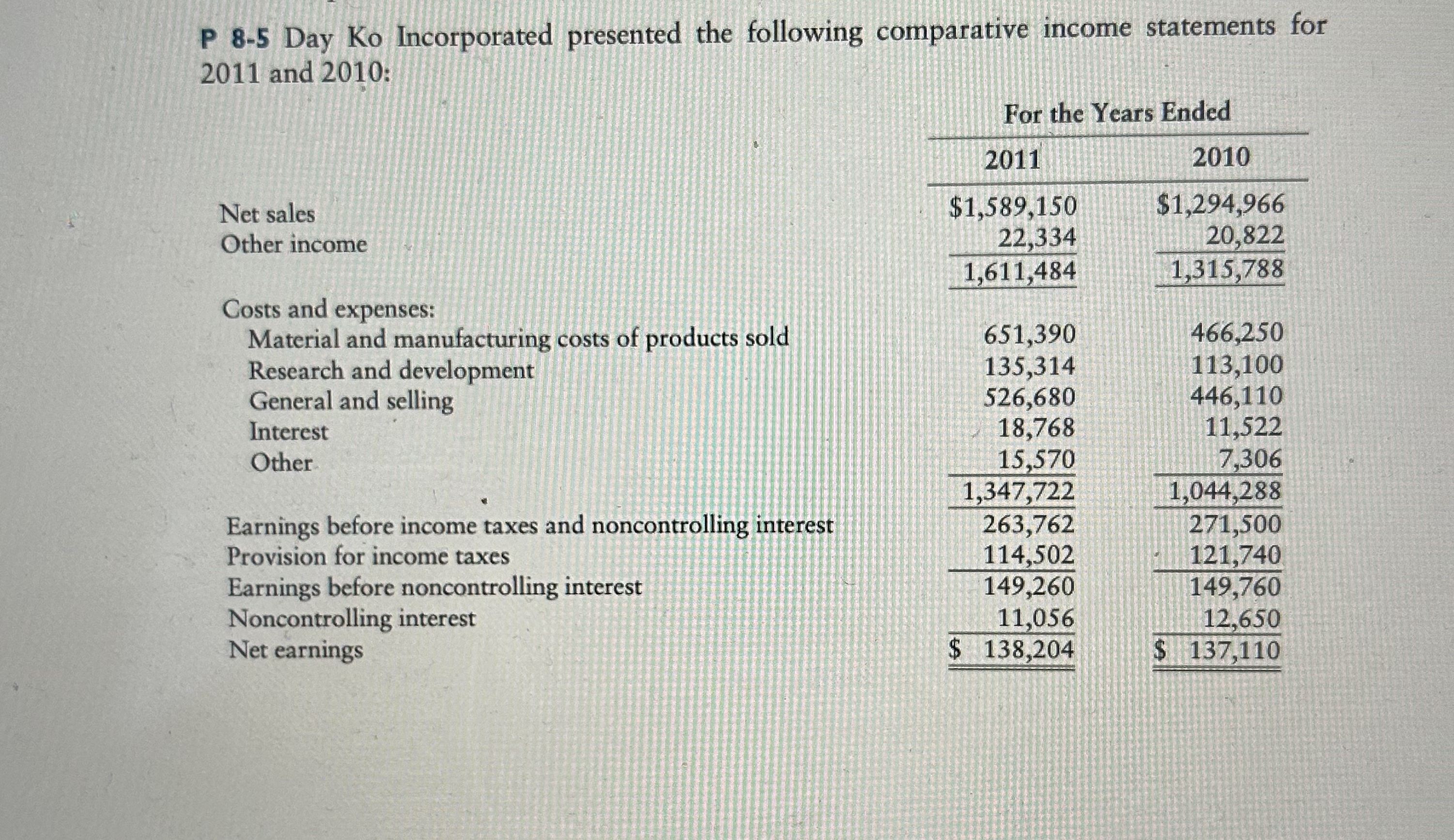

Other relevant financial information follows: For the Years Ended 2011 29,580 2010 29,480 Average common shares issued Total long-term debt Total stockholders' equity (all common) Total assets Operating assets Dividends per share Stock price (December 31) Required a. How did 2011 net sales compare with 2010? b. How did 2011 net earnings compare with 2010? c. Calculate the following for 2011 and 2010: 1. Net profit margin 2. Return on assets (using ending assets) 3. Total asset turnover (using ending assets) 4. DuPont analysis 5. Operating income margin 6. Return on operating assets (using ending assets) 7. Operating asset turnover (using ending assets) 8. DuPont analysis with operating ratios $ 209,128 $ 212,702 810,292 720,530 1,437,636 1,182,110 1,411,686 1,159,666 1.96 1.86 533/4 761/8 9. Return on investment (using ending liabilities and equity) 10. Return on equity (using ending common equity) d. Based on the previous computations, summarize the trend in profitability for this firm. P 8-5 Day Ko Incorporated presented the following comparative income statements for 2011 and 2010: Net sales Other income For the Years Ended 2011 $1,589,150 2010 $1,294,966 22,334 20,822 1,611,484 1,315,788 Costs and expenses: Material and manufacturing costs of products sold 651,390 466,250 Research and development 135,314 113,100 General and selling 526,680 446,110 Interest 18,768 11,522 Other 15,570 7,306 1,347,722 1,044,288 Earnings before income taxes and noncontrolling interest 263,762 271,500 Provision for income taxes 114,502 121,740 Earnings before noncontrolling interest 149,260 149,760 Noncontrolling interest 11,056 12,650 Net earnings $ 138,204 $ 137,110

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started