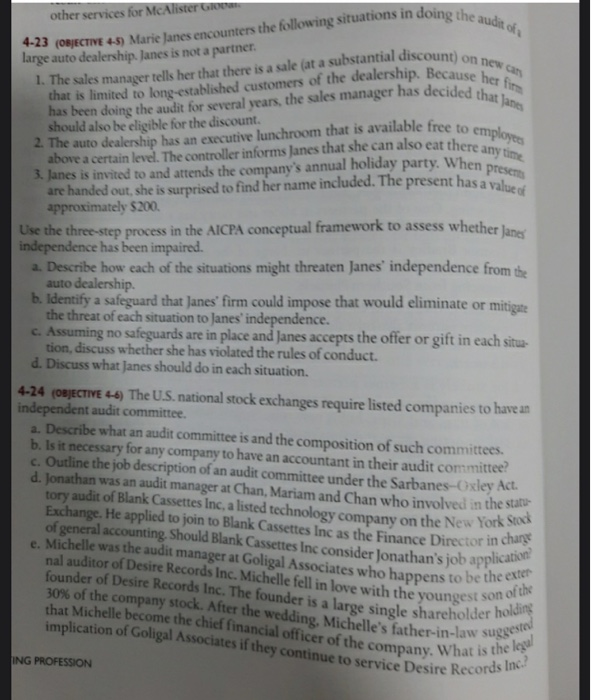

other services for McAlister on new car 1. The sales manager tells her that there is a sale (at a substantial discount) employees When presents 4-23 (OBJECTIVE 4-5) Marie Janes encounters the following situations in doing the audit of that is limited to long-established customers of the dealership. Because her fimm has been doing the audit for several years, the sales manager has decided that anes above a certain level. The controller informs Janes that she can also eat there any time are handed out, she is surprised to find her name included. The present has a value of of general accounting. Should Blank Cassettes Inc consider Jonathan's job application e. Michelle was the audit manager at Goligal Associates who happens to be the exter nal auditor of Desire Records Inc. Michelle fell in love with the youngest son of the founder of Desire Records Inc. The founder is a large single shareholder holding 30% of the company stock. After the wedding, Michelle's father-in-law suggested implication of Goligal Associates if they continue to service Desire Records Inc.? that Michelle become the chief financial officer of the company. What is the laul large auto dealership Janes is not a partner. should also be eligible for the discount. 2. The auto dealership has an executive lunchroom that is available free to 3. Janes is invited to and attends the company's annual holiday party. approximately $200 Use the three-step process in the AICPA conceptual framework to assess whether Janes independence has been impaired. a. Describe how each of the situations might threaten Janes' independence from the auto dealership b. Identify a safeguard that Janes' firm could impose that would eliminate or mitigate the threat of each situation to Janes independence. c. Assuming no safeguards are in place and Janes accepts the offer or gift in each situa- tion, discuss whether she has violated the rules of conduct. d. Discuss what Janes should do in each situation. ING PROFESSION 4-24 (OBJECTIVE 6) The U.S. national stock exchanges require listed companies to have an independent audit committee. a. Describe what an audit committee is and the composition of such committees b. Is it necessary for any company to have an accountant in their audit committee? c. Outline the job description of an audit committee under the Sarbanes-Oxley Act. d. Jonathan was an audit manager at Chan, Mariam and Chan who involved in the statu tory audit of Blank Cassettes Inc, a listed technology company on the New York seak Exchange. He applied to join to Blank Cassettes Inc as the Finance Director in chans other services for McAlister on new car 1. The sales manager tells her that there is a sale (at a substantial discount) employees When presents 4-23 (OBJECTIVE 4-5) Marie Janes encounters the following situations in doing the audit of that is limited to long-established customers of the dealership. Because her fimm has been doing the audit for several years, the sales manager has decided that anes above a certain level. The controller informs Janes that she can also eat there any time are handed out, she is surprised to find her name included. The present has a value of of general accounting. Should Blank Cassettes Inc consider Jonathan's job application e. Michelle was the audit manager at Goligal Associates who happens to be the exter nal auditor of Desire Records Inc. Michelle fell in love with the youngest son of the founder of Desire Records Inc. The founder is a large single shareholder holding 30% of the company stock. After the wedding, Michelle's father-in-law suggested implication of Goligal Associates if they continue to service Desire Records Inc.? that Michelle become the chief financial officer of the company. What is the laul large auto dealership Janes is not a partner. should also be eligible for the discount. 2. The auto dealership has an executive lunchroom that is available free to 3. Janes is invited to and attends the company's annual holiday party. approximately $200 Use the three-step process in the AICPA conceptual framework to assess whether Janes independence has been impaired. a. Describe how each of the situations might threaten Janes' independence from the auto dealership b. Identify a safeguard that Janes' firm could impose that would eliminate or mitigate the threat of each situation to Janes independence. c. Assuming no safeguards are in place and Janes accepts the offer or gift in each situa- tion, discuss whether she has violated the rules of conduct. d. Discuss what Janes should do in each situation. ING PROFESSION 4-24 (OBJECTIVE 6) The U.S. national stock exchanges require listed companies to have an independent audit committee. a. Describe what an audit committee is and the composition of such committees b. Is it necessary for any company to have an accountant in their audit committee? c. Outline the job description of an audit committee under the Sarbanes-Oxley Act. d. Jonathan was an audit manager at Chan, Mariam and Chan who involved in the statu tory audit of Blank Cassettes Inc, a listed technology company on the New York seak Exchange. He applied to join to Blank Cassettes Inc as the Finance Director in chans