Question

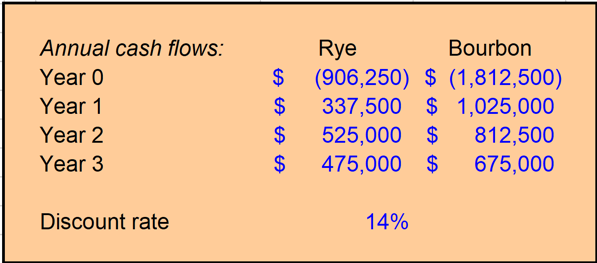

ou are the CFO of Motor City Spirits Co. in Detroit. The owner is considering two new products, a Rye or a Bourbon, but can

ou are the CFO of Motor City Spirits Co. in Detroit. The owner is considering two new products, a Rye or a Bourbon, but can only support one. Both products require some upfront costs and have projected cash flows for 3 years.

a. Given that you typically use IRR as your decision criteria, which spirit should you produce?

b. You are somewhat concerned about the scale problem associated with IRR; how do you resolve that?

c. Lastly, you recall your MBA Finance professor really liked using NPV, so you consider NPV for both projects?

d. How do you resolve potential conflict between the different decision making criteria?

Show transcribed image text

Annual cash flows: Year o Year 1 Year 2 Year 3 Rye Bourbon (906,250) $ (1,812,500) 337,500 $ 1,025,000 525,000 $ 812,500 475,000 $ 675,000 Discount rate 14%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started