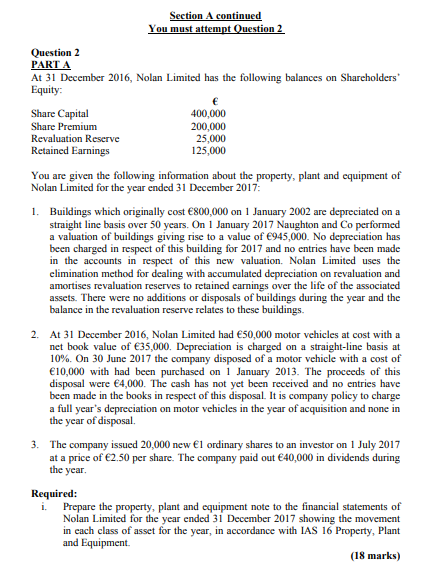

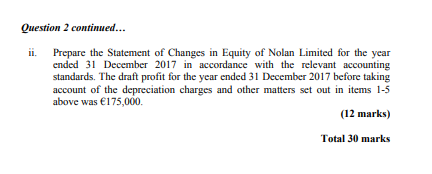

ou must attem Question 2 At 31 December 2016, Nolan Limited has the following balances on Shareholders Equity Share Capital Share Premium Revaluation Reserve Retained Earnings 400,000 200,000 25,000 125,000 You are given the following information about the property, plant and equipment of Nolan Limited for the year ended 31 December 2017 I. Buildings which originally cost 800,000 on 1 January 2002 are depreciated on a straight line basis over 50 years. On 1 January 2017 Naughton and Co performed giving rise to a value of 945,000. No depreciation has been charged in respect of this building for 2017 and no entries have been made in the accounts in respect of this new valuation. Nolan Limited uses the elimination method for dealing with accumulated depreciation on revaluation and amortises revaluation reserves to retained earnings over the life of the associated assets. There were no additions or disposals of buildings during the year and the balance in the revaluation reserve relates to these buildings. 2. At 31 December 2016, Nolan Limited had 50,000 motor vehicles at cost with a net book value of 35,000. Depreciation is charged on a straight-line basis at 10%. On 30 June 2017 the company disposed of a motor vehicle with a cost of 10,000 with had been purchased on January 2013. The proceeds of this disposal were 4,000. The cash has not yet been received and no entries have been made in the books in respect of this disposal. It is company policy to charge a full year's depreciation on motor vehicles in the year of acquisition and none in the year of disposal. 3. The company issued 20,000 new 1 ordinary shares to an investor on 1 July 2017 at a price of 2.50 per share. The company paid out 40,000 in dividends during the year Required: i. Prepare the property, plant and equipment note to the financial statements of Nolan Limited for the year ended 31 December 2017 showing the movement in each class of asset for the year, in accordance with IAS 16 Property, Plant and Equipment (18 marks) Question 2 continued... ii. Prepare the Statement of Changes in Equity of Nolan Limited for the year ended 31 December 2017 in accordance with the relevant accounting standards. The draft profit for the year ended 31 December 2017 before taking account of the depreciation charges and other matters set out in items 1-5 above was 175,000. (12 marks) Total 30 marks