Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ouestion 2 : As an enterprising member of a large company, you have developed the idea for a new venture for the company. The venture

Ouestion :

As an enterprising member of a large company, you have developed the idea for a new venture

for the company. The venture consists of the production of three new products that can be

produced on machines already owned and operated by the company. You have done your

research and are confident that you can sell as many as of each of the three products using

existing marketing tools available to the company. However, discussions with the marketing

department of the company led to the further conclusion that additional investments in

marketing specific to these products could raise sales. The initial analysis suggests that, for each

$ investment in marketing, the maximum sales limit could be increased by units.

However, the impact on sales will not be felt until the year after. Thus, if $ is invested in

marketing in year for Product A then the maximum sales for Product A would jump to for

years and Also note that if $ is invested additionally in marketing in year for Product A

then the maximum sales for Product A would jump to for year

Your CEO is interested but somewhat cautious. As a result, he agrees to give you an initial

budget of $ Due to the resource requirements of others branches of the business, he can

only provide you with hours on each of the machines in the first year but, by year that

number will jump to hours on each machine. The CEO will determine whether to continue

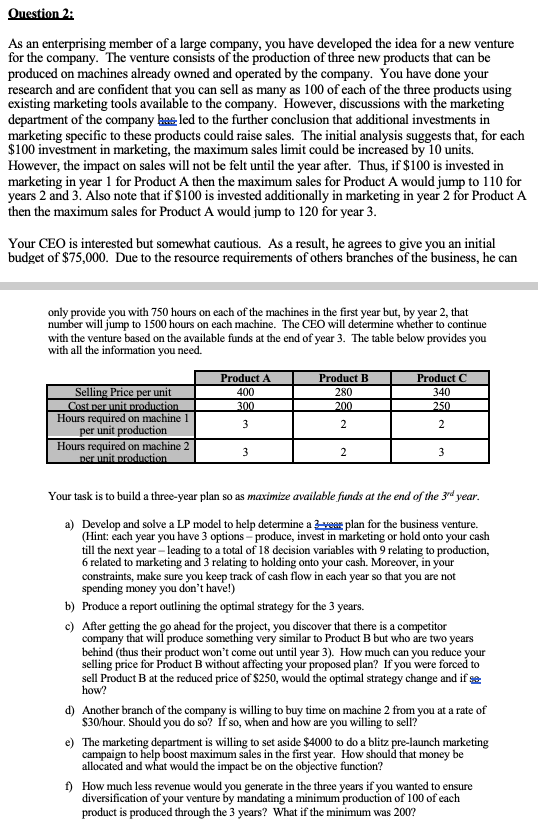

with the venture based on the available funds at the end of year The table below provides you

with all the information you need.

Your task is to build a threeyear plan so as maximize available funds at the end of the year.

a Develop and solve a LP model to help determine a seoa plan for the business venture.

Hint: each year you have options produce, invest in marketing or hold onto your cash

till the next yearleading to a total of decision variables with relating to production,

related to marketing and relating to holding onto your cash. Moreover, in your

constraints, make sure you keep track of cash flow in each year so that you are not

spending money you don't have!

b Produce a report outlining the optimal strategy for the years.

c After getting the go ahead for the project, you discover that there is a competitor

company that will produce something very similar to Product but who are two years

behind thus their product won't come out until year How much can you reduce your

selling price for Product B without affecting your proposed plan? If you were forced to

sell Product B at the reduced price of $ would the optimal strategy change and if

how?

d Another branch of the company is willing to buy time on machine from you at a rate of

$ hour. Should you do so If so when and how are you willing to sell?

e The marketing department is willing to set aside $ to do a blitz prelaunch marketing

campaign to help boost maximum sales in the first year. How should that money be

allocated and what would the impact be on the objective function?

f How much less revenue would you generate in the three years if you wanted to ensure

diversification of your venture by mandating a minimum production of of each

product is produced through the years? What if the minimum was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started