Answered step by step

Verified Expert Solution

Question

1 Approved Answer

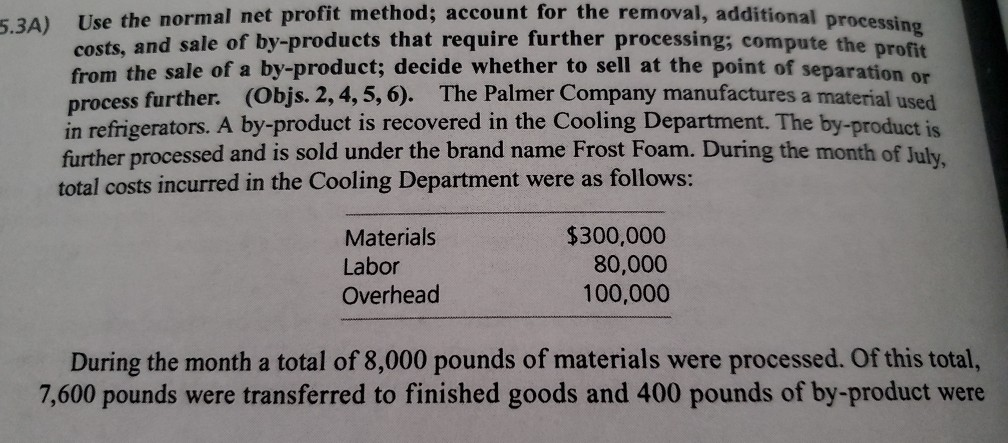

ount for the removal, additional processing ther processing; compute the profit 3A) Use the normal net profit method; account for the removal. addit costs, and

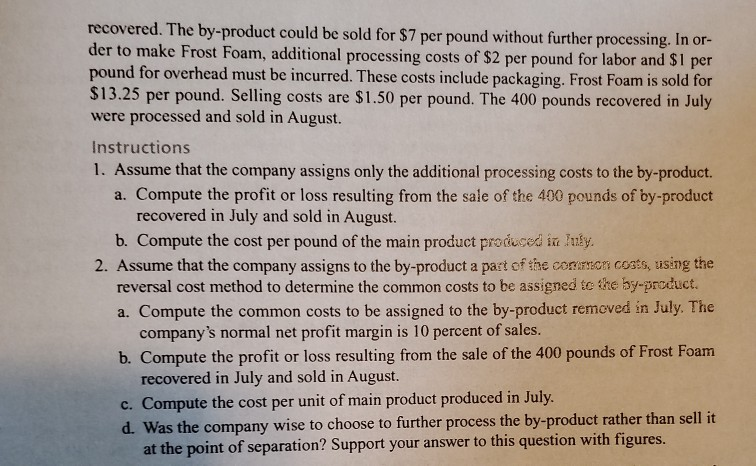

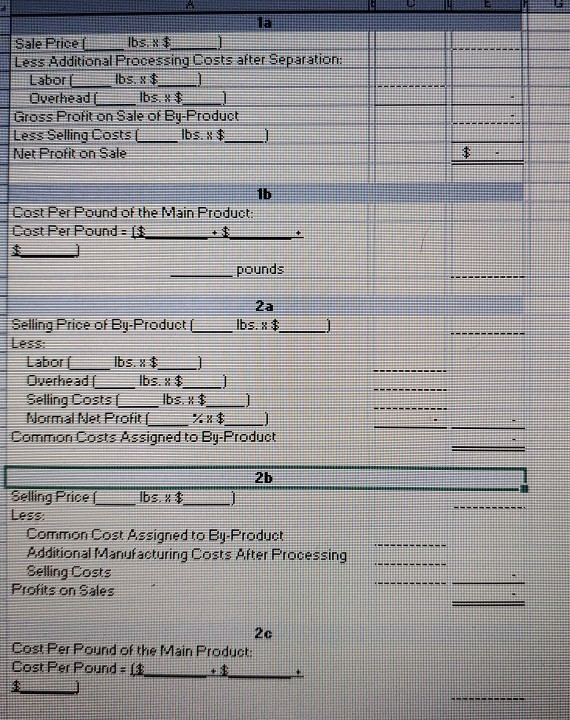

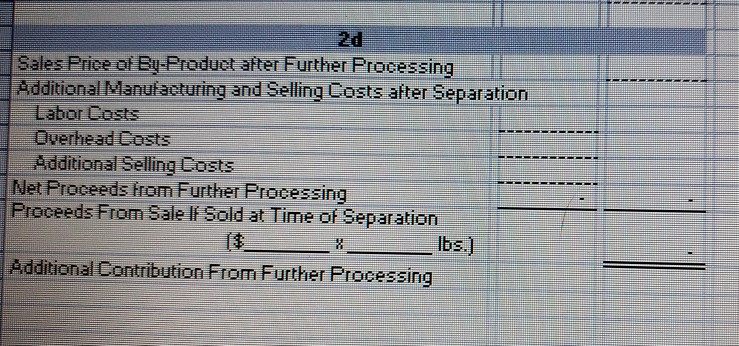

ount for the removal, additional processing ther processing; compute the profit 3A) Use the normal net profit method; account for the removal. addit costs, and sale of by-products that require further processing: comnu from the sale of a by-product; decide whether to sell at the point of senar process further. (Objs. 2,4,5,6). The Palmer Company manufactures a material in refrigerators. A by-product is recovered in the Cooling Department. The bv-nr further processed and is sold under the brand name Frost Foam. During the month of our total costs incurred in the Cooling Department were as follows: Materials Labor Overhead $300,000 80,000 100,000 During the month a total of 8,000 pounds of materials were processed. Of this total, 7,600 pounds were transferred to finished goods and 400 pounds of by-product were recovered. The by-product could be sold for $7 per pound without further processing. In or- der to make Frost Foam, additional processing costs of $2 per pound for labor and $1 per pound for overhead must be incurred. These costs include packaging. Frost Foam is sold for $13.25 per pound. Selling costs are $1.50 per pound. The 400 pounds recovered in July were processed and sold in August. Instructions 1. Assume that the company assigns only the additional processing costs to the by-product. a. Compute the profit or loss resulting from the sale of the 400 pounds of by-product recovered in July and sold in August b. Compute the cost per pound of the main product produced in luy. 2. Assume that the company assigns to the by-product a part of the coreon costs, using the reversal cost method to determine the common costs to be assigned to the by-product. a. Compute the common costs to be assigned to the by-product removed in July. The company's normal net profit margin is 10 percent of sales. b. Compute the profit or loss resulting from the sale of the 400 pounds of Frost Foam recovered in July and sold in August. c. Compute the cost per unit of main product produced in July. d. Was the company wise to choose to further process the by-product rather than sell it at the point of separation? Support your answer to this question with figures. Sale Prices $ Less Additional Processing Costs after Separation: Labor Ibs. Overhead C lbs. Gross Profit on Sale of By-Product Less Selling Costs lbs. $ Net Profit on Sale Cost Per Pound of the Main Product: Cost Per Pound = 0 _pounds Selling Price of By-Product lbs.X$ Labor lbs. ) Overhead lbs. Selling Costse lbs. * Normal Net Profit C ) Common Costs Assigned to By-Product 2b Selling Price lbs. Less: Common Cost Assigned to By-Product Additional Manufacturing Costs After Processing Selling Costs Profits on Sales SEL AL-AL----- ------ 20 Cost Per Pound of the Main Product: Cost Per Pound = 2d Sales Price of By-Product after Further Processing Additional Manufacturing and Selling Costs after Separation Labor Costs Overhead Costs Additional Selling Costs Net Proceeds from Further Processing Proceeds From Sale Ii Sold at Time of Separation lbs.) Additional Contribution From Further Processing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started