Answered step by step

Verified Expert Solution

Question

1 Approved Answer

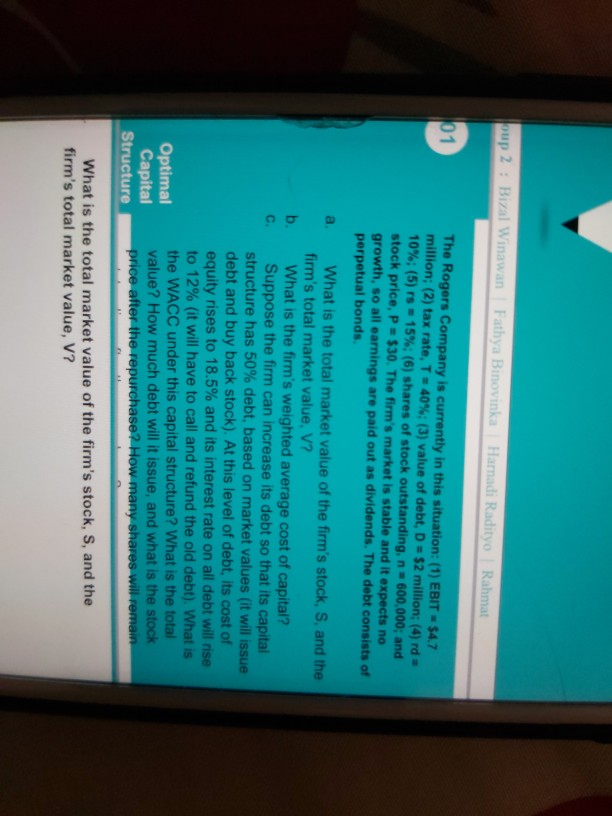

oup 2 Bizal Winawan Fathya Binovinka Hanadi Radityo Rahmat 01 The Rogers Company is currently in this situation: (1) EBIT $4.7 million; (2) tax rate,

oup 2 Bizal Winawan Fathya Binovinka Hanadi Radityo Rahmat 01 The Rogers Company is currently in this situation: (1) EBIT $4.7 million; (2) tax rate, T 40 % ; (3) value of debt, D $2 million; (4) rd 10%; ( 5) rs 15%; ( 6 ) shares of stock outstanding, n 600,000; and stock price, P = $30. The firm's market is stable and it expects no growth, so all earnings are paid out as dividends. The debt consists of perpetual bonds. What is the total market value of the firm's stock, S, and the firm's total market value, V? What is the firm's weighted average cost of capital? Suppose the firm can increase its debt so that its capital structure has 50% debt, based on market values (it will issue debt and buy back stock). At this level of debt, its cost of equity rises to 18.5% and its interest rate on all debt will rise to 12 % (it will have to call and refund the old debt). What is the WACC under this capital structure? What is the total value? How much debt will it issue, and what is the stock price after the repurchase? How many shares will remain a. b. C. Optimal Capital Structure What is the total market value of the firm's stock, S, and the firm's total market value, V? oup 2 Bizal Winawan Fathya Binovinka Hanadi Radityo Rahmat 01 The Rogers Company is currently in this situation: (1) EBIT $4.7 million; (2) tax rate, T 40 % ; (3) value of debt, D $2 million; (4) rd 10%; ( 5) rs 15%; ( 6 ) shares of stock outstanding, n 600,000; and stock price, P = $30. The firm's market is stable and it expects no growth, so all earnings are paid out as dividends. The debt consists of perpetual bonds. What is the total market value of the firm's stock, S, and the firm's total market value, V? What is the firm's weighted average cost of capital? Suppose the firm can increase its debt so that its capital structure has 50% debt, based on market values (it will issue debt and buy back stock). At this level of debt, its cost of equity rises to 18.5% and its interest rate on all debt will rise to 12 % (it will have to call and refund the old debt). What is the WACC under this capital structure? What is the total value? How much debt will it issue, and what is the stock price after the repurchase? How many shares will remain a. b. C. Optimal Capital Structure What is the total market value of the firm's stock, S, and the firm's total market value, V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started