Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our client John Doe married on June 1, 1988, and separated on June 1, 2007, for a total of 19 years at the time

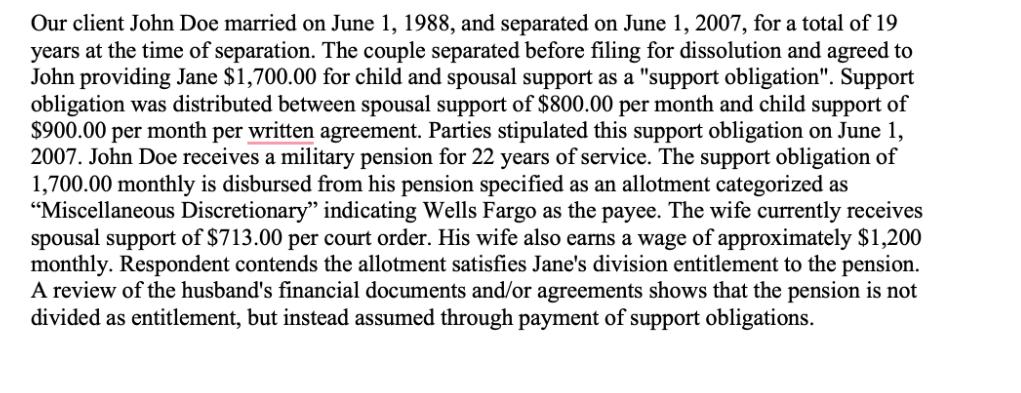

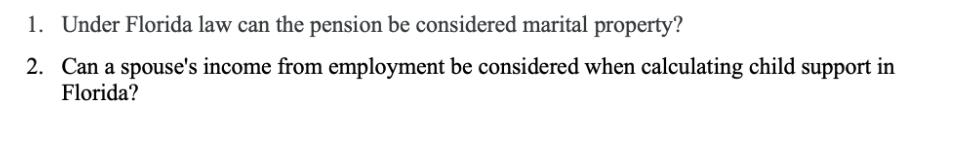

Our client John Doe married on June 1, 1988, and separated on June 1, 2007, for a total of 19 years at the time of separation. The couple separated before filing for dissolution and agreed to John providing Jane $1,700.00 for child and spousal support as a "support obligation". Support obligation was distributed between spousal support of $800.00 per month and child support of $900.00 per month per written agreement. Parties stipulated this support obligation on June 1, 2007. John Doe receives a military pension for 22 years of service. The support obligation of 1,700.00 monthly is disbursed from his pension specified as an allotment categorized as "Miscellaneous Discretionary" indicating Wells Fargo as the payee. The wife currently receives spousal support of $713.00 per court order. His wife also earns a wage of approximately $1,200 monthly. Respondent contends the allotment satisfies Jane's division entitlement to the pension. A review of the husband's financial documents and/or agreements shows that the pension is not divided as entitlement, but instead assumed through payment of support obligations. 1. Under Florida law can the pension be considered marital property? 2. Can a spouse's income from employment be considered when calculating child support in Florida?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

It appears that you have provided an excerpt from a case or a scenario related to divorce and are as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started