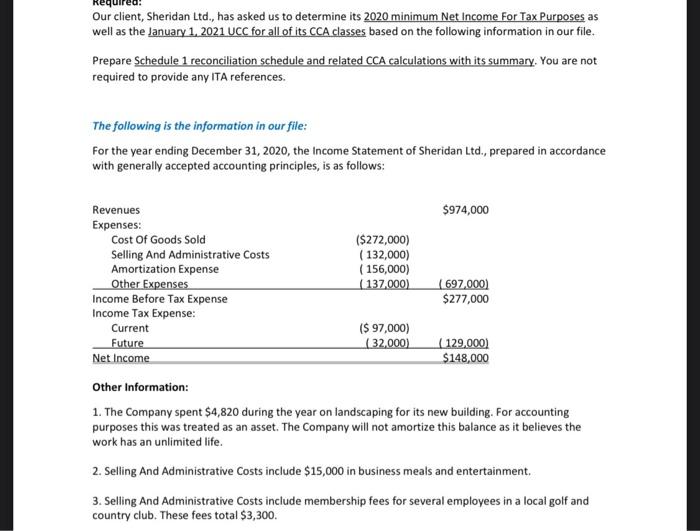

Our client, Sheridan Ltd., has asked us to determine its 2020 minimum Net Income For Tax Purposes as well as the January 1, 2021 UCC for all of its CCA classes based on the following information in our file. Prepare Schedule 1 reconciliation schedule and related CCA calculations with its summary. You are not required to provide any ITA references. The following is the information in our file: For the year ending December 31, 2020, the Income Statement of Sheridan Ltd., prepared in accordance with generally accepted accounting principles, is as follows: Revenues $974,000 Expenses: Cost Of Goods Sold ($272,000) Selling And Administrative Costs ( 132,000) Amortization Expense (156,000) Other Expenses (137,000) ( 697,000) Income Before Tax Expense $277,000 Income Tax Expense: Current ($ 97,000) Future (32,000) (129,000) Net Income $148,000 Other Information: 1. The Company spent $4,820 during the year on landscaping for its new building. For accounting purposes this was treated as an asset. The Company will not amortize this balance as it believes the work has an unlimited life. 2. Selling And Administrative Costs include $15,000 in business meals and entertainment. 3. Selling And Administrative Costs include membership fees for several employees in a local golf and country club. These fees total $3,300. Our client, Sheridan Ltd., has asked us to determine its 2020 minimum Net Income For Tax Purposes as well as the January 1, 2021 UCC for all of its CCA classes based on the following information in our file. Prepare Schedule 1 reconciliation schedule and related CCA calculations with its summary. You are not required to provide any ITA references. The following is the information in our file: For the year ending December 31, 2020, the Income Statement of Sheridan Ltd., prepared in accordance with generally accepted accounting principles, is as follows: Revenues $974,000 Expenses: Cost Of Goods Sold ($272,000) Selling And Administrative Costs ( 132,000) Amortization Expense (156,000) Other Expenses (137,000) ( 697,000) Income Before Tax Expense $277,000 Income Tax Expense: Current ($ 97,000) Future (32,000) (129,000) Net Income $148,000 Other Information: 1. The Company spent $4,820 during the year on landscaping for its new building. For accounting purposes this was treated as an asset. The Company will not amortize this balance as it believes the work has an unlimited life. 2. Selling And Administrative Costs include $15,000 in business meals and entertainment. 3. Selling And Administrative Costs include membership fees for several employees in a local golf and country club. These fees total $3,300