Question

our company has been approached by ZZZ Service Corporation to become an investment partner. ZZZ formed on 12/31/2016 and started business on 1/01/2017. They have

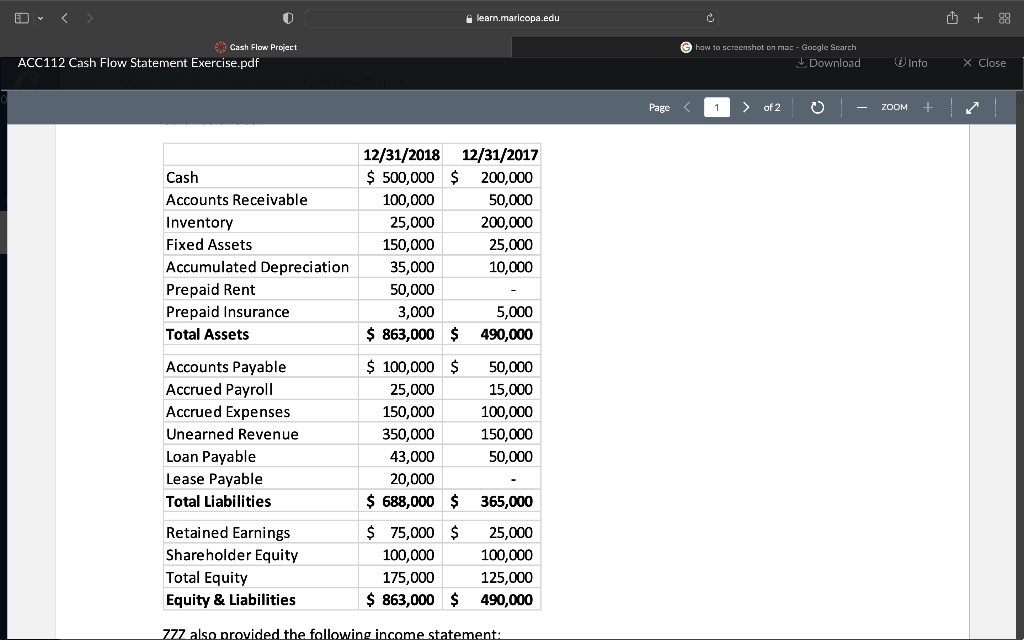

our company has been approached by ZZZ Service Corporation to become an investment partner. ZZZ formed on 12/31/2016 and started business on 1/01/2017. They have completed two years of business and our quick to point out how quickly they were able to grow sales. ZZZ has provided the following balance sheet:

ZZZs statements are unaudited and they did not provide a cash flow statement. Their accounting department is quite inexperienced and was unable to create a cash flow statement. Your CFO has received these statements directly from the company. He wants you to analyze them and identify if there are any errors. Required: 1. Prepare an indirect cash flow statement in good form. Use the example provided in the textbook as a model format. If you identify any errors in the financial statements, not it in your work and adjust opening balances to balance the statement properly. 2. Prepare a memo discussing the cash flow statement and if ZZZ appears to be a good investment. ZZ is asking for $80,000 for a 25% interest in the company. ZZZ says this is a bargain given sales, cash growth and size of asset base. Hint: Pay particular attention to cash flows from operating activities and take a close look at the balance sheet in relation to the income statement

learn.maricopa.edu U + 88 Cash Flow Project ACC112 Cash Flow Statement Exercise.pdf how to screenshot on mac - Google Search Download Info X Close Page 1 > of 2 - ZOOM + Cash Accounts Receivable Inventory Fixed Assets Accumulated Depreciation Prepaid Rent Prepaid Insurance Total Assets 12/31/2018 12/31/2017 $ 500,000 $ 200,000 100,000 50,000 25,000 200,000 150,000 25,000 35,000 10,000 50,000 3,000 $ 863,000 $ 490,000 - 5,000 Accounts Payable Accrued Payroll Accrued Expenses Unearned Revenue Loan Payable Lease Payable Total Liabilities $ 100,000 $ 25,000 150,000 350,000 43,000 20,000 $ 688,000 $ 50,000 15,000 100,000 150,000 50,000 365,000 Retained Earnings Shareholder Equity Total Equity Equity & Liabilities $ 75,000 $ 100,000 175,000 $ 863,000 $ 25,000 100,000 125,000 490,000 777 also provided the following income statement: learn.maricopa.edu U + 88 Cash Flow Project ACC112 Cash Flow Statement Exercise.pdf how to screenshot on mac - Google Search Download Info X Close Page 1 > of 2 - ZOOM + Cash Accounts Receivable Inventory Fixed Assets Accumulated Depreciation Prepaid Rent Prepaid Insurance Total Assets 12/31/2018 12/31/2017 $ 500,000 $ 200,000 100,000 50,000 25,000 200,000 150,000 25,000 35,000 10,000 50,000 3,000 $ 863,000 $ 490,000 - 5,000 Accounts Payable Accrued Payroll Accrued Expenses Unearned Revenue Loan Payable Lease Payable Total Liabilities $ 100,000 $ 25,000 150,000 350,000 43,000 20,000 $ 688,000 $ 50,000 15,000 100,000 150,000 50,000 365,000 Retained Earnings Shareholder Equity Total Equity Equity & Liabilities $ 75,000 $ 100,000 175,000 $ 863,000 $ 25,000 100,000 125,000 490,000 777 also provided the following income statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started