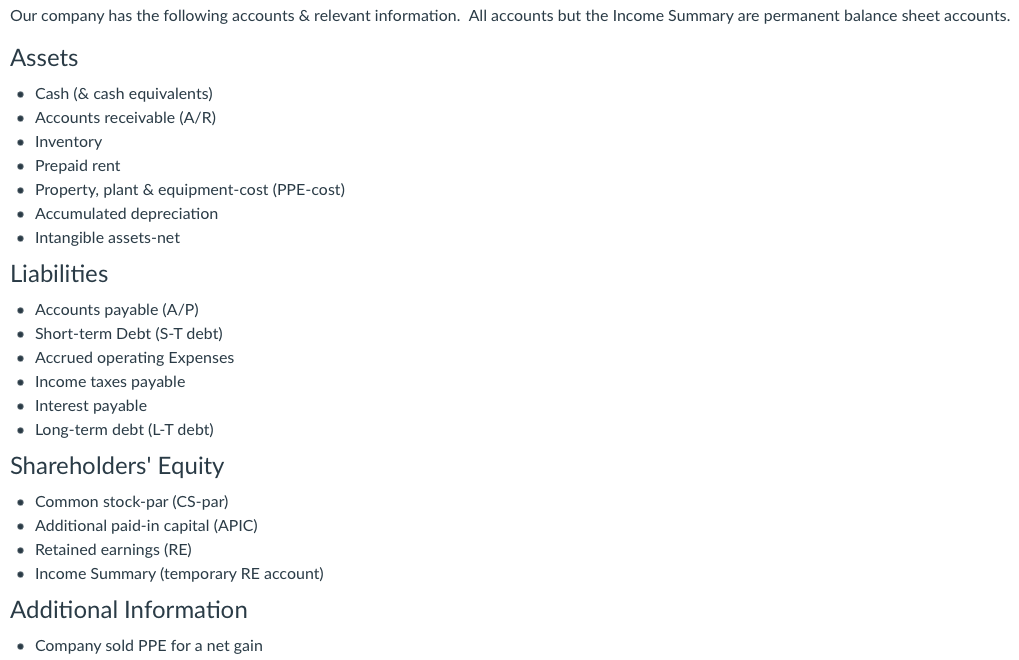

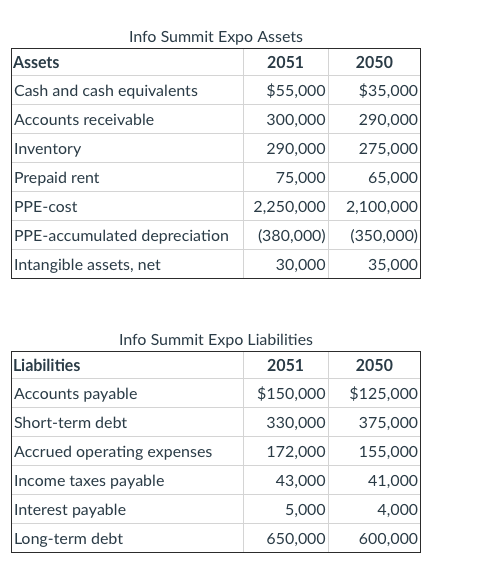

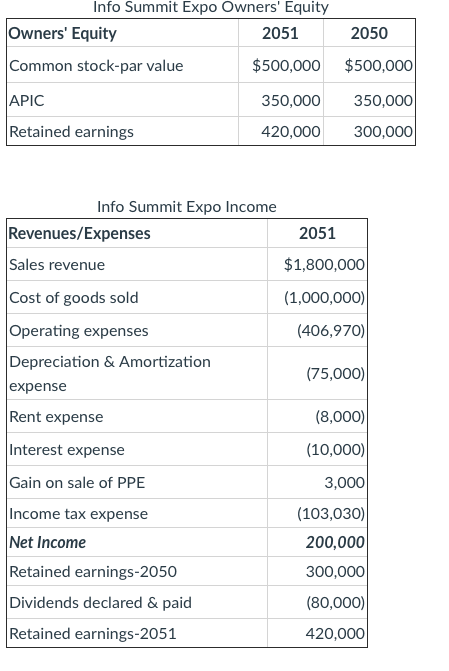

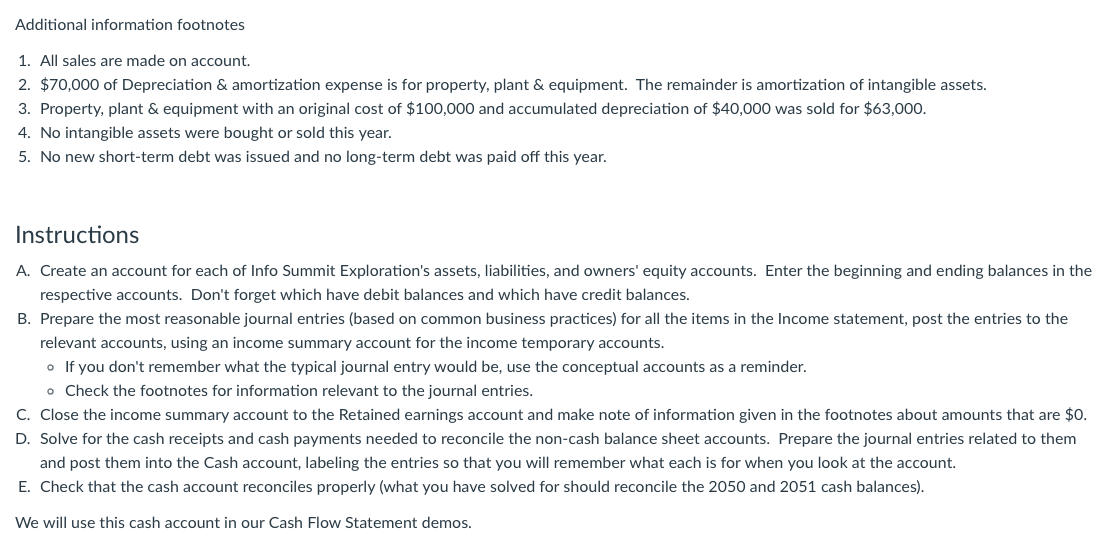

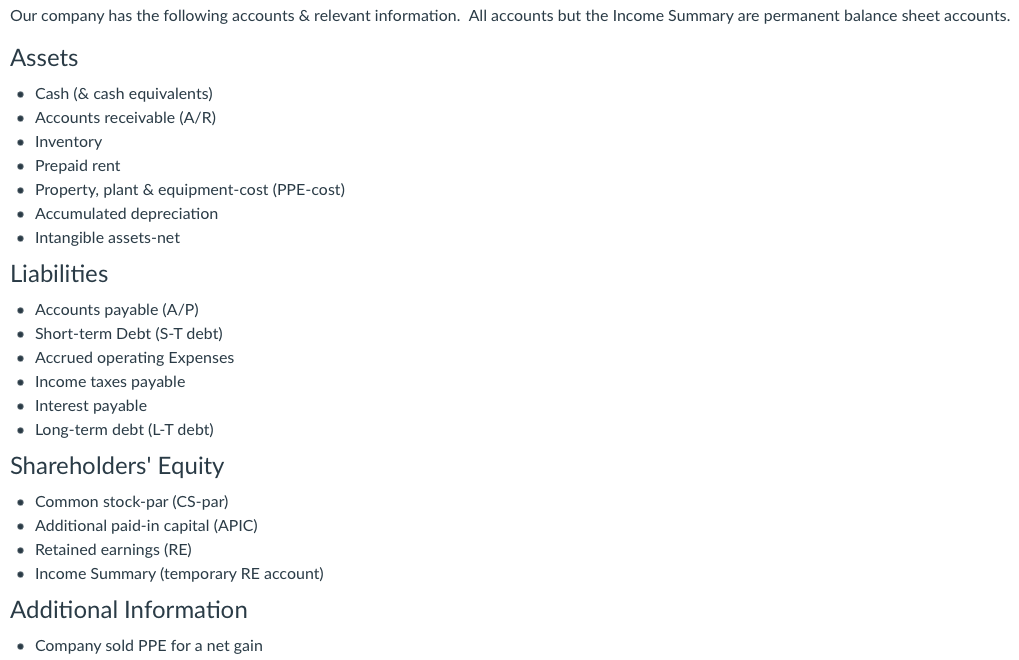

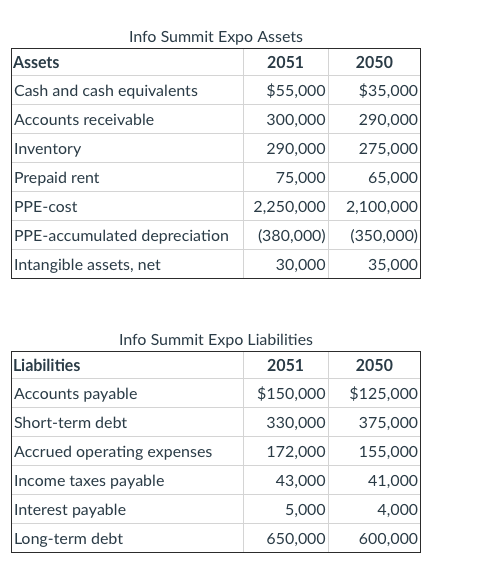

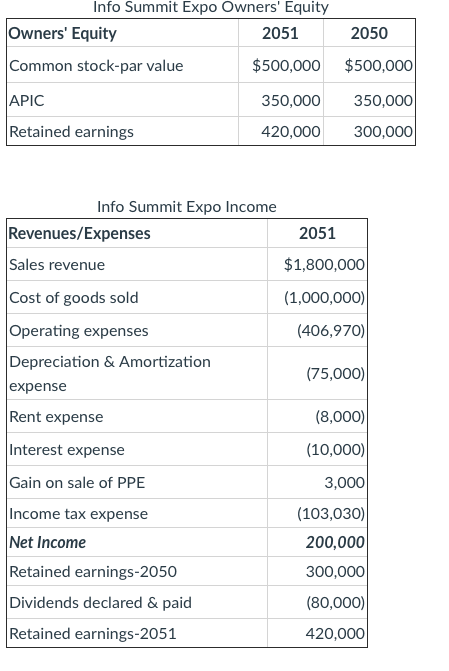

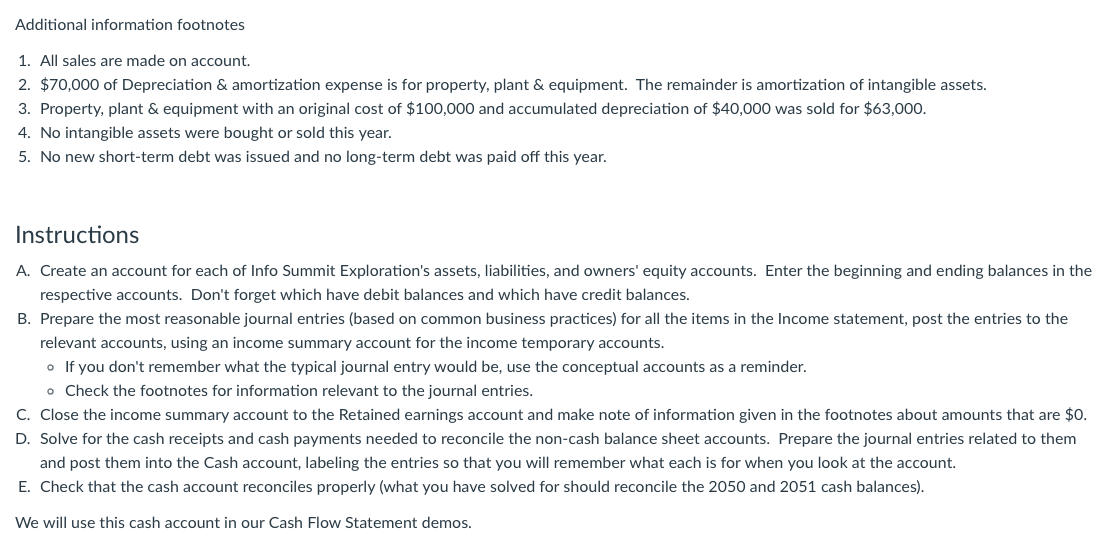

Our company has the following accounts & relevant information. All accounts but the Income Summary are permanent balance sheet accounts. Assets - Cash (\& cash equivalents) - Accounts receivable (A/R) - Inventory - Prepaid rent - Property, plant \& equipment-cost (PPE-cost) - Accumulated depreciation - Intangible assets-net Liabilities - Accounts payable (A/P) - Short-term Debt (S-T debt) - Accrued operating Expenses - Income taxes payable - Interest payable - Long-term debt (L-T debt) Shareholders' Equity - Common stock-par (CS-par) - Additional paid-in capital (APIC) - Retained earnings (RE) - Income Summary (temporary RE account) Additional Information Info Summit Expo Assets \begin{tabular}{|l|r|r|} \hline Assets & \multicolumn{1}{|c|}{2051} & \multicolumn{1}{c|}{2050} \\ \hline Cash and cash equivalents & $55,000 & $35,000 \\ \hline Accounts receivable & 300,000 & 290,000 \\ \hline Inventory & 290,000 & 275,000 \\ \hline Prepaid rent & 75,000 & 65,000 \\ \hline PPE-cost & 2,250,000 & 2,100,000 \\ \hline PPE-accumulated depreciation & (380,000) & (350,000) \\ \hline Intangible assets, net & 30,000 & 35,000 \\ \hline \end{tabular} Info Summit Expo Liabilities \begin{tabular}{|l|r|r|} \hline Liabilities & \multicolumn{1}{|c|}{2051} & \multicolumn{1}{c|}{2050} \\ \hline Accounts payable & $150,000 & $125,000 \\ \hline Short-term debt & 330,000 & 375,000 \\ \hline Accrued operating expenses & 172,000 & 155,000 \\ \hline Income taxes payable & 43,000 & 41,000 \\ \hline Interest payable & 5,000 & 4,000 \\ \hline Long-term debt & 650,000 & 600,000 \\ \hline \end{tabular} Info Summit Expo Owners' Equity \begin{tabular}{|l|r|c|} \hline Owners' Equity & \multicolumn{1}{|c|}{2051} & \multicolumn{1}{c|}{2050} \\ \hline Common stock-par value & $500,000 & $500,000 \\ \hline APIC & 350,000 & 350,000 \\ \hline Retained earnings & 420,000 & 300,000 \\ \hline \end{tabular} Info Summit Expo Income \begin{tabular}{|l|r|} \hline Revenues/Expenses & \multicolumn{1}{c|}{2051} \\ \hline Sales revenue & $1,800,000 \\ \hline Cost of goods sold & (1,000,000) \\ \hline Operating expenses & (406,970) \\ \hline Depreciation \& Amortization & (75,000) \\ \hline expense & (8,000) \\ \hline Rent expense & (10,000) \\ \hline Interest expense & 3,000 \\ \hline Gain on sale of PPE & (103,030) \\ \hline Income tax expense & 200,000 \\ \hline Net Income & 300,000 \\ \hline Retained earnings-2050 & (80,000) \\ \hline Dividends declared \& paid & 420,000 \\ \hline Retained earnings-2051 & \\ \hline \end{tabular} Additional information footnotes 1. All sales are made on account. 3. Property, plant & equipment with an original cost of $100,000 and accumulated depreciation of $40,000 was sold for $63,000. 4. No intangible assets were bought or sold this year. 5. No new short-term debt was issued and no long-term debt was paid off this year. Instructions A. Create an account for each of Info Summit Exploration's assets, liabilities, and owners' equity accounts. Enter the beginning and ending balances in the respective accounts. Don't forget which have debit balances and which have credit balances. B. Prepare the most reasonable journal entries (based on common business practices) for all the items in the Income statement, post the entries to the relevant accounts, using an income summary account for the income temporary accounts. - If you don't remember what the typical journal entry would be, use the conceptual accounts as a reminder. - Check the footnotes for information relevant to the journal entries. C. Close the income summary account to the Retained earnings account and make note of information given in the footnotes about amounts that and post them into the Cash account, labeling the entries so that you will remember what each is for when you look at the account. E. Check that the cash account reconciles properly (what you have solved for should reconcile the 2050 and 2051 cash balances). We will use this cash account in our Cash Flow Statement demos