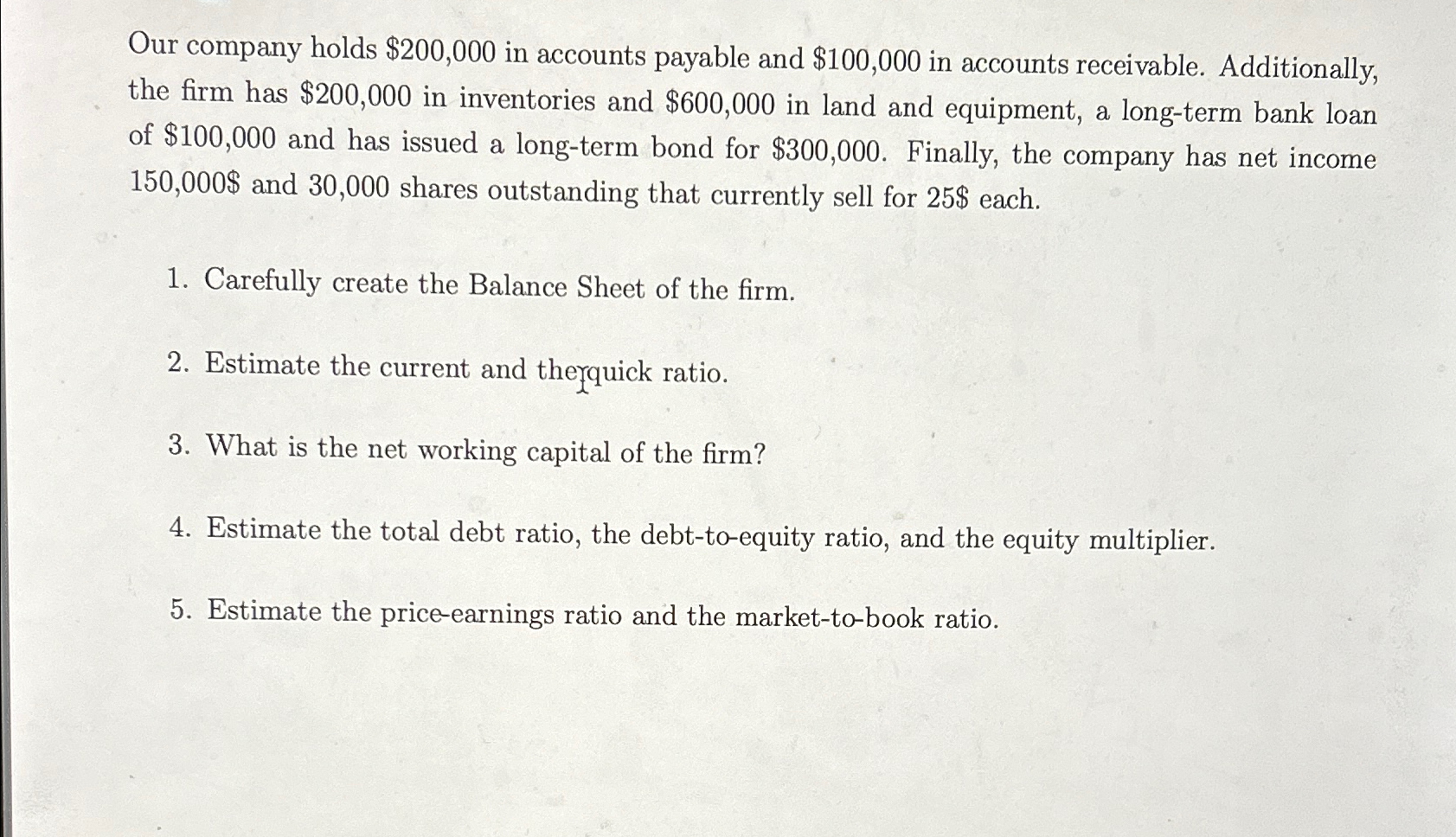

Our company holds $200,000 in accounts payable and $100,000 in accounts receivable. Additionally, the firm has $200,000 in inventories and $600,000 in land and equipment,

Our company holds

$200,000in accounts payable and

$100,000in accounts receivable. Additionally, the firm has

$200,000in inventories and

$600,000in land and equipment, a long-term bank loan of

$100,000and has issued a long-term bond for

$300,000. Finally, the company has net income

150,000$and 30,000 shares outstanding that currently sell for

25$each.\ Carefully create the Balance Sheet of the firm.\ Estimate the current and therquick ratio.\ What is the net working capital of the firm?\ Estimate the total debt ratio, the debt-to-equity ratio, and the equity multiplier.\ Estimate the price-earnings ratio and the market-to-book ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started