Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our Health is a not-for-profit private health insurance company. Like most private health insurance providers in Australia, Our Health puts annual limits on their

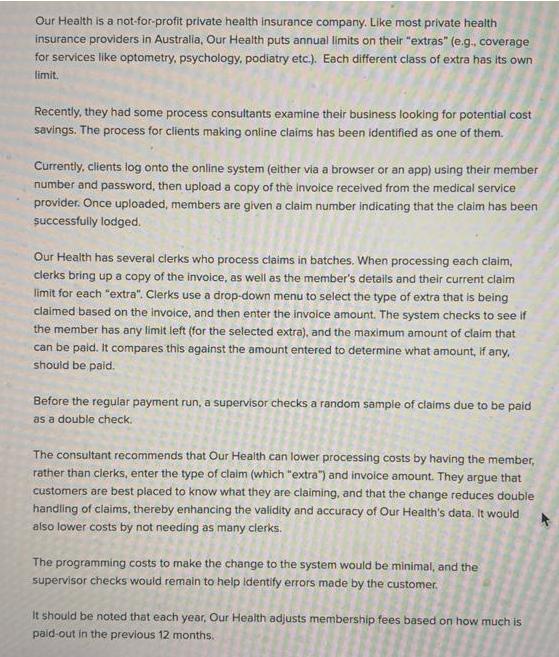

Our Health is a not-for-profit private health insurance company. Like most private health insurance providers in Australia, Our Health puts annual limits on their "extras" (e.g., coverage for services like optometry, psychology, podiatry etc.). Each different class of extra has its own limit. Recently, they had some process consultants examine their business looking for potential cost savings. The process for clients making online claims has been identified as one of them. Currently, clients log onto the online system (either via a browser or an app) using their member number and password, then upload a copy of the invoice received from the medical service provider. Once uploaded, members are given a claim number indicating that the claim has been successfully lodged. Our Health has several clerks who process claims in batches. When processing each claim, clerks bring up a copy of the invoice, as well as the member's details and their current claim limit for each "extra". Clerks use a drop-down menu to select the type of extra that is being claimed based on the invoice, and then enter the invoice amount. The system checks to see if the member has any limit left (for the selected extra), and the maximum amount of claim that can be paid. It compares this against the amount entered to determine what amount, if any, should be paid. Before the regular payment run, a supervisor checks a random sample of claims due to be paid as a double check. The consultant recommends that Our Health can lower processing costs by having the member, rather than clerks, enter the type of claim (which "extra") and invoice amount. They argue that customers are best placed to know what they are claiming, and that the change reduces double handling of claims, thereby enhancing the validity and accuracy of Our Health's data. It would also lower costs by not needing as many clerks. The programming costs to make the change to the system would be minimal, and the supervisor checks would remain to help identify errors made by the customer. It should be noted that each year, Our Health adjusts membership fees based on how much is paid-out in the previous 12 months. Would the online claim process be part of Our Health's Revenue or Expenditure cycle; explain why with reference to economic events? Enter your answer here Q3.2 5 Points (a) Would the process change lead to a more valid and accurate data? Explain why. (3 mark) Enter your answer here (b) Could any costs increase as a result of this change? (1 mark) Enter your answer here (c) Based on your answers in (a) and (b), should Our Health make the change? Justify your answer. (1 mark) Our Health is a not-for-profit private health insurance company. Like most private health insurance providers in Australia, Our Health puts annual limits on their "extras" (e.g., coverage for services like optometry, psychology, podiatry etc.). Each different class of extra has its own limit. Recently, they had some process consultants examine their business looking for potential cost savings. The process for clients making online claims has been identified as one of them. Currently, clients log onto the online system (either via a browser or an app) using their member number and password, then upload a copy of the invoice received from the medical service provider. Once uploaded, members are given a claim number indicating that the claim has been successfully lodged. Our Health has several clerks who process claims in batches. When processing each claim, clerks bring up a copy of the invoice, as well as the member's details and their current claim limit for each "extra". Clerks use a drop-down menu to select the type of extra that is being claimed based on the invoice, and then enter the invoice amount. The system checks to see if the member has any limit left (for the selected extra), and the maximum amount of claim that can be paid. It compares this against the amount entered to determine what amount, if any, should be paid. Before the regular payment run, a supervisor checks a random sample of claims due to be paid as a double check. The consultant recommends that Our Health can lower processing costs by having the member, rather than clerks, enter the type of claim (which "extra") and invoice amount. They argue that customers are best placed to know what they are claiming, and that the change reduces double handling of claims, thereby enhancing the validity and accuracy of Our Health's data. It would also lower costs by not needing as many clerks. The programming costs to make the change to the system would be minimal, and the supervisor checks would remain to help identify errors made by the customer. It should be noted that each year, Our Health adjusts membership fees based on how much is paid-out in the previous 12 months. Would the online claim process be part of Our Health's Revenue or Expenditure cycle; explain why with reference to economic events? Enter your answer here Q3.2 5 Points (a) Would the process change lead to a more valid and accurate data? Explain why. (3 mark) Enter your answer here (b) Could any costs increase as a result of this change? (1 mark) Enter your answer here (c) Based on your answers in (a) and (b), should Our Health make the change? Justify your answer. (1 mark)

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started