Question

Our HR department has determined that as an added incentive, all new employees hired into our Smoothie business unit should receive a pension of

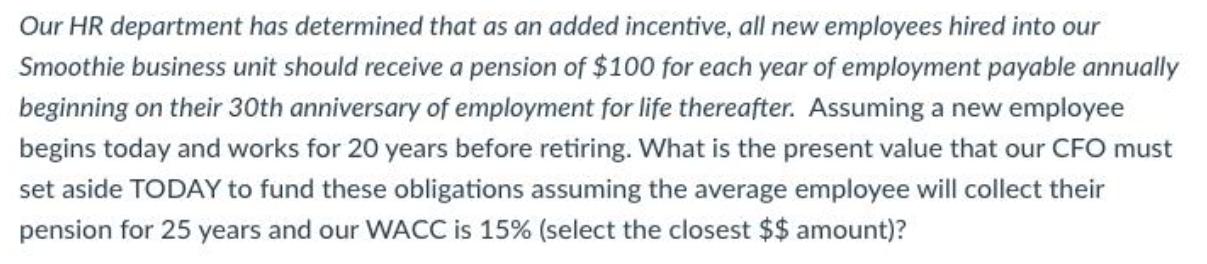

Our HR department has determined that as an added incentive, all new employees hired into our Smoothie business unit should receive a pension of $100 for each year of employment payable annually beginning on their 30th anniversary of employment for life thereafter. Assuming a new employee begins today and works for 20 years before retiring. What is the present value that our CFO must set aside TODAY to fund these obligations assuming the average employee will collect their pension for 25 years and our WACC is 15% (select the closest $$ amount)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of the pension obligations for an employee who works for 20 years bef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App