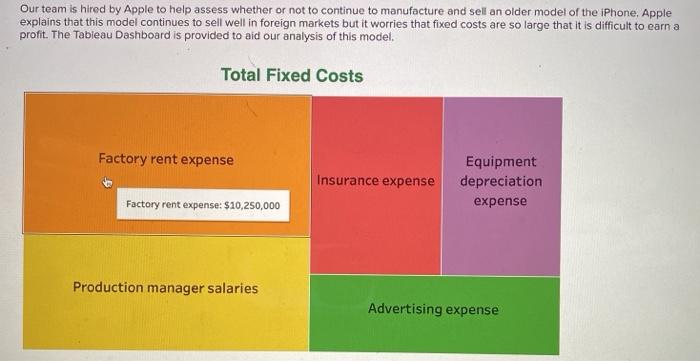

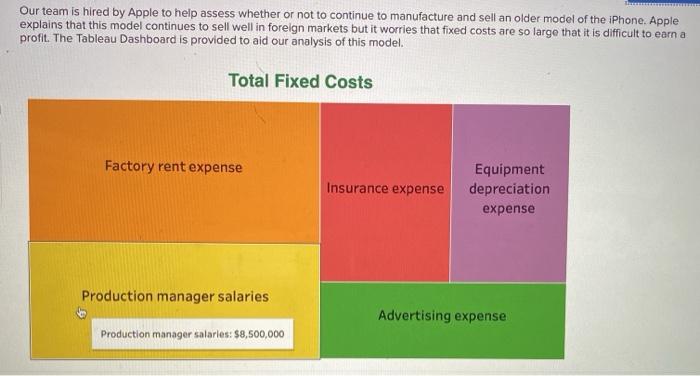

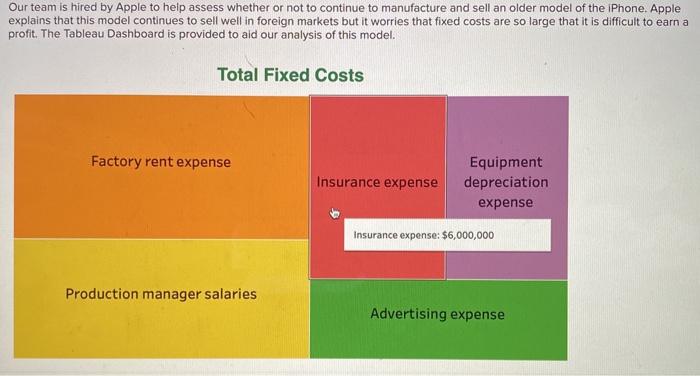

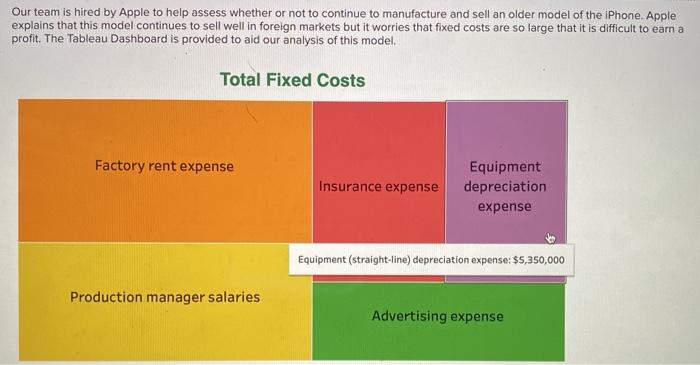

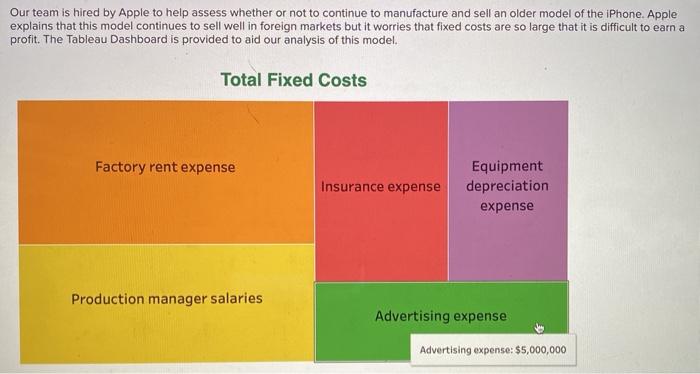

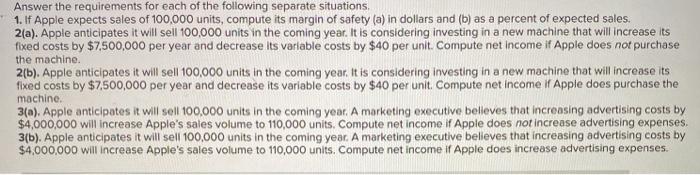

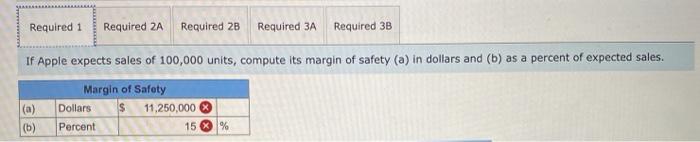

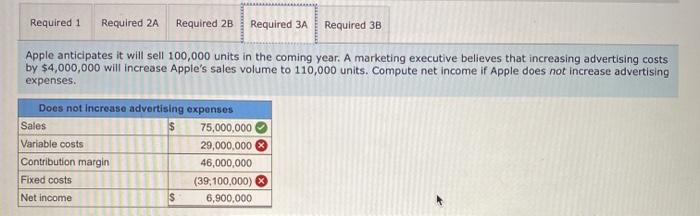

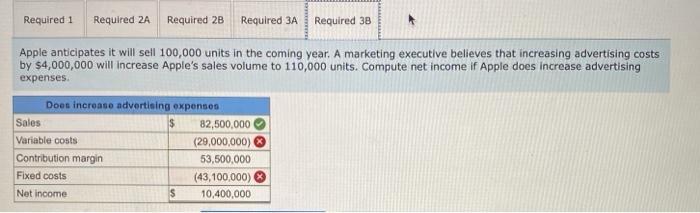

Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone, Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Factory rent expense: $10,250,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Production manager salaries Advertising expense Production manager salaries: $8,500,000 Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Insurance expense: $6,000,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Equipment (straight-line) depreciation expense: $5,350,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Production manager salaries Advertising expense Advertising expense: $5,000,000 Variable Costs Per Unit Battery Camera Internal Components Receiver Screen Speaker WWW Sales Price Per Unit iPhone Answer the requirements for each of the following separate situations, 1. If Apple expects sales of 100,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. 2(a). Apple anticipates it will sell 100,000 units in the coming year. It is considering investing in a new machine that will increase its fixed costs by $7,500,000 per year and decrease its variable costs by $40 per unit. Compute net income if Apple does not purchase the machine 2(b). Apple anticipates it will sell 100,000 units in the coming year. It is considering investing in a new machine that will increase its fixed costs by $7,500,000 per year and decrease its variable costs by $40 per unit. Compute net income ir Apple does purchase the machine. 3(a). Apple anticipates it will sell 100,000 units in the coming year. A marketing executive belleves that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does not increase advertising expenses. 3(b). Apple anticipates it will sell 100,000 units in the coming year. A marketing executive believes that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does increase advertising expenses. Required 1 Required 2A Required 2B Required 3A Required 3B If Apple expects sales of 100,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. (a) (b) Margin of Safety Dollars 11,250,000 Percent 15 % Required 38 Required 1 Required 2A Required 2B Required 3A Apple anticipates it will sell 100,000 units in the coming year. A marketing executive believes that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does increase advertising expenses Does increase advertising expenses Sales 82,500,000 Variable costs (29,000,000) Contribution margin 53,500,000 Fixed costs (43,100,000) Net Income S 10,400,000 Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone, Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Factory rent expense: $10,250,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Production manager salaries Advertising expense Production manager salaries: $8,500,000 Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Insurance expense: $6,000,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Equipment (straight-line) depreciation expense: $5,350,000 Production manager salaries Advertising expense Our team is hired by Apple to help assess whether or not to continue to manufacture and sell an older model of the iPhone Apple explains that this model continues to sell well in foreign markets but it worries that fixed costs are so large that it is difficult to earn a profit. The Tableau Dashboard is provided to aid our analysis of this model. Total Fixed Costs Factory rent expense Insurance expense Equipment depreciation expense Production manager salaries Advertising expense Advertising expense: $5,000,000 Variable Costs Per Unit Battery Camera Internal Components Receiver Screen Speaker WWW Sales Price Per Unit iPhone Answer the requirements for each of the following separate situations, 1. If Apple expects sales of 100,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. 2(a). Apple anticipates it will sell 100,000 units in the coming year. It is considering investing in a new machine that will increase its fixed costs by $7,500,000 per year and decrease its variable costs by $40 per unit. Compute net income if Apple does not purchase the machine 2(b). Apple anticipates it will sell 100,000 units in the coming year. It is considering investing in a new machine that will increase its fixed costs by $7,500,000 per year and decrease its variable costs by $40 per unit. Compute net income ir Apple does purchase the machine. 3(a). Apple anticipates it will sell 100,000 units in the coming year. A marketing executive belleves that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does not increase advertising expenses. 3(b). Apple anticipates it will sell 100,000 units in the coming year. A marketing executive believes that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does increase advertising expenses. Required 1 Required 2A Required 2B Required 3A Required 3B If Apple expects sales of 100,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. (a) (b) Margin of Safety Dollars 11,250,000 Percent 15 % Required 38 Required 1 Required 2A Required 2B Required 3A Apple anticipates it will sell 100,000 units in the coming year. A marketing executive believes that increasing advertising costs by $4,000,000 will increase Apple's sales volume to 110,000 units. Compute net income if Apple does increase advertising expenses Does increase advertising expenses Sales 82,500,000 Variable costs (29,000,000) Contribution margin 53,500,000 Fixed costs (43,100,000) Net Income S 10,400,000