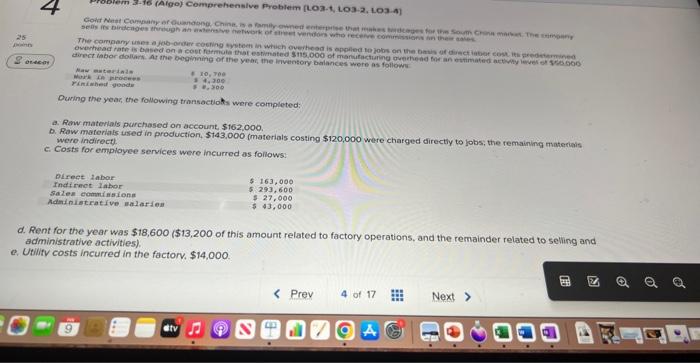

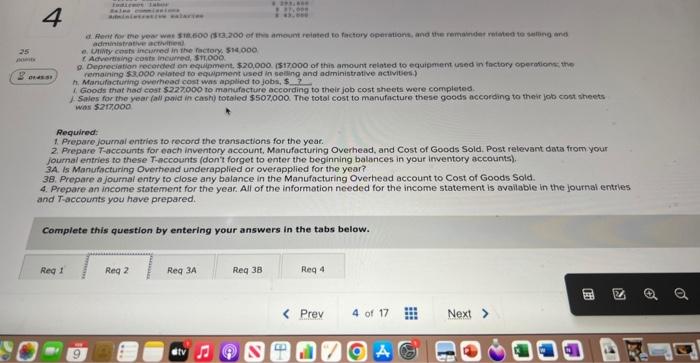

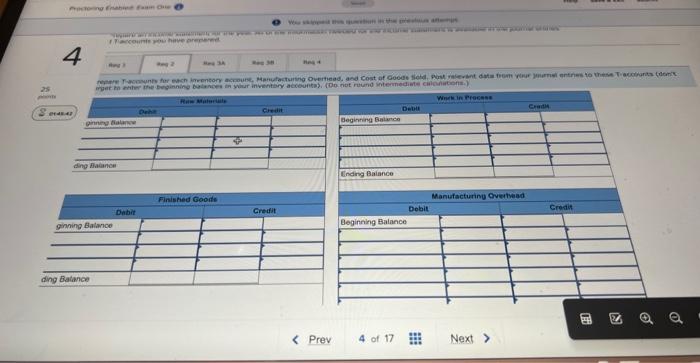

Ouring the yoar, the following transactiok were completed: a. Row materials purchased on accournt. $162,000. b. Raw marerials issed in production, $143,000 imaterials costing $120,000 were chatged directly to jobs, the remaining materiaks c. Costs for empiayee services wore incurred as follows: d. Rent for the year was $18,600 (\$13,200 of this amount related to factory operations, and the remainder related to seling and administrative activities). 2. Ubility costs incurred in the factorv. $14,000. adminis brative icthenien? e. Uinby cons incianred in the factory, 514000 1. Actwertining couts incurred, $7 trooo a. Depreciafion recorded on equilpment, $20,000. (\$17000 of this amount cetated to equipment uned in factory ope rofions; ihe remaining ssi,ooo relored no equipment used in beding and administrativo activites.) A. Maniciacturing overhead cost was applied to jobs, $ ? 3. Goods that had cost 5227000 to manufacture according to their job cost sheets were completed. 1. Sples for the year (all paid in cashy toraled 5507000 . The total cost to manufacture these goods according to their job cost sheets was $217,00 Required: 1. Prepare journai entrios to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from. your journal entries to these T-apccouants (don't forgot to enter the beginning balances in your inventory accountes). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 39. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the informotion needed for the income statement is avaiabie in the iournal entries and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. Ouring the yoar, the following transactiok were completed: a. Row materials purchased on accournt. $162,000. b. Raw marerials issed in production, $143,000 imaterials costing $120,000 were chatged directly to jobs, the remaining materiaks c. Costs for empiayee services wore incurred as follows: d. Rent for the year was $18,600 (\$13,200 of this amount related to factory operations, and the remainder related to seling and administrative activities). 2. Ubility costs incurred in the factorv. $14,000. adminis brative icthenien? e. Uinby cons incianred in the factory, 514000 1. Actwertining couts incurred, $7 trooo a. Depreciafion recorded on equilpment, $20,000. (\$17000 of this amount cetated to equipment uned in factory ope rofions; ihe remaining ssi,ooo relored no equipment used in beding and administrativo activites.) A. Maniciacturing overhead cost was applied to jobs, $ ? 3. Goods that had cost 5227000 to manufacture according to their job cost sheets were completed. 1. Sples for the year (all paid in cashy toraled 5507000 . The total cost to manufacture these goods according to their job cost sheets was $217,00 Required: 1. Prepare journai entrios to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from. your journal entries to these T-apccouants (don't forgot to enter the beginning balances in your inventory accountes). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 39. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the informotion needed for the income statement is avaiabie in the iournal entries and T-accounts you have prepared. Complete this question by entering your answers in the tabs below