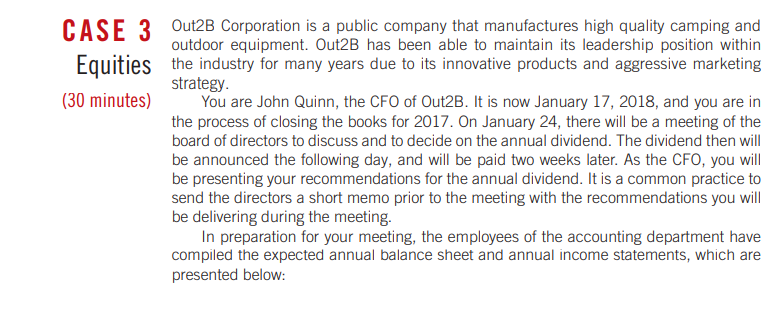

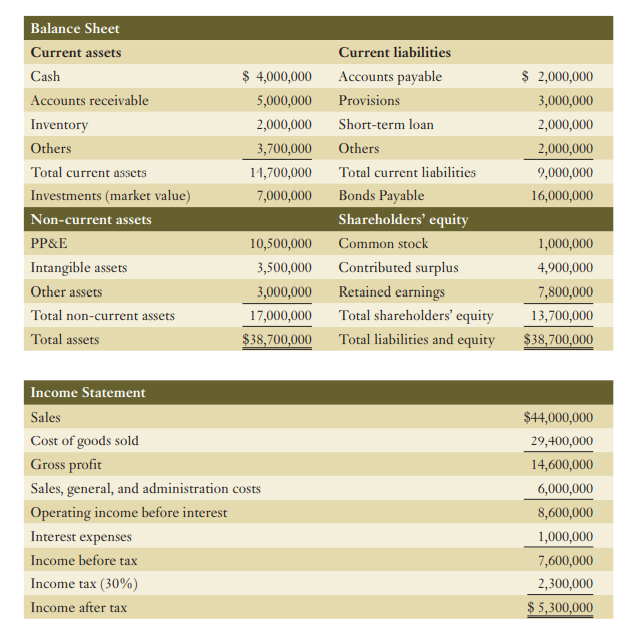

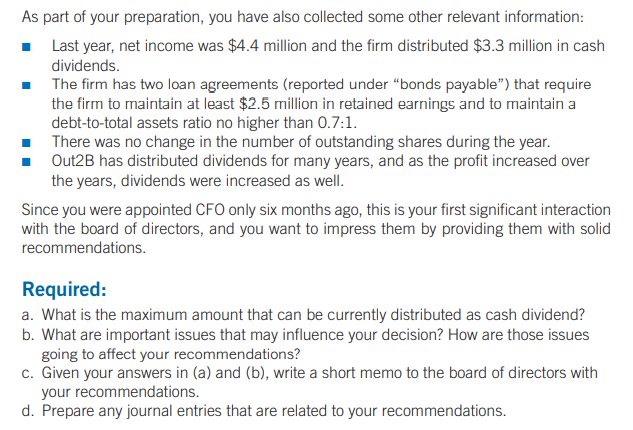

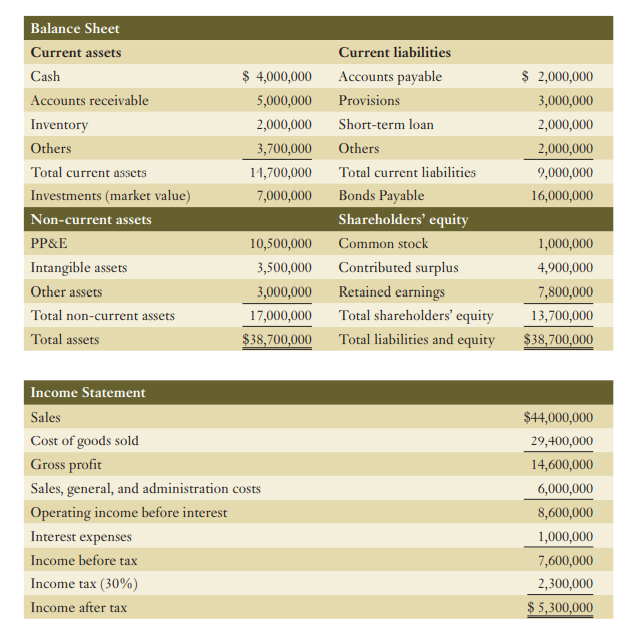

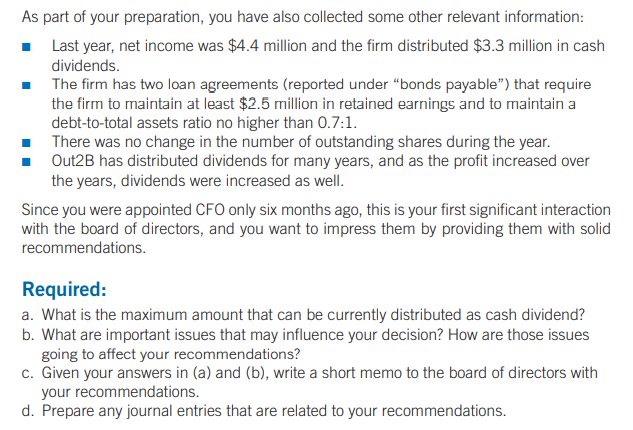

Out2B Corporation is a public company that manufactures high quality camping and outdoor equipment. Out2B has been able to maintain its leadership position within the industry for many years due to its innovative products and aggressive marketing strategy. You are John Quinn, the CFO of Out2B. It is now January 17, 2018, and you are in the process of closing the books for 2017 . On January 24 , there will be a meeting of the board of directors to discuss and to decide on the annual dividend. The dividend then will be announced the following day, and will be paid two weeks later. As the CFO, you will be presenting your recommendations for the annual dividend. It is a common practice to send the directors a short memo prior to the meeting with the recommendations you will be delivering during the meeting. In preparation for your meeting, the employees of the accounting department have compiled the expected annual balance sheet and annual income statements, which are presented below: \begin{tabular}{lc} \hline Income Statement & \\ \hline Sales & $44,000,000 \\ \hline Cost of goods sold & 29,400,000 \\ \hline Gross profit & 14,600,000 \\ \hline Sales, general, and administration costs & 6,000,000 \\ \hline Operating income before interest & 8,600,000 \\ \hline Interest expenses & 1,000,000 \\ \hline Income before tax & 7,600,000 \\ \hline Income tax (30%) & 2,300,000 \\ \hline Income after tax & $5,300,000 \\ \hline \end{tabular} As part of your preparation, you have also collected some other relevant information: Last year, net income was $4.4 million and the firm distributed $3.3 million in cash dividends. The firm has two loan agreements (reported under "bonds payable") that require the firm to maintain at least $2.5 million in retained earnings and to maintain a debt-to-total assets ratio no higher than 0.7:1. There was no change in the number of outstanding shares during the year. Out2B has distributed dividends for many years, and as the profit increased over the years, dividends were increased as well. Since you were appointed CFO only six months ago, this is your first significant interaction with the board of directors, and you want to impress them by providing them with solid recommendations. Required: a. What is the maximum amount that can be currently distributed as cash dividend? b. What are important issues that may influence your decision? How are those issues going to affect your recommendations? c. Given your answers in (a) and (b), write a short memo to the board of directors with your recommendations. d. Prepare any journal entries that are related to your recommendations. Out2B Corporation is a public company that manufactures high quality camping and outdoor equipment. Out2B has been able to maintain its leadership position within the industry for many years due to its innovative products and aggressive marketing strategy. You are John Quinn, the CFO of Out2B. It is now January 17, 2018, and you are in the process of closing the books for 2017 . On January 24 , there will be a meeting of the board of directors to discuss and to decide on the annual dividend. The dividend then will be announced the following day, and will be paid two weeks later. As the CFO, you will be presenting your recommendations for the annual dividend. It is a common practice to send the directors a short memo prior to the meeting with the recommendations you will be delivering during the meeting. In preparation for your meeting, the employees of the accounting department have compiled the expected annual balance sheet and annual income statements, which are presented below: \begin{tabular}{lc} \hline Income Statement & \\ \hline Sales & $44,000,000 \\ \hline Cost of goods sold & 29,400,000 \\ \hline Gross profit & 14,600,000 \\ \hline Sales, general, and administration costs & 6,000,000 \\ \hline Operating income before interest & 8,600,000 \\ \hline Interest expenses & 1,000,000 \\ \hline Income before tax & 7,600,000 \\ \hline Income tax (30%) & 2,300,000 \\ \hline Income after tax & $5,300,000 \\ \hline \end{tabular} As part of your preparation, you have also collected some other relevant information: Last year, net income was $4.4 million and the firm distributed $3.3 million in cash dividends. The firm has two loan agreements (reported under "bonds payable") that require the firm to maintain at least $2.5 million in retained earnings and to maintain a debt-to-total assets ratio no higher than 0.7:1. There was no change in the number of outstanding shares during the year. Out2B has distributed dividends for many years, and as the profit increased over the years, dividends were increased as well. Since you were appointed CFO only six months ago, this is your first significant interaction with the board of directors, and you want to impress them by providing them with solid recommendations. Required: a. What is the maximum amount that can be currently distributed as cash dividend? b. What are important issues that may influence your decision? How are those issues going to affect your recommendations? c. Given your answers in (a) and (b), write a short memo to the board of directors with your recommendations. d. Prepare any journal entries that are related to your recommendations