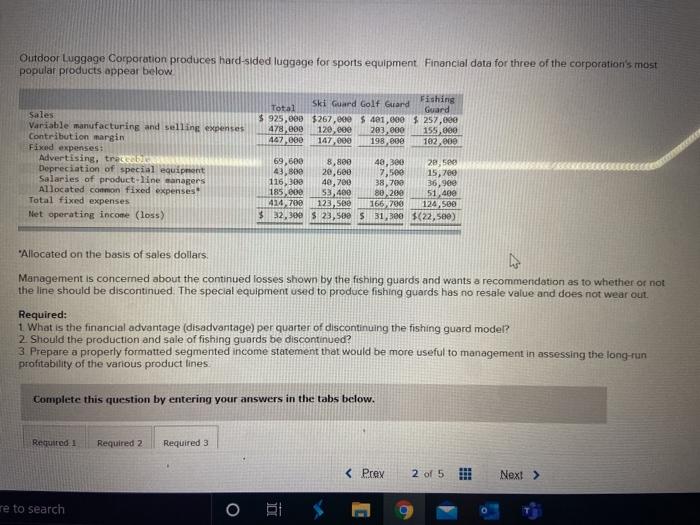

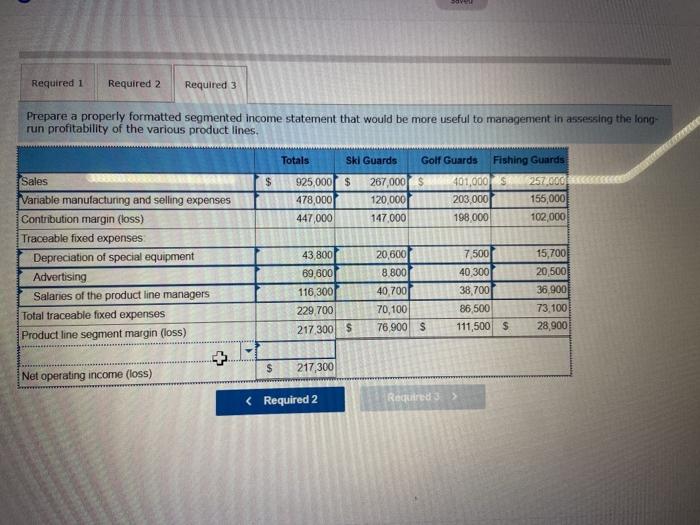

Outdoor Luggage Corporation produces hard-sided luggage for sports equipment Financial data for three of the corporation's most popular products appear below Total Ski Guard Golf Girard Fishing Guard $ 925,000 $267,eee $ 481,000 $257,000 478,000 120,000 203,000 155,000 447,080 147,000 198,888 102,000 Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses. Advertising, trace Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses Total fixed expenses Met operating income (loss) 69,600 8,800 43,800 20,680 116,300 40, 700 185,800 5.400 414,700 123,5ee $ 32,300 $ 23,500 5 48,300 20,5 7,500 15,709 38,700 36,900 80,200 51,400 166, 700 124,500 31,300 $(22,500) "Allocated on the basis of sales dollars is Management is concerned about the continued losses shown by the fishing guards and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce fishing guards has no resale value and does not wear out. Required: 1 What is the financial advantage (disadvantage) per quarter of discontinuing the fishing guard model? 2 Should the production and sale of fishing guards be discontinued? 3 Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long run profitability of the various product lines Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 re to search Required 1 Required 2 Required 3 Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long- run profitability of the various product lines. Totals Skl Guards $ 925,000 $ 478,000 447,000 267,000 120,000 147 000 Golf Guards Fishing Guards $ 401,000 257.000 203,000 155,000 198 000 102,000 Sales Variable manufacturing and selling expenses Contribution margin (loss) Traceable fixed expenses Depreciation of special equipment Advertising Salaries of the product line managers Total traceable fixed expenses Product line segment margin (loss) 15,700 43 800 69 600 116,300 229 700 217 300 S 20,600 8 800 40.700 7.500 40,300 38,700 86 500 111,500 $ 20 500 36 900 73.100 28.900 70,100 76,900 $ + $ 217 300 Net operating income (loss)