Question

OUTSOURCING HOMEWORK BACKGROUND : The purpose of this homework is to create an optimal product mix using traditional accounting and throughput accounting. You will be

OUTSOURCING HOMEWORK

BACKGROUND: The purpose of this homework is to create an optimal product mix using traditional accounting and throughput accounting. You will be provided with a system under investigation containing a select number of products and processes. You will define the product mix using traditional cost accounting (ranking based on marginal profit per product) and throughput accounting (ranking based on contribution per constraint minute). You will then be asked to maximize profit given the ability to outsource a single product (either partial outsource or full outsource).

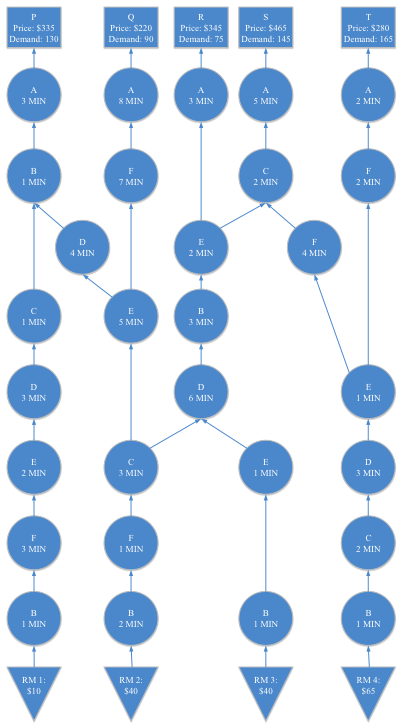

SYSTEM UNDER INVESTIGATION: The figure on the next page contains routing and processing information regarding the flow of materials through the system. The system produces five products (P, Q, R, S, & T). The purchase price, weekly demand, and raw material cost for each product is shown. The process locations do not reflect physical routings; rather the routings depicted reflect the sequence of production as materials move through the six resources (A, B, C, D, E, & F) required to produce each product.

Each resource is assumed to have 2,400 minutes of available capacity per week based on five eight-hour work days. Points of convergence represent assembly operations, requiring material availability along both arcs for the product to be processed. Points of divergence represent differences in processing at the selected location, allowing the output to be used as an input at one of the subsequent locations.

The system has a fixed weekly cost of operation of $110,000 and an initial investment of $4,000,000. Allocation of overhead is based on machine minutes.

Once you have identified the constraint, you should create (1) a traditional product mix and (2) a TOC product mix. Based on both product mixes, you should establish the (3) profit per week , (4) the profit difference between the product mixes, and (5) the annual return on investment.

Finally, as a manager for the company under investigation, you are allowed to outsource 1 of your products. The purchasing manager for this product line has negotiated a price with a contract manufacturer that is 20% below your fully absorbed cost of manufacturing (Direct and Allocated Indirect cost). According to the negotiated price, you may partially or totally outsource only a single product. (6) Which product should you outsource, (7) how much of that product should you outsource, (8) what is the impact on profitability, and (9) what is the impact on annual ROI?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started