Answered step by step

Verified Expert Solution

Question

1 Approved Answer

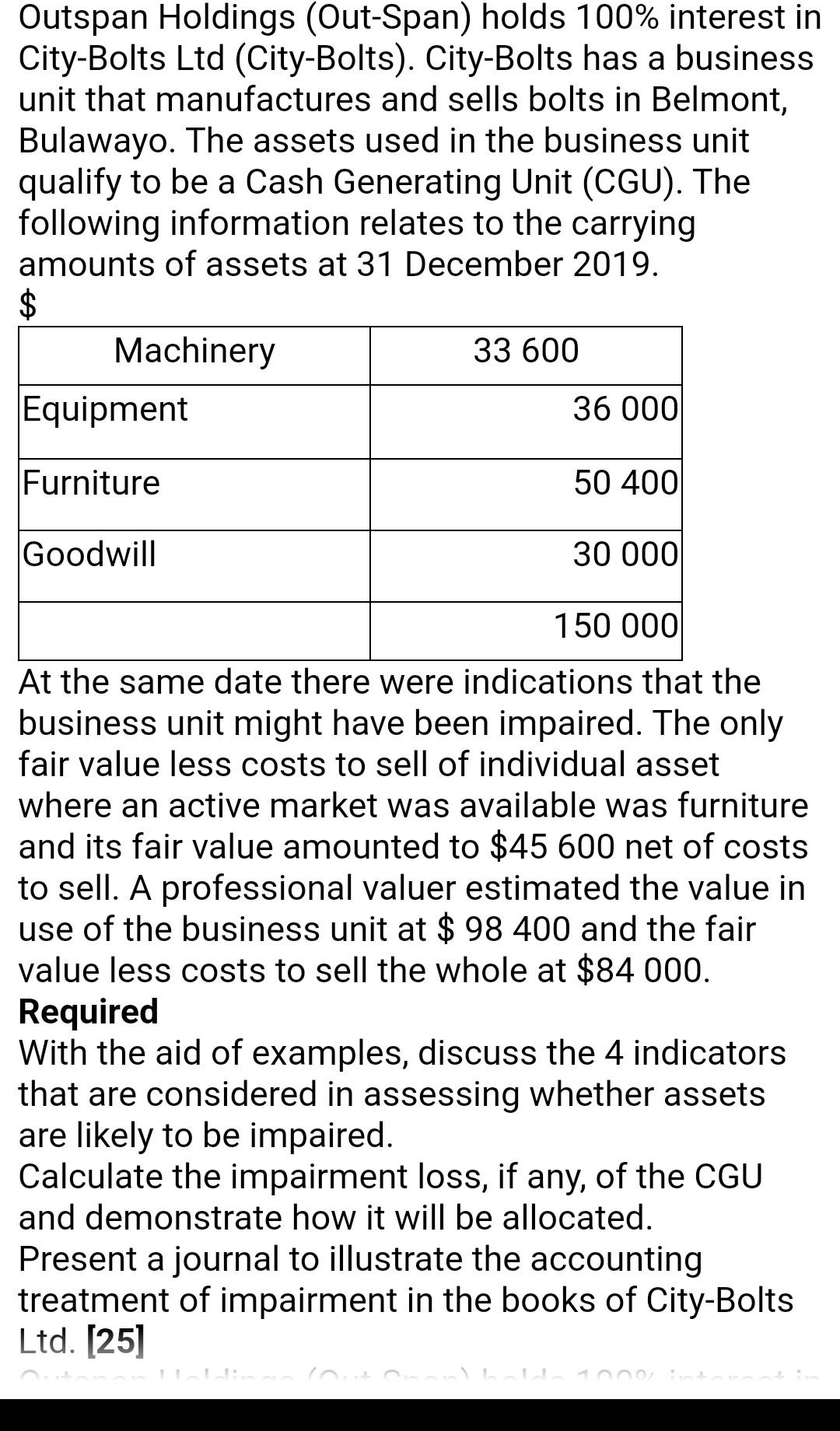

Outspan Holdings (Out-Span) holds 100% interest in City-Bolts Ltd (City-Bolts). City-Bolts has a business unit that manufactures and sells bolts in Belmont, Bulawayo. The assets

Outspan Holdings (Out-Span) holds 100% interest in City-Bolts Ltd (City-Bolts). City-Bolts has a business unit that manufactures and sells bolts in Belmont, Bulawayo. The assets used in the business unit qualify to be a Cash Generating Unit (CGU). The following information relates to the carrying amounts of assets at 31 December 2019. $ At the same date there were indications that the business unit might have been impaired. The only fair value less costs to sell of individual asset where an active market was available was furniture and its fair value amounted to $45600 net of costs to sell. A professional valuer estimated the value in use of the business unit at $98400 and the fair value less costs to sell the whole at $84000. Required With the aid of examples, discuss the 4 indicators that are considered in assessing whether assets are likely to be impaired. Calculate the impairment loss, if any, of the CGU and demonstrate how it will be allocated. Present a journal to illustrate the accounting treatment of impairment in the books of City-Bolts Ltd. [25]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started