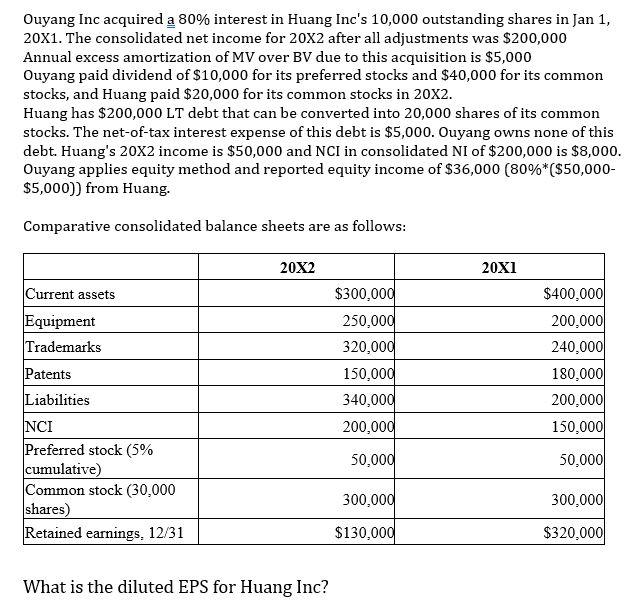

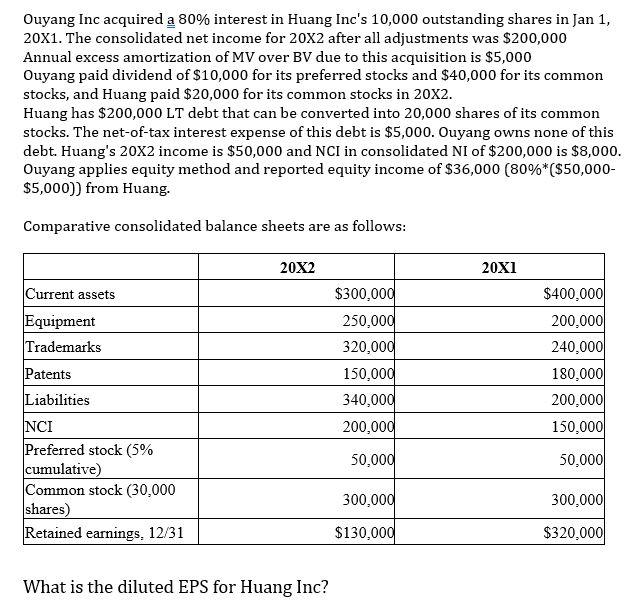

Ouyang Inc acquired a 80% interest in Huang Inc's 10,000 outstanding shares in Jan 1, 20X1. The consolidated net income for 20x2 after all adjustments was $200,000 Annual excess amortization of MV over BV due to this acquisition is $5,000 Ouyang paid dividend of $10,000 for its preferred stocks and $40,000 for its common stocks, and Huang paid $20,000 for its common stocks in 20x2. Huang has $200,000 LT debt that can be converted into 20,000 shares of its common stocks. The net-of-tax interest expense of this debt is $5,000. Ouyang owns none of this debt. Huang's 20x2 income is $50,000 and NCI in consolidated NI of $200,000 is $8,000. Ouyang applies equity method and reported equity income of $36,000 (80%*($50,000- $5,000)) from Huang. Comparative consolidated balance sheets are as follows: 20X2 20X1 Current assets Equipment Trademarks Patents Liabilities NCI Preferred stock (5% cumulative) Common stock (30,000 shares) Retained earnings. 12/31 $300,000 250,000 320,000 150,000 340,000 200,000 $400,000 200,000 240,000 180,000 200,000 150,000 50,000 50,000 300,000 300,000 $130,000 $320,000 What is the diluted EPS for Huang Inc? Ouyang Inc acquired a 80% interest in Huang Inc's 10,000 outstanding shares in Jan 1, 20X1. The consolidated net income for 20x2 after all adjustments was $200,000 Annual excess amortization of MV over BV due to this acquisition is $5,000 Ouyang paid dividend of $10,000 for its preferred stocks and $40,000 for its common stocks, and Huang paid $20,000 for its common stocks in 20x2. Huang has $200,000 LT debt that can be converted into 20,000 shares of its common stocks. The net-of-tax interest expense of this debt is $5,000. Ouyang owns none of this debt. Huang's 20x2 income is $50,000 and NCI in consolidated NI of $200,000 is $8,000. Ouyang applies equity method and reported equity income of $36,000 (80%*($50,000- $5,000)) from Huang. Comparative consolidated balance sheets are as follows: 20X2 20X1 Current assets Equipment Trademarks Patents Liabilities NCI Preferred stock (5% cumulative) Common stock (30,000 shares) Retained earnings. 12/31 $300,000 250,000 320,000 150,000 340,000 200,000 $400,000 200,000 240,000 180,000 200,000 150,000 50,000 50,000 300,000 300,000 $130,000 $320,000 What is the diluted EPS for Huang Inc