Question

Over the last five years, the following returns have been experienced by Firm A and Firm B. a. b. Firm A (% pa) Firm

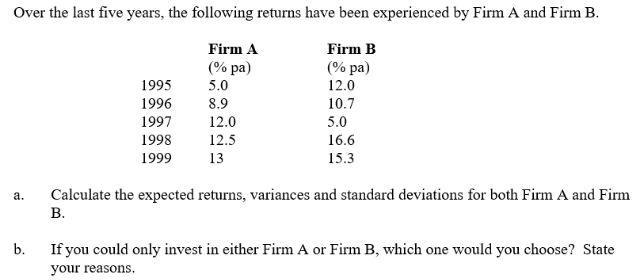

Over the last five years, the following returns have been experienced by Firm A and Firm B. a. b. Firm A (% pa) Firm B (% pa) 1995 5.0 12.0 1996 8.9 10.7 1997 12.0 5.0 1998 12.5 16.6 1999 13 15.3 Calculate the expected returns, variances and standard deviations for both Firm A and Firm B. If you could only invest in either Firm A or Firm B, which one would you choose? State your reasons.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Marketing And Export Management

Authors: Gerald Albaum , Alexander Josiassen , Edwin Duerr

8th Edition

1292016922, 978-1292016924

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App