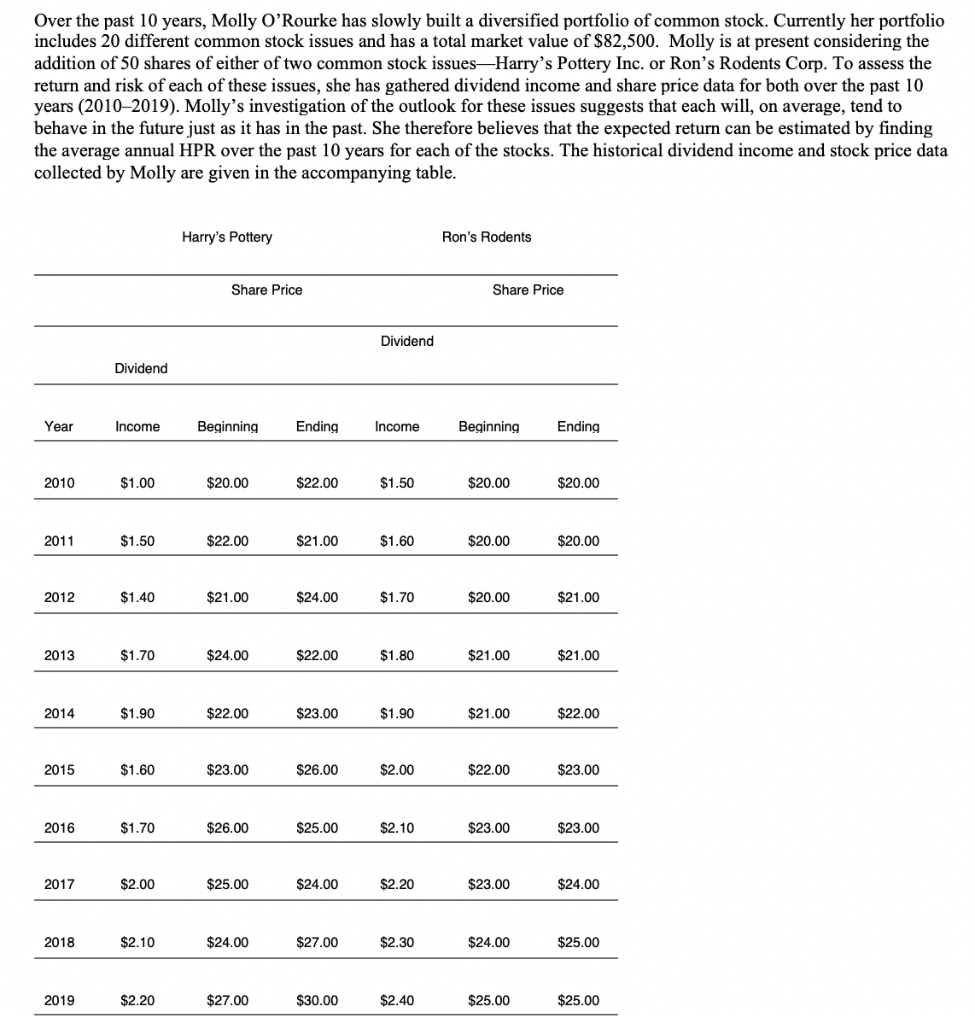

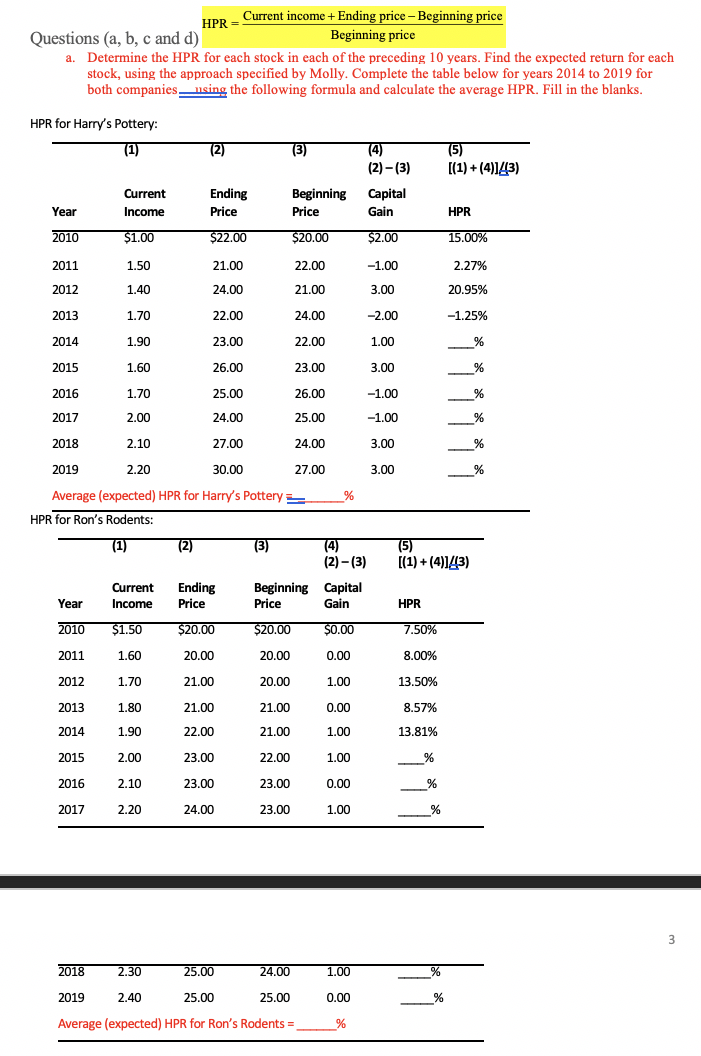

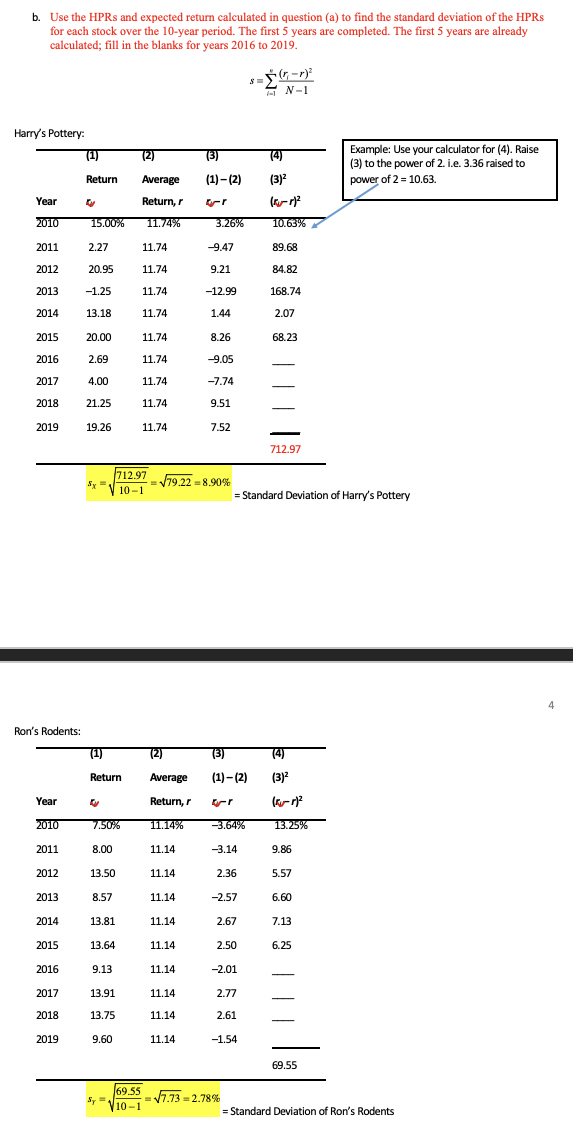

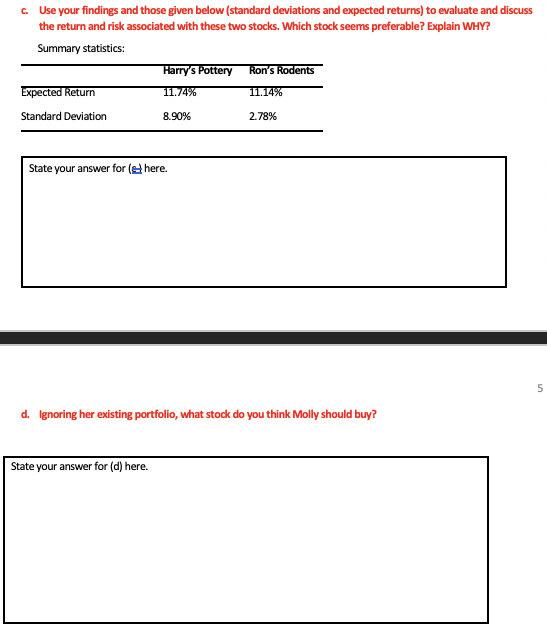

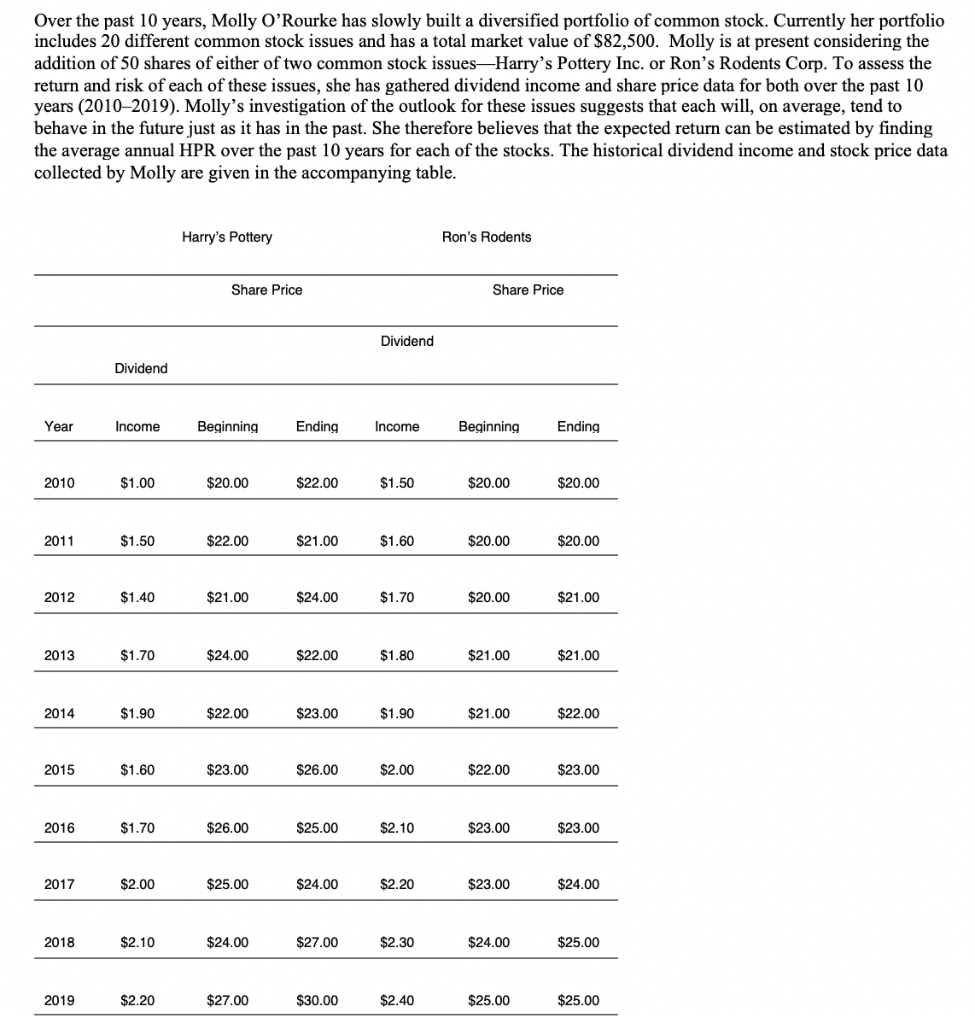

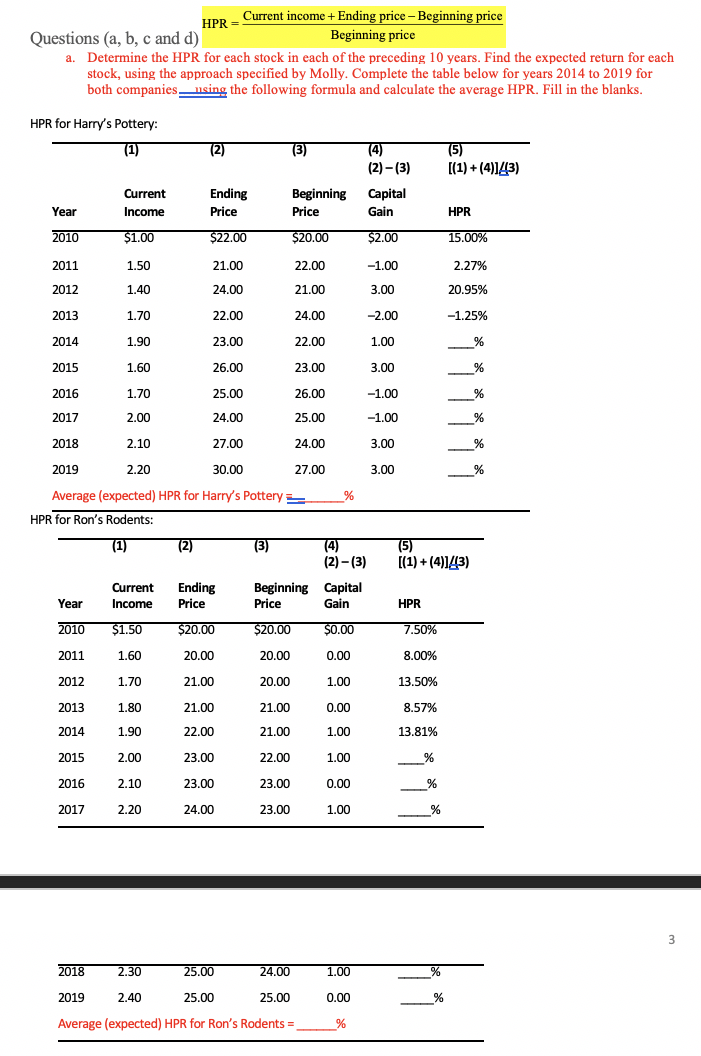

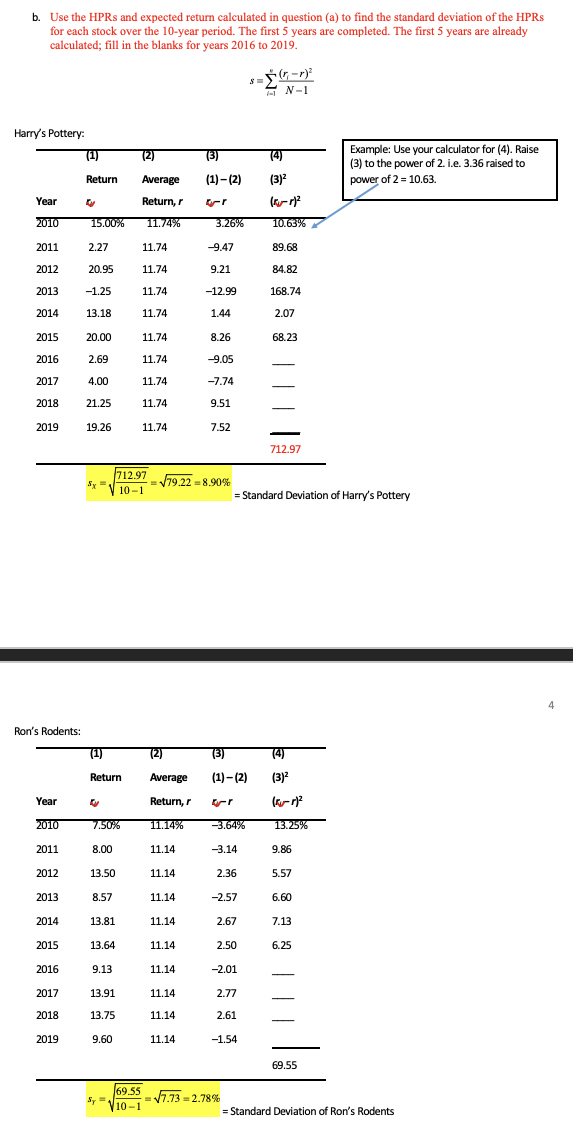

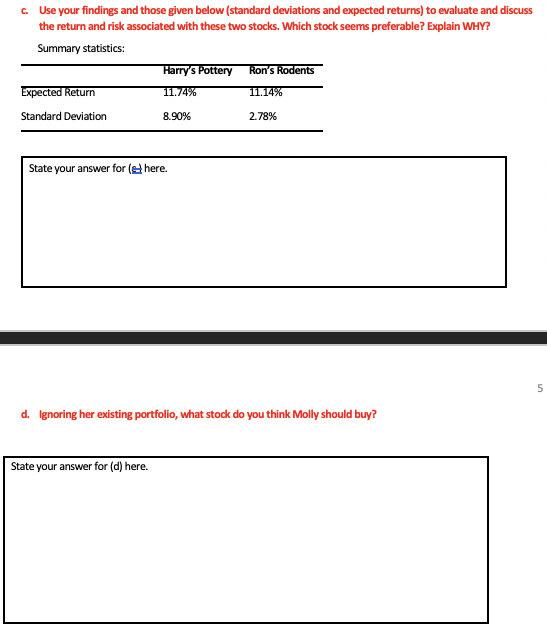

Over the past 10 years, Molly O'Rourke has slowly built a diversified portfolio of common stock. Currently her portfolio includes 20 different common stock issues and has a total market value of $82,500. Molly is at present considering the addition of 50 shares of either of two common stock issues-Harry's Pottery Inc. or Ron's Rodents Corp. To assess the return and risk of each of these issues, she has gathered dividend income and share price data for both over the past 10 years (2010-2019). Molly's investigation of the outlook for these issues suggests that each will, on average, tend to behave in the future just as it has in the past. She therefore believes that the expected return can be estimated by finding the average annual HPR over the past 10 years for each of the stocks. The historical dividend income and stock price data collected by Molly are given in the accompanying table. Harry's Pottery Ron's Rodents Share Price Share Price Dividend Dividend Year Income Beginning Ending Income Beginning Ending 2010 $1.00 $20.00 $22.00 $1.50 $20.00 $20.00 2011 $1.50 $22.00 $21.00 $1.60 $20.00 $20.00 2012 $1.40 $21.00 $24.00 $1.70 $20.00 $21.00 2013 $1.70 $24.00 $22.00 $1.80 $21.00 $21.00 44 90 2014 $1.90 $22.00 $23.00 $1.90 $21.00 $22.00 2015 $1.60 $23.00 $26.00 $2.00 $22.00 $23.00 2016 $1.70 $26.00 $25.00 $2.10 $23.00 $23.00 2017 $2.00 $25.00 $24.00 $2.20 $23.00 $24.00 2018 $2.10 $24.00 $27.00 $2.30 $25.00 2019 $2.20 $27.00 $30.00 $2.40 $25.00 $25.00 TDD Current income + Ending price - Beginning price Questions (a, b, c and d) Beginning price a. Determine the HPR for each stock in each of the preceding 10 years. Find the expected return for each stock, using the approach specified by Molly. Complete the table below for years 2014 to 2019 for both companies using the following formula and calculate the average HPR. Fill in the blanks. 3.00 23.00 3.00 HPR for Harry's Pottery: (2) (3) (5) (2)-(3) [(1) + (4)143) Current Ending Beginning Capital Year Income Price Price Gain HPR 2010 $1.00 $22.00 $20.00 $2.00 15.00% 2011 1.50 21.00 22.00 -1.00 2.27% 2012 1.40 24.00 21.00 20.95% 2013 1.70 22.00 24.00 -2.00 -1.25% 2014 1.90 22.00 1.00 2015 1.60 26.00 23.00 2016 1.70 25.00 26.00 -1.00 2017 2.00 24.00 25.00 2018 2.10 27.00 24.00 2019 2.20 27.00 Average (expected) HPR for Harry's Pottery = _% HPR for Ron's Rodents: (1) (2) (2)-(3) [(1) + (4)143) Current Ending Beginning Capital Year Income Price Price Gain HPR 2010 $1.50 $20.00 $20.00 $0.00 7.50% 2011 1.60 20.00 20.00 0.00 8.00% 2012 1.70 21.00 20.00 1.00 13.50% 2013 1.80 21.00 21.00 0.00 8.57% 2014 1.90 22.00 1.00 13.81% 2015 2.00 23.00 22.00 1.00 2016 2.10 23.00 23.00 0.00 2017 2.20 24.00 23.00 1.00 % 30.00 14 (13) 14 _% 2018 2.30 25.00 24.00 2019 2.40 25.00 25.00 Average (expected) HPR for Ron's Rodents = _ 1.00 0.00 _% b. Use the HPRs and expected return calculated in question (a) to find the standard deviation of the HPRS for each stock over the 10-year period. The first 5 years are completed. The first 5 years are already calculated; fill in the blanks for years 2016 to 2019. NI Harry's Pottery: Example: Use your calculator for (4). Raise (3) to the power of 2. i.e. 3.36 raised to power of 2 = 10.63. Return Year (2) Average Return, 11.74% 11.74 11.74 11.74 11.74 (3) (1)-(2) or 3.26% 9.47 (4) (3) -72 10.63% 89.68 9.21 84.82 -12.99 168.74 1.44 2.07 2011 2012 2013 2014 2015 2016 2017 2018 2019 15.00% 2.27 20.95 -1.25 13.18 20.00 2.69 4.00 21.25 19.26 8.26 68.23 11.74 11.74 9.05 -7.74 11.74 11.74 11.74 9.51 7.52 712.97 sx - 72.97 V79.22 = 8.90% = Standard Deviation of Harry's Pottery Ron's Rodents: Return Year 2010 Average Return,r 11.14% (1)-(2) nr -3,64% (3)2 2 13.25% 9.86 7.50% 2011 8.00 11.14 -3.14 2.36 2012 13.50 11.14 5.57 8.57 11.14 -2.57 6.60 2013 2014 11.14 2015 13.81 13.64 9.13 13.91 2.67 2.50 -2.01 2.77 11.14 11.14 11.14 11.14 11.14 2016 2017 13.75 2019 9.60 69.55 5,- V - 17.73 = 2.78% = Standard Deviation of Ron's Rodents c. Use your findings and those given below (standard deviations and expected returns) to evaluate and discuss the return and risk associated with these two stocks. Which stock seems preferable? Explain WHY? Summary statistics: Harry's Pottery 11.74% Expected Return Ron's Rodents 11.14% 2.78% Standard Deviation State your answer for (here. d. Ignoring her existing portfolio, what stock do you think Molly should buy? State your answer for (d) here. Over the past 10 years, Molly O'Rourke has slowly built a diversified portfolio of common stock. Currently her portfolio includes 20 different common stock issues and has a total market value of $82,500. Molly is at present considering the addition of 50 shares of either of two common stock issues-Harry's Pottery Inc. or Ron's Rodents Corp. To assess the return and risk of each of these issues, she has gathered dividend income and share price data for both over the past 10 years (2010-2019). Molly's investigation of the outlook for these issues suggests that each will, on average, tend to behave in the future just as it has in the past. She therefore believes that the expected return can be estimated by finding the average annual HPR over the past 10 years for each of the stocks. The historical dividend income and stock price data collected by Molly are given in the accompanying table. Harry's Pottery Ron's Rodents Share Price Share Price Dividend Dividend Year Income Beginning Ending Income Beginning Ending 2010 $1.00 $20.00 $22.00 $1.50 $20.00 $20.00 2011 $1.50 $22.00 $21.00 $1.60 $20.00 $20.00 2012 $1.40 $21.00 $24.00 $1.70 $20.00 $21.00 2013 $1.70 $24.00 $22.00 $1.80 $21.00 $21.00 44 90 2014 $1.90 $22.00 $23.00 $1.90 $21.00 $22.00 2015 $1.60 $23.00 $26.00 $2.00 $22.00 $23.00 2016 $1.70 $26.00 $25.00 $2.10 $23.00 $23.00 2017 $2.00 $25.00 $24.00 $2.20 $23.00 $24.00 2018 $2.10 $24.00 $27.00 $2.30 $25.00 2019 $2.20 $27.00 $30.00 $2.40 $25.00 $25.00 TDD Current income + Ending price - Beginning price Questions (a, b, c and d) Beginning price a. Determine the HPR for each stock in each of the preceding 10 years. Find the expected return for each stock, using the approach specified by Molly. Complete the table below for years 2014 to 2019 for both companies using the following formula and calculate the average HPR. Fill in the blanks. 3.00 23.00 3.00 HPR for Harry's Pottery: (2) (3) (5) (2)-(3) [(1) + (4)143) Current Ending Beginning Capital Year Income Price Price Gain HPR 2010 $1.00 $22.00 $20.00 $2.00 15.00% 2011 1.50 21.00 22.00 -1.00 2.27% 2012 1.40 24.00 21.00 20.95% 2013 1.70 22.00 24.00 -2.00 -1.25% 2014 1.90 22.00 1.00 2015 1.60 26.00 23.00 2016 1.70 25.00 26.00 -1.00 2017 2.00 24.00 25.00 2018 2.10 27.00 24.00 2019 2.20 27.00 Average (expected) HPR for Harry's Pottery = _% HPR for Ron's Rodents: (1) (2) (2)-(3) [(1) + (4)143) Current Ending Beginning Capital Year Income Price Price Gain HPR 2010 $1.50 $20.00 $20.00 $0.00 7.50% 2011 1.60 20.00 20.00 0.00 8.00% 2012 1.70 21.00 20.00 1.00 13.50% 2013 1.80 21.00 21.00 0.00 8.57% 2014 1.90 22.00 1.00 13.81% 2015 2.00 23.00 22.00 1.00 2016 2.10 23.00 23.00 0.00 2017 2.20 24.00 23.00 1.00 % 30.00 14 (13) 14 _% 2018 2.30 25.00 24.00 2019 2.40 25.00 25.00 Average (expected) HPR for Ron's Rodents = _ 1.00 0.00 _% b. Use the HPRs and expected return calculated in question (a) to find the standard deviation of the HPRS for each stock over the 10-year period. The first 5 years are completed. The first 5 years are already calculated; fill in the blanks for years 2016 to 2019. NI Harry's Pottery: Example: Use your calculator for (4). Raise (3) to the power of 2. i.e. 3.36 raised to power of 2 = 10.63. Return Year (2) Average Return, 11.74% 11.74 11.74 11.74 11.74 (3) (1)-(2) or 3.26% 9.47 (4) (3) -72 10.63% 89.68 9.21 84.82 -12.99 168.74 1.44 2.07 2011 2012 2013 2014 2015 2016 2017 2018 2019 15.00% 2.27 20.95 -1.25 13.18 20.00 2.69 4.00 21.25 19.26 8.26 68.23 11.74 11.74 9.05 -7.74 11.74 11.74 11.74 9.51 7.52 712.97 sx - 72.97 V79.22 = 8.90% = Standard Deviation of Harry's Pottery Ron's Rodents: Return Year 2010 Average Return,r 11.14% (1)-(2) nr -3,64% (3)2 2 13.25% 9.86 7.50% 2011 8.00 11.14 -3.14 2.36 2012 13.50 11.14 5.57 8.57 11.14 -2.57 6.60 2013 2014 11.14 2015 13.81 13.64 9.13 13.91 2.67 2.50 -2.01 2.77 11.14 11.14 11.14 11.14 11.14 2016 2017 13.75 2019 9.60 69.55 5,- V - 17.73 = 2.78% = Standard Deviation of Ron's Rodents c. Use your findings and those given below (standard deviations and expected returns) to evaluate and discuss the return and risk associated with these two stocks. Which stock seems preferable? Explain WHY? Summary statistics: Harry's Pottery 11.74% Expected Return Ron's Rodents 11.14% 2.78% Standard Deviation State your answer for (here. d. Ignoring her existing portfolio, what stock do you think Molly should buy? State your answer for (d) here