Answered step by step

Verified Expert Solution

Question

1 Approved Answer

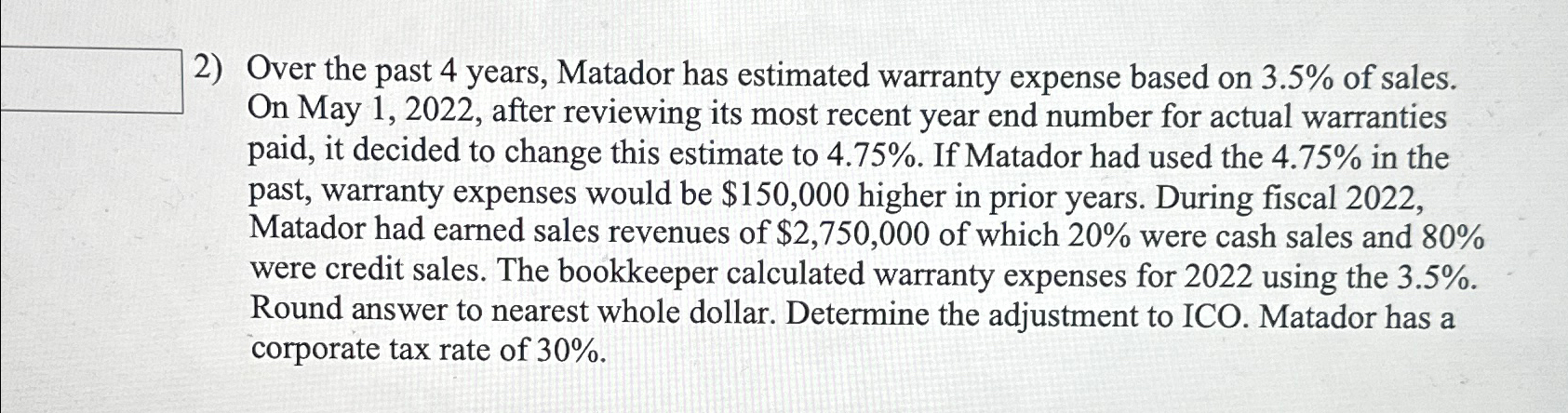

Over the past 4 years, Matador has estimated warranty expense based on 3 . 5 % of sales. On May 1 , 2 0 2

Over the past years, Matador has estimated warranty expense based on of sales. On May after reviewing its most recent year end number for actual warranties paid, it decided to change this estimate to If Matador had used the in the past, warranty expenses would be $ higher in prior years. During fiscal Matador had earned sales revenues of $ of which were cash sales and were credit sales. The bookkeeper calculated warranty expenses for using the Round answer to nearest whole dollar. Determine the adjustment to ICO. Matador has a corporate tax rate of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started