Question

Over the past 56 yers, the average excess return on on the S&P/TSX composite portfolio is 4.24% per annual. And the standard deviation has been

Over the past 56 yers, the average excess return on on the S&P/TSX composite portfolio is 4.24% per annual. And the standard deviation has been 17.42% per year. Assume

that these estimates from historical data are representative of investors expectations about future performance and the current T-bill rate is 5%.

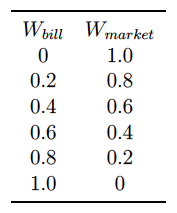

a Calculate the expected return and standard deviation of portfolios invested in

T-bills and the composite index with weights as follows:

b Calculate the Sharpe ratio of each risky portfolio. Compare your results with the Sharpe ratio of the composite portfolio, What conclusion do you make.

c Suppose that you decide to invest a proportion y of total investment in the composite index so that you maximize the expected return on the overall portfolio

subject to the constraint that the standard deviation of your overall portfolio does not exceed 15%. What is the investment proportion and the expected rate

of return on your overall portfolio?

W market Wbill 0 0.2 0.4 0.6 0.8 1.0 1.0 0.8 0.6 0.4 0.2 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started