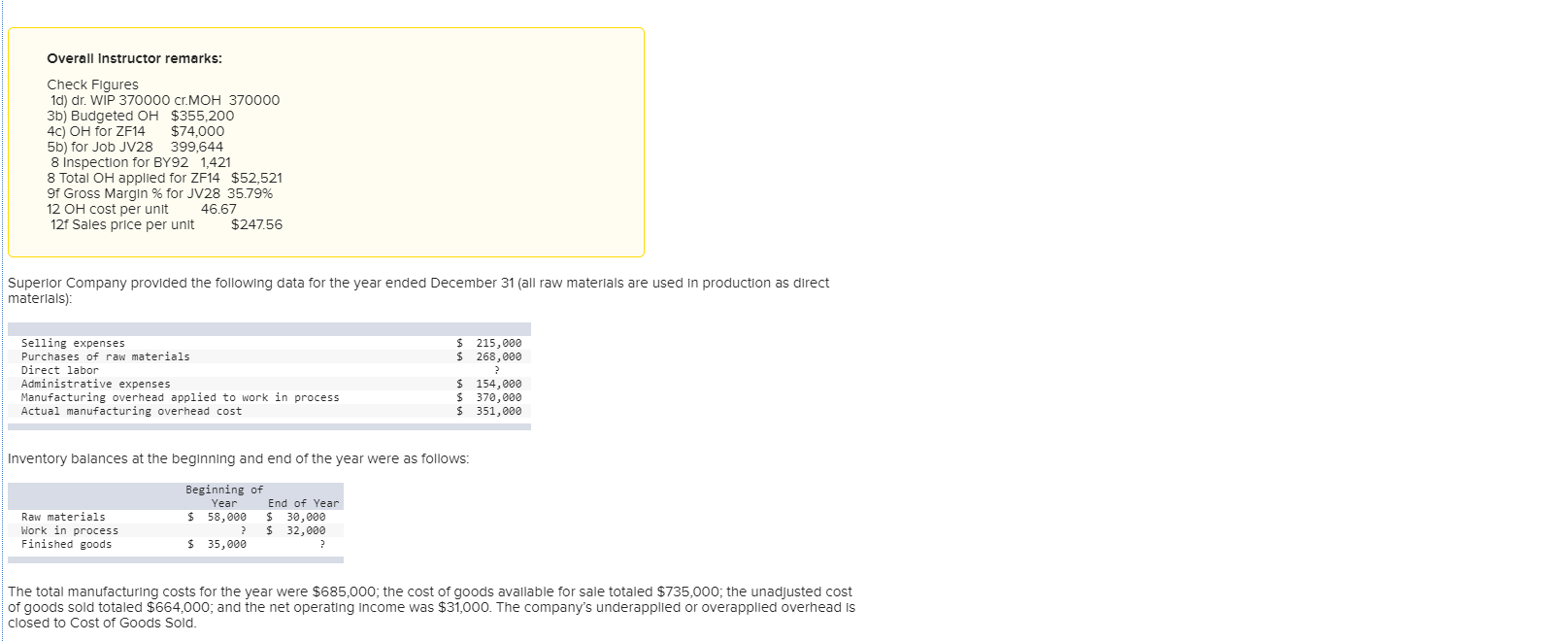

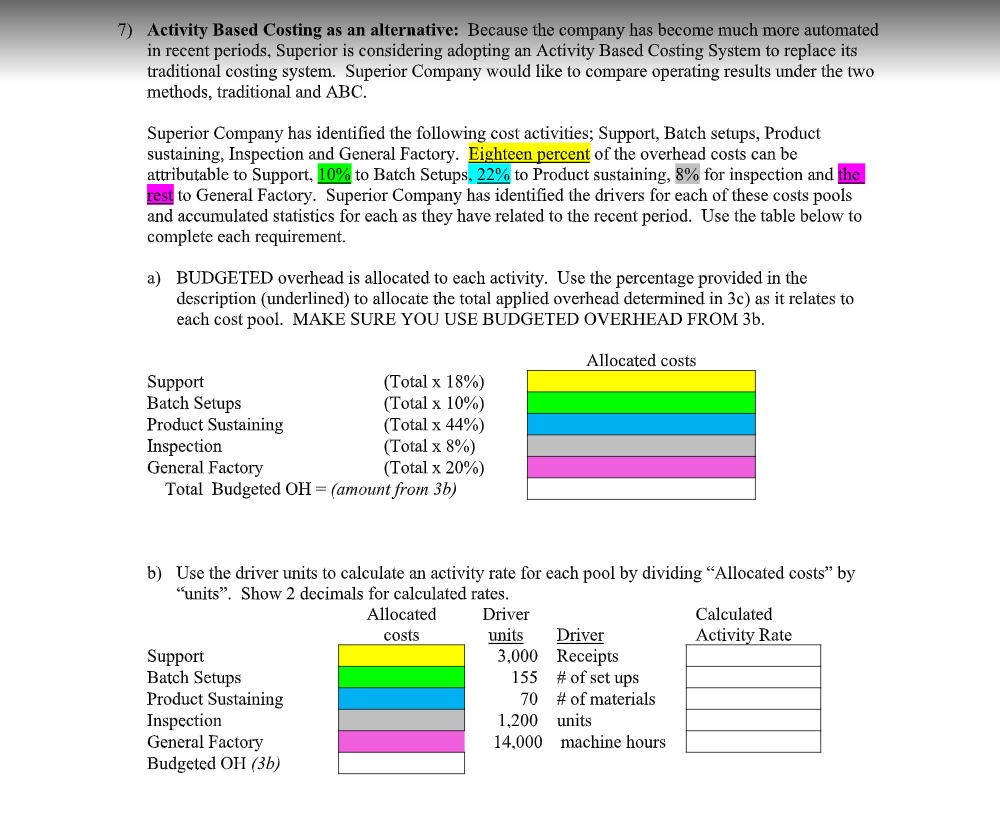

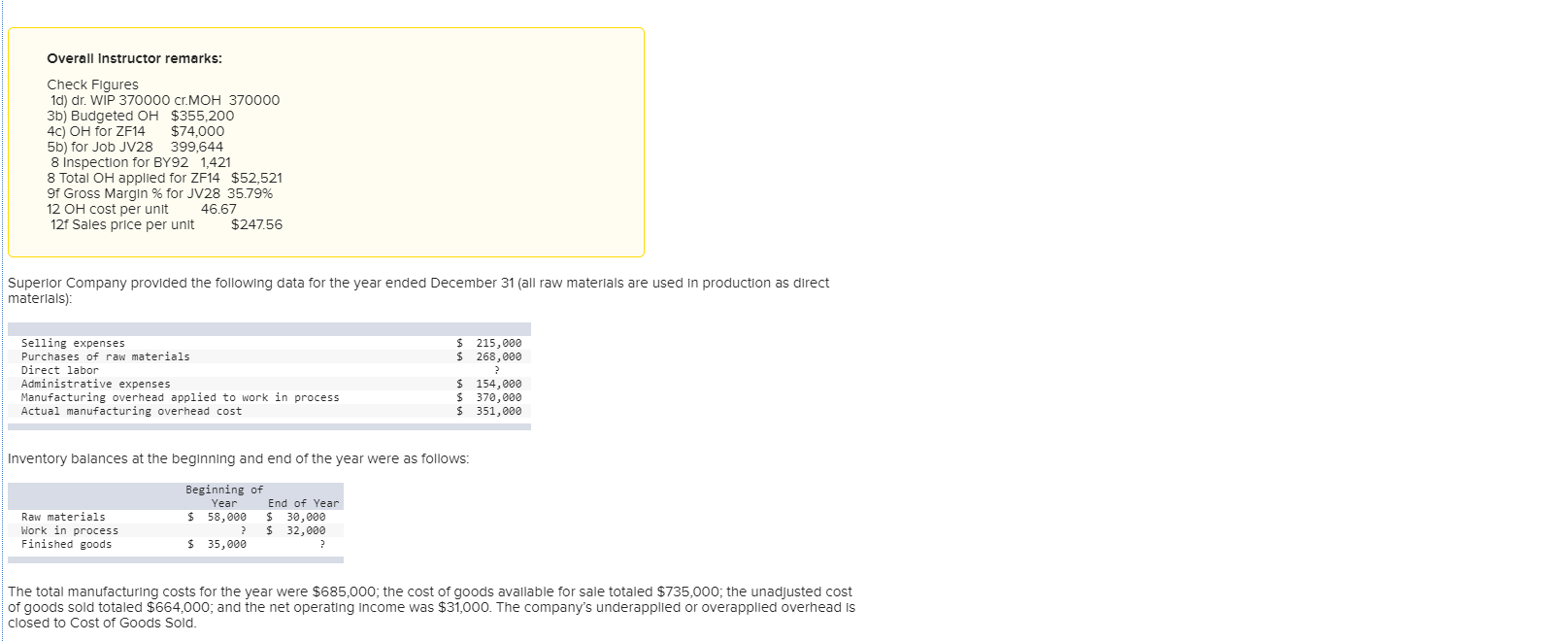

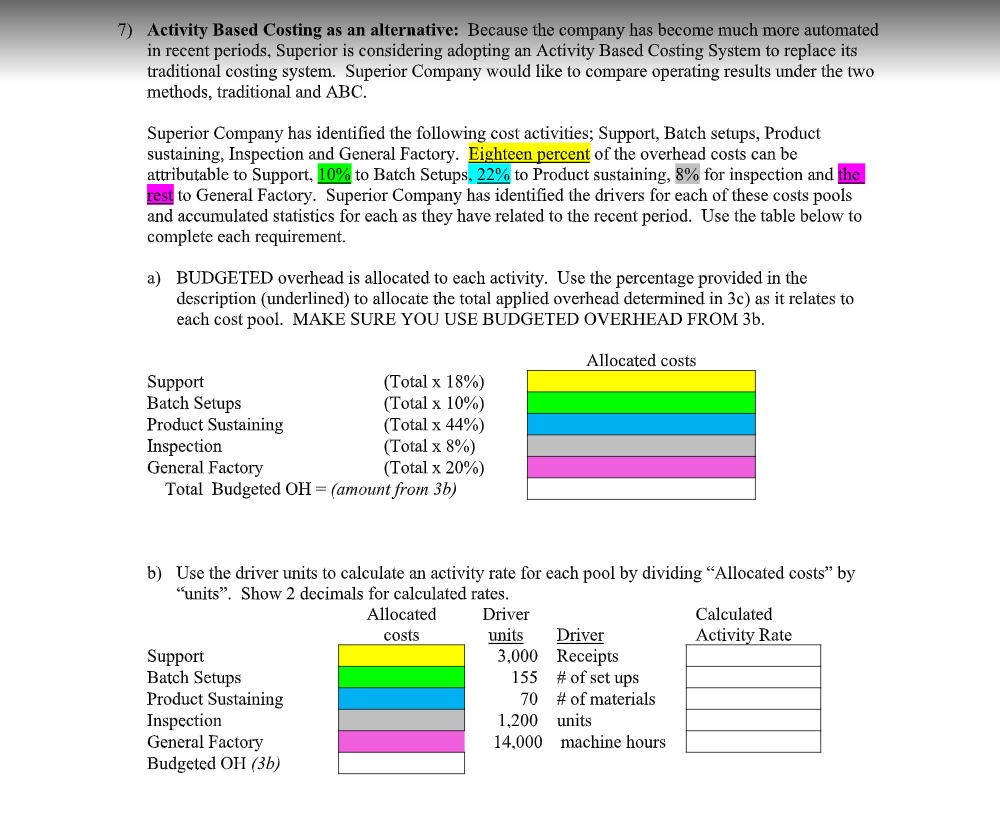

Overall Instructor remarks: Check Figures 1d) dr. WIP 370000 cr.MOH 370000 3b) Budgeted OH $355,200 4c) OH for ZF14 $74.000 5b) 399.644 8 Inspection for BY92 1,421 8 Total OH applied for ZF14 $52,521 9f Gross Margin % for JV28 35.79% 12 OH cost per unit 46.67 12f Sales price per unit $247.56 ) for Job JV28 Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials) $ 215,000 $ 268,000 Selling expenses Purchases of raw materials Direct labor Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead cost $ 154,000 $ 370,000 $ 351,000 Inventory balances at the beginning and end of the year were as follows: Raw materials Work in process Finished goods Beginning of Year End of Year $ 58,000 $ 30,000 $ 32,000 $ 35,000 ? ? The total manufacturing costs for the year were $685,000; the cost of goods available for sale totaled $735,000; the unadjusted cost of goods sold totaled $664,000; and the net operating income was $31,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 7) Activity Based Costing as an alternative: Because the company has become much more automated in recent periods, Superior is considering adopting an Activity Based Costing System to replace its traditional costing system. Superior Company would like to compare operating results under the two methods, traditional and ABC. Superior Company has identified the following cost activities; Support, Batch setups, Product sustaining, Inspection and General Factory. Eighteen percent of the overhead costs can be attributable to Support, 10% to Batch Setups, 22% to Product sustaining, 8% for inspection and the rest to General Factory. Superior Company has identified the drivers for each of these costs pools and accumulated statistics for each as they have related to the recent period. Use the table below to complete each requirement. a) BUDGETED overhead is allocated to each activity. Use the percentage provided in the description (underlined) to allocate the total applied overhead determined in 3c) as it relates to each cost pool. MAKE SURE YOU USE BUDGETED OVERHEAD FROM 3b. Allocated costs Support (Total x 18%) Batch Setups (Total x 10%) Product Sustaining (Total x 44%) Inspection (Total x 8%) General Factory (Total x 20%) Total Budgeted OH = (amount from 3b) b) Use the driver units to calculate an activity rate for each pool by dividing "Allocated costs" by "units". Show 2 decimals for calculated rates. Allocated Driver Calculated costs units Driver Activity Rate Support 3,000 Receipts Batch Setups 155 # of set ups Product Sustaining 70 # of materials Inspection 1,200 units General Factory 14,000 machine hours Budgeted OH (3b)