Answered step by step

Verified Expert Solution

Question

1 Approved Answer

overdell Education Savings Account (ESA) is most likely to be taxaible? A O that is a return of investment, used to pay qualifying education expenses

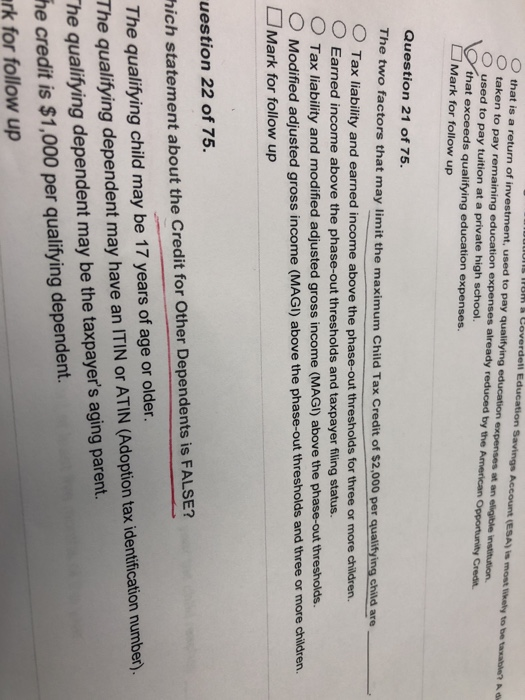

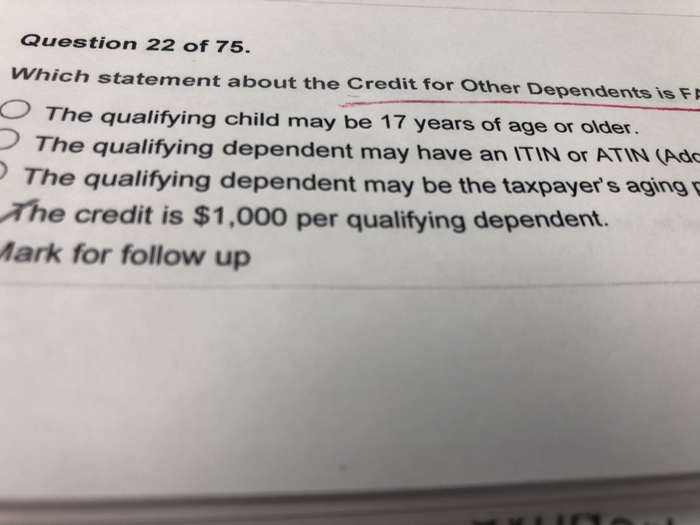

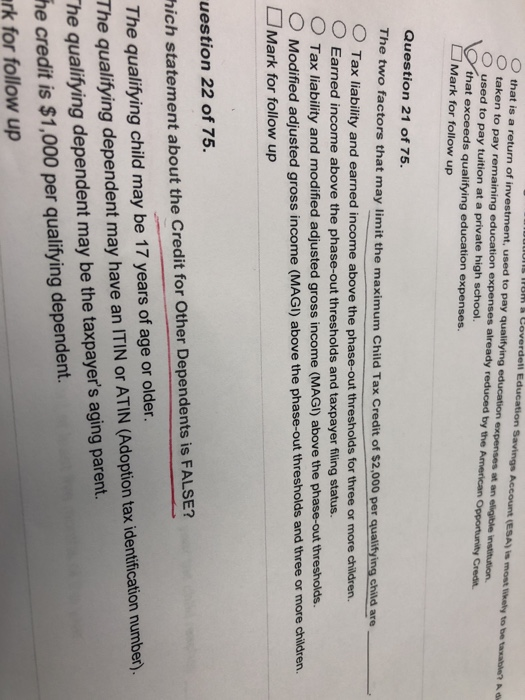

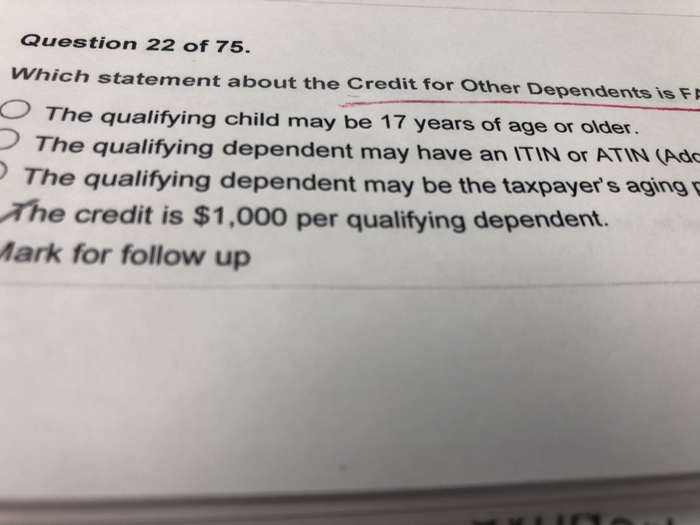

overdell Education Savings Account (ESA) is most likely to be taxaible? A O that is a return of investment, used to pay qualifying education expenses at an eligible institution. taken to pay remaining education expenses already reduced by the American Opportunity Credit. Oused to pay tuition at a private high school. that ex s qualifying education expenses. Mark for follow up Question 21 of 75. The two factors that may limit the maximum Child Tax Credit of $2.000 per qualifying child are O Tax liability and earned income above the phase-out thresholds for three or more children. O Earned income above the phase-out thresholds and taxpayer fling status O Tax liability and modified adjusted gross income (MAGI) above the phase-out thresholds. O Modified adjusted gross income (MAGI) above the phase-out thresholds and three or more children. Mark for follow up uestion 22 of 75. hich statement about the Credit for Other Dependents is FALSE? The qualifying child may be 17 years of age or older. The qualifying dependent may have an ITIN or ATIN (Adoption tax identification number), The qualifying dependent may be the taxpayer's aging parent. he credit is $1,000 per qualifying dependent. rk for follow up

overdell Education Savings Account (ESA) is most likely to be taxaible? A O that is a return of investment, used to pay qualifying education expenses at an eligible institution. taken to pay remaining education expenses already reduced by the American Opportunity Credit. Oused to pay tuition at a private high school. that ex s qualifying education expenses. Mark for follow up Question 21 of 75. The two factors that may limit the maximum Child Tax Credit of $2.000 per qualifying child are O Tax liability and earned income above the phase-out thresholds for three or more children. O Earned income above the phase-out thresholds and taxpayer fling status O Tax liability and modified adjusted gross income (MAGI) above the phase-out thresholds. O Modified adjusted gross income (MAGI) above the phase-out thresholds and three or more children. Mark for follow up uestion 22 of 75. hich statement about the Credit for Other Dependents is FALSE? The qualifying child may be 17 years of age or older. The qualifying dependent may have an ITIN or ATIN (Adoption tax identification number), The qualifying dependent may be the taxpayer's aging parent. he credit is $1,000 per qualifying dependent. rk for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started