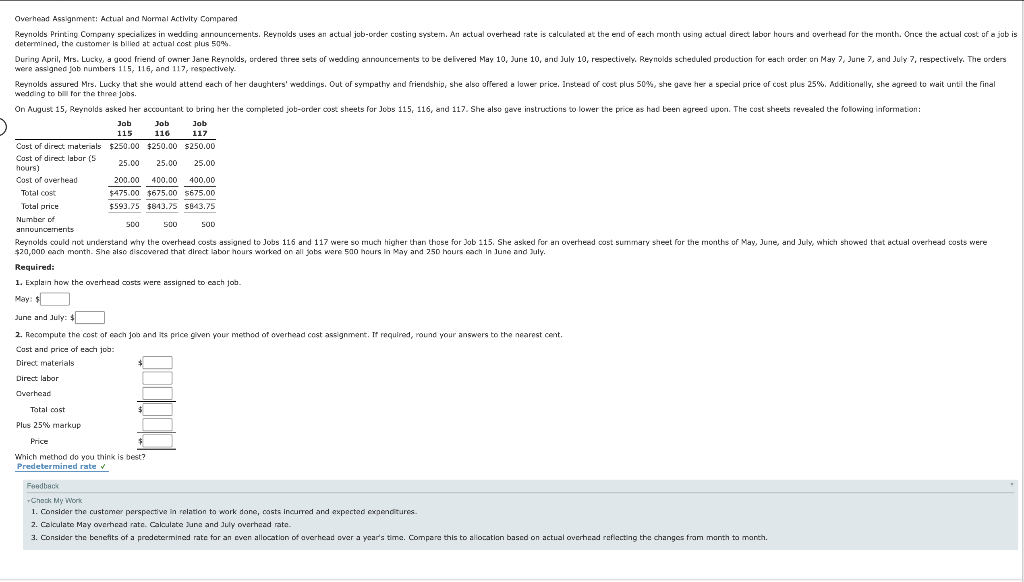

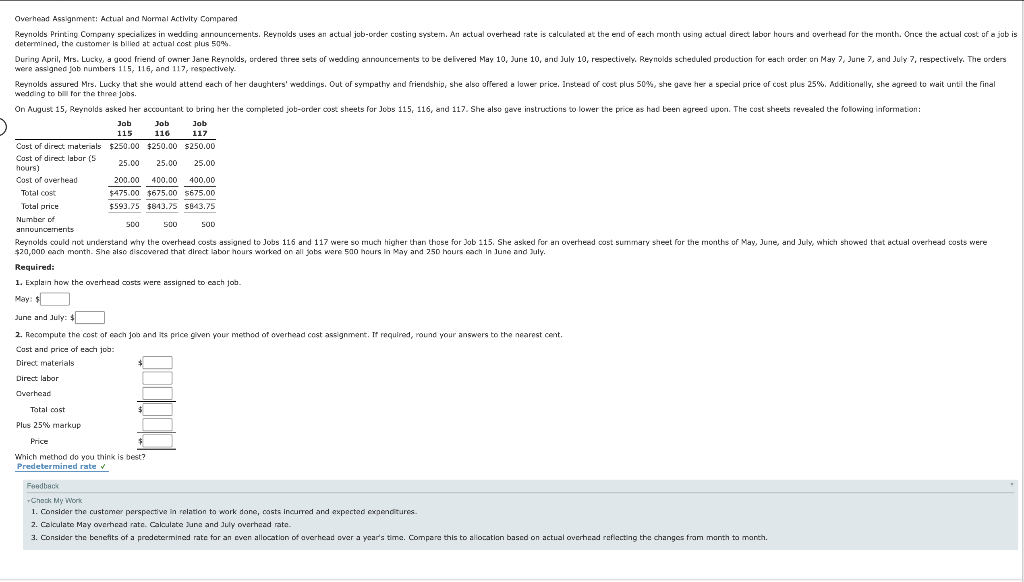

Overhead Assignment: Actual and Normal Activity Compared Reynolds Printing Company specializes in weduing announcements. Reynolds uses an actual job-order costing system. An actual overhead rate is calculated at the end of each month using actual direct labor hours and overhead for the month. Once the actual cost of a job is determined, the customer is billed at actual cost plus 50% During April, Mrs. Lucky, a good friend of varier Jane Reynolds, urdered three sets of wedding announcements to be delivered May 10, June 10, and July 10, respectively. Reynolds scheduled production for each order un May 7, June 7, and July 7, respectively. The orders were assigned fob numbers 115, 116, and 117, respectively Reynolds assured Mrs. Lucky that she would attend each of her daughters' weddings. Out of sympathy and friendship, she also offered a lower price. Instead of cost plus 50%, she gave her a special price of cost plus 25%. Additionally, she agreed to wait until the final wedding to all for the three jobs. On August 15, Reynolds asked her accountant to bring her the completed job-order cost sheets for Jobs 115, 116, and 117. She also yeve instructions to lower the price es had been egreed upon. The cost sheets revealed the following information: Job Job Job 115 116 117 Cost of direct materials $250.00 $250.00 $250.00 Cost of direct labor 5 05.00 25.00 25.00 hours) Cost of overhead 200.00 400.00 400.00 Total cost $475.00 $675.00 5675.00 Total price $593.75 $813.25 S643.75 Number of 500 500 SOD announcements Reynolds could not understand why the overhead costs assigned to Jobs 116 and 117 were so much higher than those for Job 115. She asked for an overhead cost surntary sheet for the months of May, June, and July, which showed that actual overhead costs were $20,000 each month. She also discovered that direct labor hour's worked on all jobs were 500 hours in May and 250 hours each in June and July. Required: 1. Explain how the overhead costs were assigned to each job. May: $ June and July: $ 2. Recompute the cost of each job and its price given your method of overhead cost assignment. If required, round your answers to the nearest cent. Cost and price of each job: Direct materials Direct labor Overhead Total cost Plus 25% markup Price Which method do you think is best? Predetermined rate Feedback Check My Work 1. Consider the customer perspective in relation to work done, costs incurred and expected expenditures. 2. Calculate May overhead rate. Calculate June and July overhead rate. 3. Consider the benefits of a predetermined rate for an even allocation of overhead over a year's time. Compare this to allocation based on actual overhead reflecting the changes from month to month