Answered step by step

Verified Expert Solution

Question

1 Approved Answer

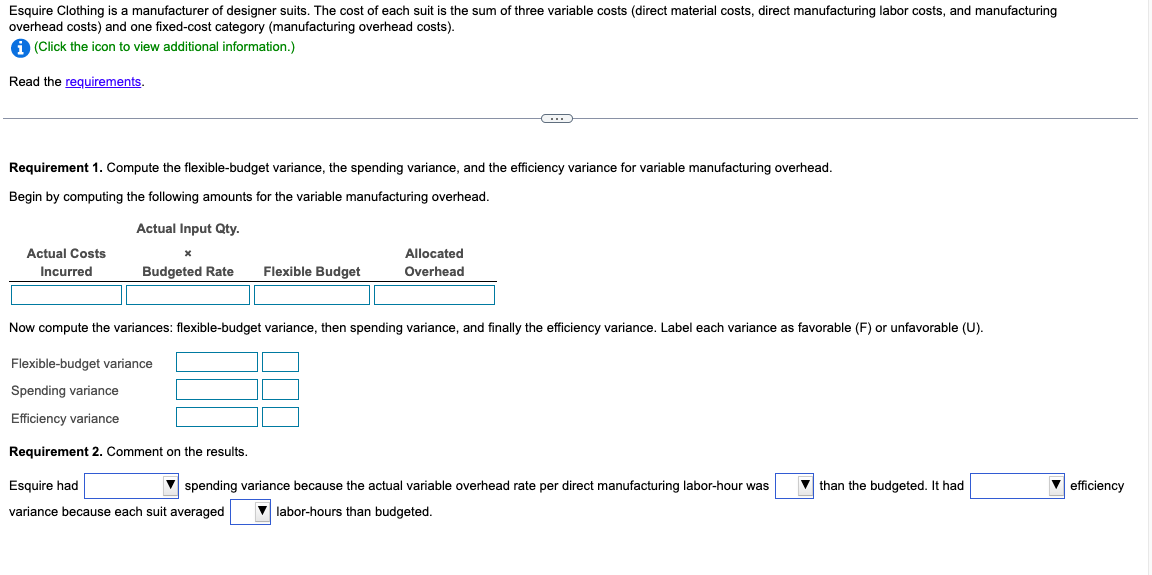

overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements. Requirement 1. Compute the flexible-budget variance,

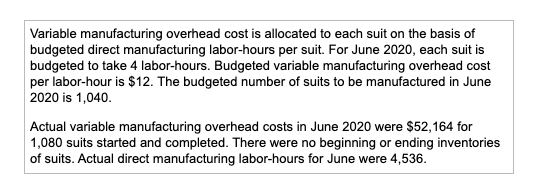

overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements. Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Begin by computing the following amounts for the variable manufacturing overhead. Requirement 2. Comment on the results. Esquire had spending variance because the actual variable overhead rate per direct manufacturing labor-hour was than the budgeted. It had efficiency variance because each suit averaged labor-hours than budgeted. Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2020, each suit is budgeted to take 4 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $12. The budgeted number of suits to be manufactured in June 2020 is 1,040 . Actual variable manufacturing overhead costs in June 2020 were $52,164 for 1,080 suits started and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4,536

overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements. Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Begin by computing the following amounts for the variable manufacturing overhead. Requirement 2. Comment on the results. Esquire had spending variance because the actual variable overhead rate per direct manufacturing labor-hour was than the budgeted. It had efficiency variance because each suit averaged labor-hours than budgeted. Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2020, each suit is budgeted to take 4 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $12. The budgeted number of suits to be manufactured in June 2020 is 1,040 . Actual variable manufacturing overhead costs in June 2020 were $52,164 for 1,080 suits started and completed. There were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4,536 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started