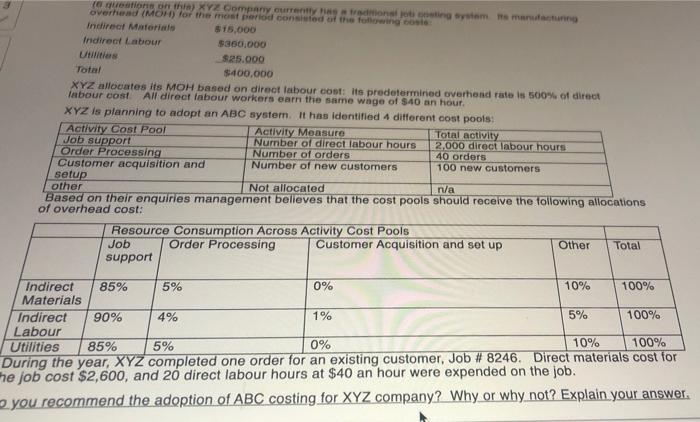

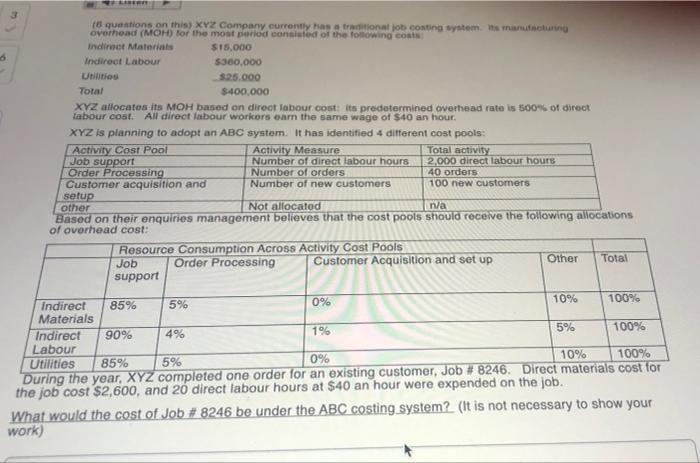

overhead (MOH) for the most period consisted of the following costs one on the XYZ Oompany currentrionale ning system manut Indirect Materiais 315,000 Indirect Labour $360,000 $25.000 Total $400.000 XYZ allocates its MOH based on direct labour cost: its predetermined overhead rate is 500% of direct labour cost All direct labour workers earn the same wage of $40 an hour. XYZ is planning to adopt an ABC system. It has identified 4 different cost pools: Activity Cost Pool Activity Measure Total activity Job support Nurnber of direct labour hours 2,000 direct labour hours Order Processing Number of orders 40 orders Customer acquisition and Number of new customers 100 new customers setup other Not allocated n/a Based on their enquiries management believes that the cost pools should receive the following allocations of overhead cost: Resource onsumption Across Activity Cost Pools Job Order Processing Customer Acquisition and set up Other Total support Indirect 85% 5% 0% 10% 100% Materials 100% Indirect 90% 1% 4% Labour 10% 0% 100% Utilities 85% 5% During the year, XYZ completed one order for an existing customer, Job # 8246. Direct materials cost for The job cost $2,600, and 20 direct labour hours at $40 an hour were expended on the job. you recommend the adoption of ABC costing for XYZ company? Why or why not? Explain your answer. 5% LARI 18 questions on this) XYZ Company currently has trional job costing system is manufacturing overhead (MOH) for the most period consisted of the following costs Indirect Materials $15.000 Indirect Labour $360,000 Utilities 5:25.000 Total $400.000 XYZ allocates its MOH based on direct labour cost: its predetermined overhead rate is 100% of direct labour cost. All direct labour workers earn the same wage of $40 an hour. XYZ is planning to adopt an ABC system. It has identified 4 different cost pools: Activity Cost Pool Activity Measure Total activity Job support Number of direct labour hours 2.000 direct labour hours Order Processing Number of orders 40 orders Customer acquisition and Number of new customers 100 new customers setup other Not allocated n/a Based on their enquiries management believes that the cost pools should receive the following allocations of overhead cost: Resource Consumption Across Activity Cost Pools Job Order Processing Customer Acquisition and set up Other Total support 85% Indirect 5% 10% 0% 100% Materials 5% Indirect 90% 1% 4% 100% Labour 10% Utilities 100% 85% 0% 5% During the year, XYZ completed one order for an existing customer, Job # 8246. Direct materials cost for the job cost $2,600, and 20 direct labour hours at $40 an hour were expended on the job. What would the cost of Job # 8246 be under the ABC costing system(It is not necessary to show your work)