Question

overhead was $165,000, and actual labor hours were 15,000, what entry is necessary to dispose of the balance in the Manufacturing Overhead account? SEM has

- overhead was $165,000, and actual labor hours were 15,000, what entry is necessary to dispose of the balance in the Manufacturing Overhead account?

- SEM has a contribution margin of $750,000 and net income of $150,000. What is its degree of operating leverage for SEM? If sales increase 10%, by how much will net income increase at SEM?

- Laker Company sold 10,000 units, had variable costs of $4 per unit, fixed costs of $120,000, and net income of $50,000. What is the selling price per unit?

- Hurt Corporation sells its product for $15 per unit. Next year, fixed expenses are expected to be $300,000 and variable expenses are expected to be $8 per unit. How many units must the company sell to generate a target profit of $50,000?

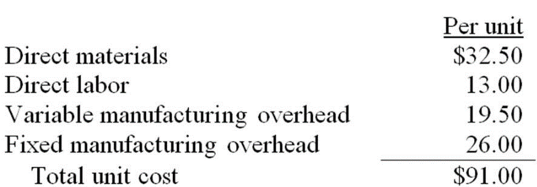

- Bailey Corp currently makes 10,000 subcomponents a year in one of its factories. The unit costs to make are:

An outside supplier has offered to provide Bailey Corp with the 5,000 subcomponents at a $74.50 per unit price. Fixed overhead is unavoidable. If Cotton Corp accepts the outside offer, what is the effect on profit? Increase? Decrease? By how much?

6. Jillian Inc. produces leather handbags. The production budget for the next three months is: July 5,000 units, August 7,000, September 7,500. Each handbag requires 1.3 hours of unskilled labor (paid $8 per hour) and 2.2 hours of skilled labor (paid $15 per hour). What will be the total labor cost for each of the months?

Per unit $32.50 13.00 19.50 26.00 $91.00 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit costStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started