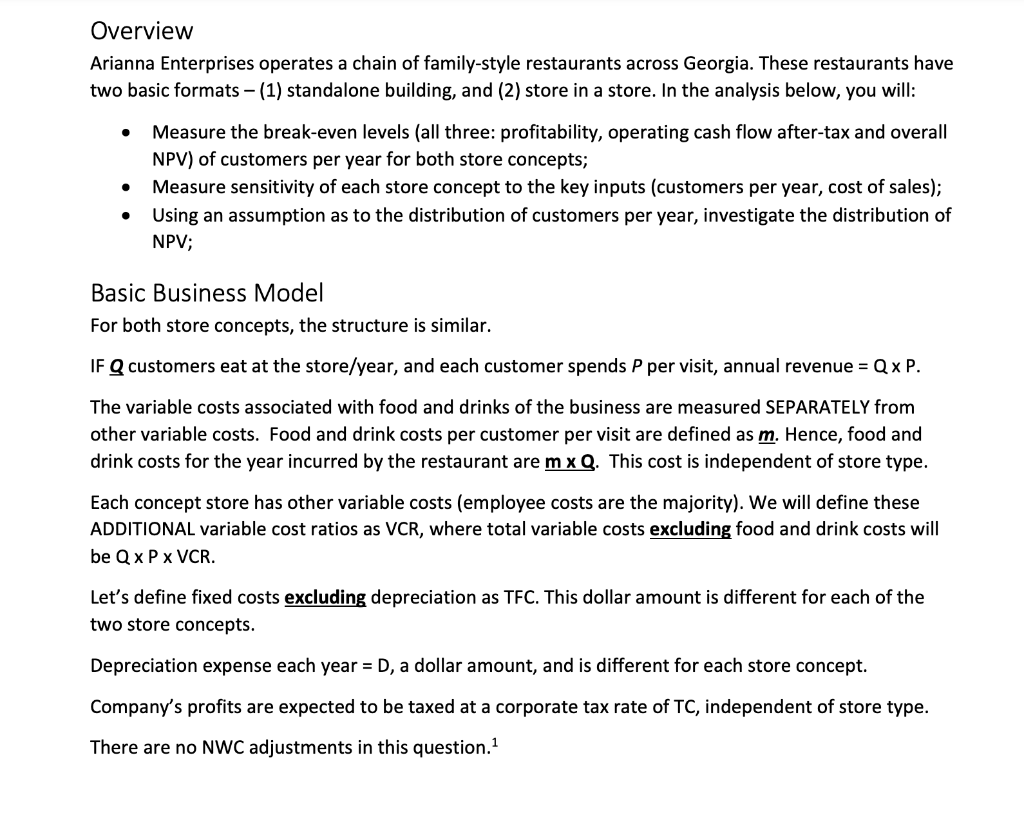

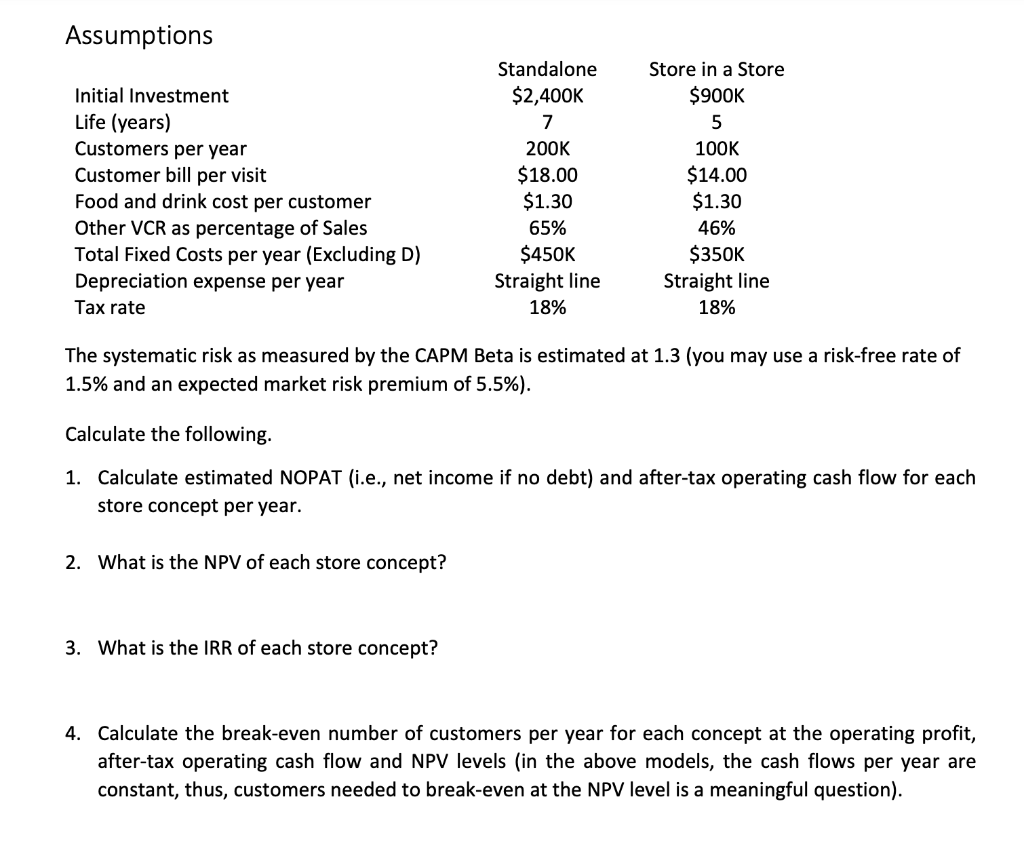

Overview Arianna Enterprises operates a chain of family-style restaurants across Georgia. These restaurants have two basic formats - (1) standalone building, and (2) store in a store. In the analysis below, you will: - Measure the break-even levels (all three: profitability, operating cash flow after-tax and overall NPV) of customers per year for both store concepts; - Measure sensitivity of each store concept to the key inputs (customers per year, cost of sales); - Using an assumption as to the distribution of customers per year, investigate the distribution of NPV; Basic Business Model For both store concepts, the structure is similar. IF Q customers eat at the store/year, and each customer spends P per visit, annual revenue =QP. The variable costs associated with food and drinks of the business are measured SEPARATELY from other variable costs. Food and drink costs per customer per visit are defined as m. Hence, food and drink costs for the year incurred by the restaurant are mQ. This cost is independent of store type. Each concept store has other variable costs (employee costs are the majority). We will define these ADDITIONAL variable cost ratios as VCR, where total variable costs excluding food and drink costs will be QPVCR. Let's define fixed costs excluding depreciation as TFC. This dollar amount is different for each of the two store concepts. Depreciation expense each year =D, a dollar amount, and is different for each store concept. Company's profits are expected to be taxed at a corporate tax rate of TC, independent of store type. There are no NWC adjustments in this question. 1 The systematic risk as measured by the CAPM Beta is estimated at 1.3 (you may use a risk-free rate of 1.5% and an expected market risk premium of 5.5%). Calculate the following. 1. Calculate estimated NOPAT (i.e., net income if no debt) and after-tax operating cash flow for each store concept per year. 2. What is the NPV of each store concept? 3. What is the IRR of each store concept? 4. Calculate the break-even number of customers per year for each concept at the operating profit, after-tax operating cash flow and NPV levels (in the above models, the cash flows per year are constant, thus, customers needed to break-even at the NPV level is a meaningful question)