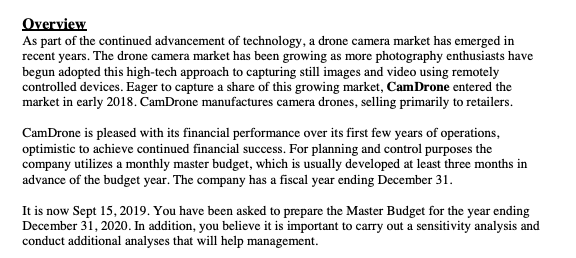

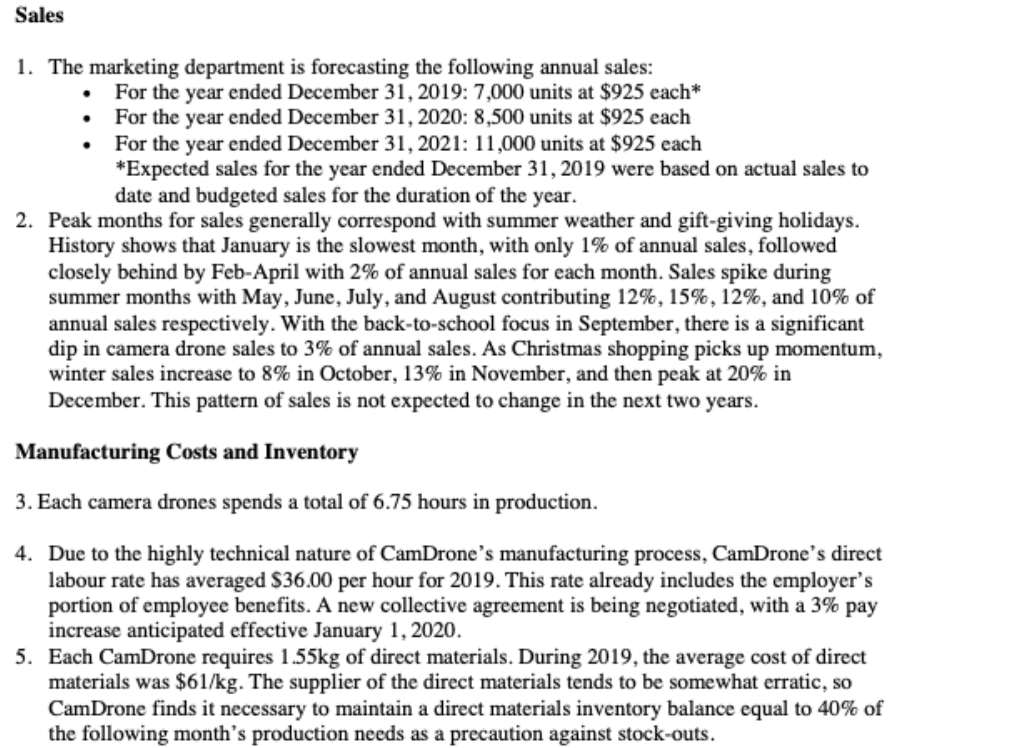

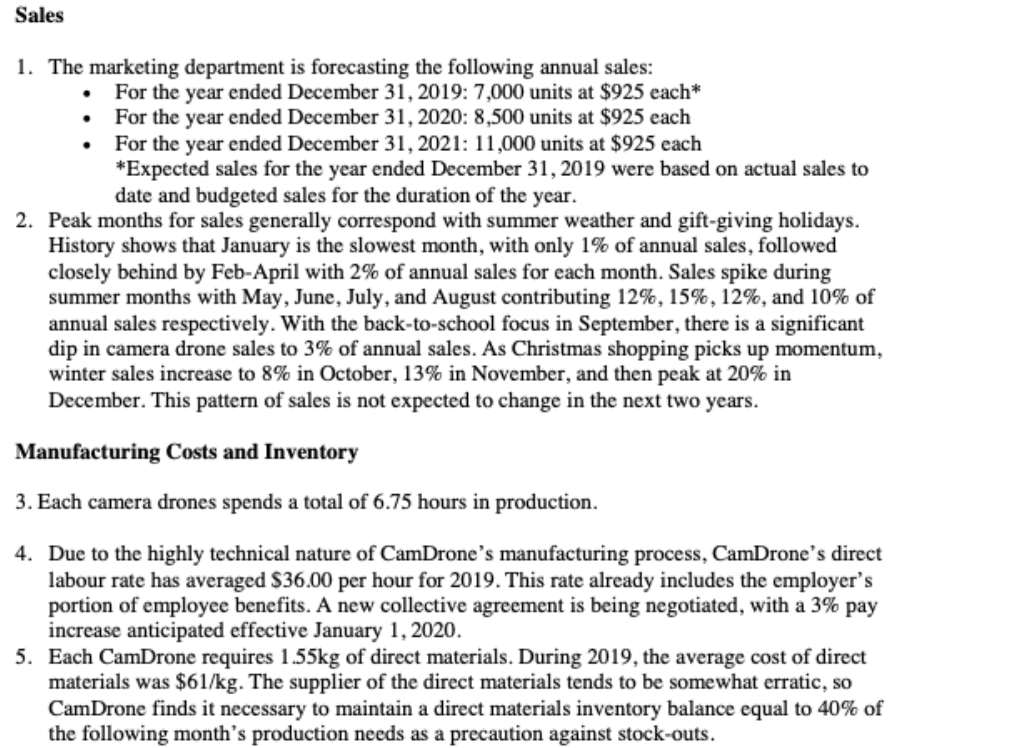

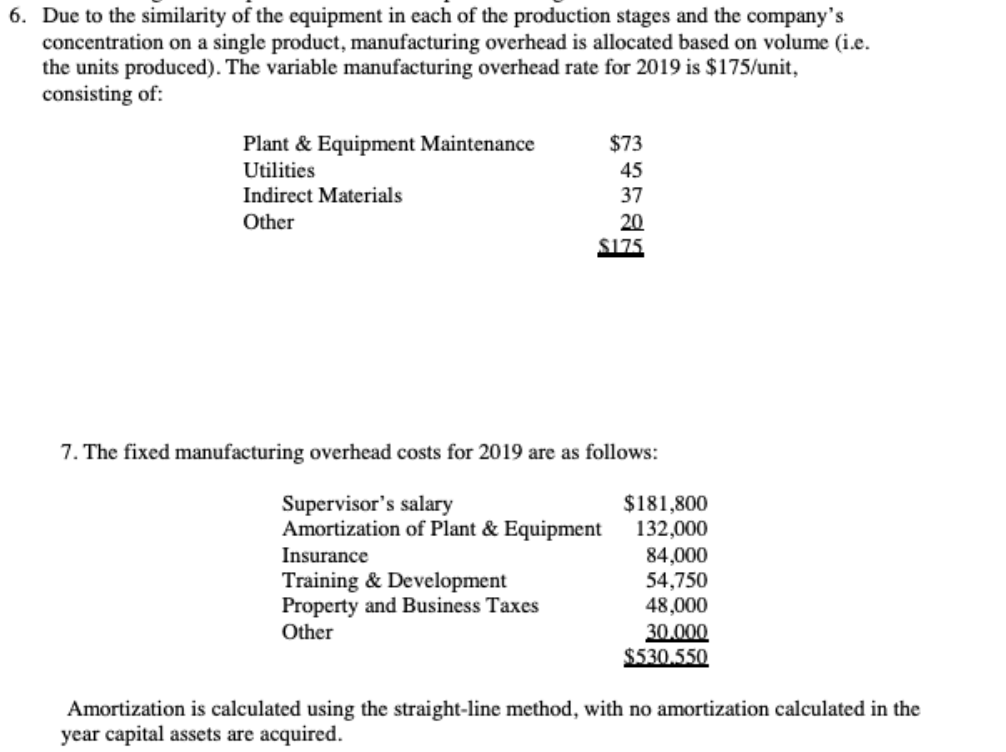

Overview As part of the continued advancement of technology, a drone camera market has emerged in recent years. The drone camera market has been growing as more photography enthusiasts have begun adopted this high-tech approach to capturing still images and video using remotely controlled devices. Eager to capture a share of this growing market, Cam Drone entered the market in early 2018. CamDrone manufactures camera drones, selling primarily to retailers. CamDrone is pleased with its financial performance over its first few years of operations, optimistic to achieve continued financial success. For planning and control purposes the company utilizes a monthly master budget, which is usually developed at least three months in advance of the budget year. The company has a fiscal year ending December 31. It is now Sept 15, 2019. You have been asked to prepare the Master Budget for the year ending December 31, 2020. In addition, you believe it is important to carry out a sensitivity analysis and conduct additional analyses that will help management. Sales 1. The marketing department is forecasting the following annual sales: For the year ended December 31, 2019: 7,000 units at $925 each* For the year ended December 31, 2020: 8,500 units at $925 each For the year ended December 31, 2021: 11,000 units at $925 each *Expected sales for the year ended December 31, 2019 were based on actual sales to date and budgeted sales for the duration of the year. 2. Peak months for sales generally correspond with summer weather and gift-giving holidays. History shows that January is the slowest month, with only 1% of annual sales, followed closely behind by Feb-April with 2% of annual sales for each month. Sales spike during summer months with May, June, July, and August contributing 12%, 15%, 12%, and 10% of annual sales respectively. With the back-to-school focus in September, there is a significant dip in camera drone sales to 3% of annual sales. As Christmas shopping picks up momentum, winter sales increase to 8% in October, 13% in November, and then peak at 20% in December. This pattern of sales is not expected to change in the next two years. Manufacturing Costs and Inventory 3. Each camera drones spends a total of 6.75 hours in production. 4. Due to the highly technical nature of CamDrone's manufacturing process, CamDrone's direct labour rate has averaged $36.00 per hour for 2019. This rate already includes the employer's portion of employee benefits. A new collective agreement is being negotiated, with a 3% pay increase anticipated effective January 1, 2020. 5. Each CamDrone requires 1.55kg of direct materials. During 2019, the average cost of direct materials was $61/kg. The supplier of the direct materials tends to be somewhat erratic, so CamDrone finds it necessary to maintain a direct materials inventory balance equal to 40% of the following month's production needs as a precaution against stock-outs. 6. Due to the similarity of the equipment in each of the production stages and the company's concentration on a single product, manufacturing overhead is allocated based on volume (i.e. the units produced). The variable manufacturing overhead rate for 2019 is $175/unit, consisting of: Plant & Equipment Maintenance $73 Utilities 45 Indirect Materials 37 Other 20 $175. 7. The fixed manufacturing overhead costs for 2019 are as follows: Supervisor's salary Amortization of Plant & Equipment Insurance Training & Development Property and Business Taxes Other $181,800 132,000 84,000 54,750 48,000 30.000 $530.550 Amortization is calculated using the straight-line method, with no amortization calculated in the year capital assets are acquired. 8. Aside from amortization, all other manufacturing costs are expected to increase by 3% in 2020 due to inflation. 9. From previous experience, management has determined that an ending finished goods inventory equal to 25% of the next month's sales is required to efficiently meet customer demands. Collections Pattern 10. Sales are on a cash and credit basis, with 49% collected during the month of the sale, 33% the following month, and 15% the month thereafter. There are no early payment discounts for customers. Bad debt expense (amounts considered uncollectible) account for 3% of sales. 11. Based on the collection pattern described above, accounts payable as at end of business day on December 31, 2019 is projected to be $1,098,899 arising from the following estimates: Sales (November 2019) Sales (December 2019) $1,170,000 1,800,000 Payments Pattern 12. CamDrone pays for 20% of a month's purchases of direct materials in the month of purchase, 50% in the following month and the remaining 30% two months after the month of purchase. There are no early payment discounts offered by suppliers. 13. Based on the payment pattern described above, accounts payable as at end of business day on December 31, 2019 is projected to be $78,641 arising from the following estimates: Direct Material Purchases (November 2019) Direct Material Purchases (December 2019) $95,888 62,334 14. All payroll costs are paid in the period in which they are incurred. 15. The property and business taxes, paid at the beginning of July each year, apply to the following 12-month period. Any increases for inflation on property and business taxes do not take effect until the beginning of July each year. 16. Annual insurance premiums, paid at the beginning of April each year, apply to the following 12-month period. Any increases for inflation on insurance premiums do not take effect until the beginning of April each year. 17. Fixed manufacturing overhead costs are incurred evenly over the year and "cash-related" amounts are paid as incurred. 18. Selling and administrative expenses are paid in the month in which they occur. Other 19. Anticipating a significant increase in customer demand and market share over the next few years, CamDrone is planning a significant expansion involving acquiring additional manufacturing equipment for $3,000,000 cash. Half of this amount is to be paid to the equipment supplier in July 2020, with the remainder to be paid in October 2020. 20. Selling and administrative expenses are known to be a mixed cost; however, there is a lot of uncertainty about the portion that is fixed. Based on prior year experience: Lowest level of monthly sales: 80 units ... Total Operating Expenses: $87,270* Highest level of monthly sales: 1,600 units ... Total Operating Expenses: $360,780* * excluding bad debts and amounts described below These expenses are expected to increase by 3% in 2020 due to inflation. 25. The company is forecasting the following balances as at the end of business day on December 31, 2019: Assets Cash Accounts Receivable Inventory: Direct Materials Inventory: Finished Goods Prepaid Property and Business Taxes Prepaid Insurance Capital Assets (Net) Total Assets $100,000 1.098,899 3,591 11.640 24,000 21,000 571.800 1830.930 Liabilities & Shareholders' Equity Accounts Payable Income Taxes Payable Capital Stock Retained Earnings Total Liabilities and Shareholders' Equity $78,641 19,700 500,000 1.232,589 S1830.030 Prepare a Selling and Administrative Expense Budget schedule with the template. CamDrone Selling and Administrative Expense Budget For the year ended December 31, 2020 March April May June July January Feburary August September October November December Year