Question

Overview Footnotes to financial statements provide additional information or details to clarify figures. They refer to additional information that helps explain how a company arrived

Overview

Footnotes to financial statements provide additional information or details to clarify figures. They refer to additional information that helps explain how a company arrived at the numbers outlined in the data. They also help to explain any irregularities or perceived inconsistencies in the account, from one year to another. Review the Supporting Materials section to see examples of footnotes in an 8-K report for a well-known organization.

In this assignment, you will create footnotes to support financial data. This assignment will help you complete Project One, where you will complete consolidated balance sheets.

Directions

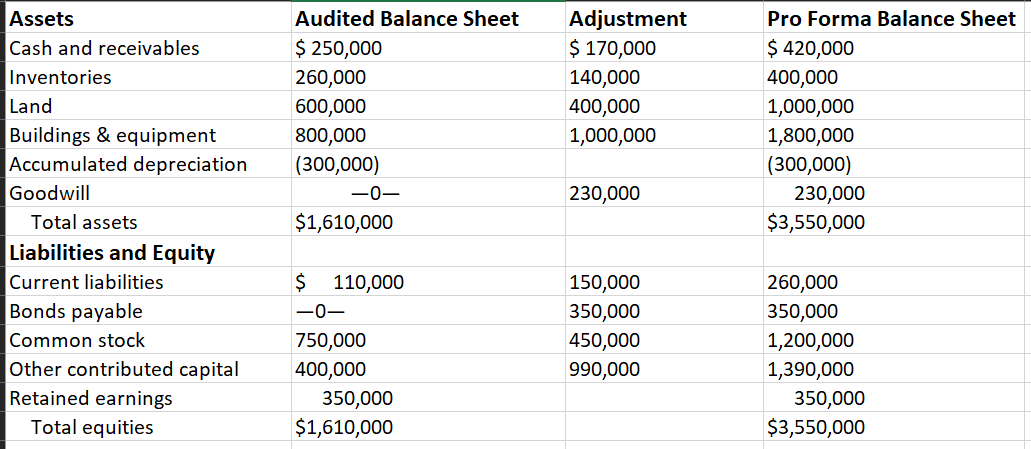

Part One: Footnotes Use data from your textbook, Illustration 2-5 P Company Pro Forma Balance Sheet, linked in the Supporting Materials section, to create an applicable footnotes page. Pay particular attention to adjustments that stand out and may require footnotes.

Part One: Footnotes

Identify four to five adjustments that require footnotes.

Explain irregularities based on the adjusted numbers using footnotes. Consider the following questions to guide your response:

What might be a potential reasonable explanation for the irregularity?

Why might certain original amounts in the audited balance sheet have previously been zero?

Provide a rationale for why the footnotes are required. Consider the following questions to guide your response:

What criteria did you use to determine that an adjustment needed a footnote?

What threshold number created a concern, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started