Overview: For Milestone One, which is due in Module Three, you will create adjusting entries for various situations, prepare annual financial reports, calculate

ratios, and develop a brief report for management explaining accounting ratios and the effects of interest rates on the future value of money. You will build on

this milestone in subsequent modules leading up to the final project.

Prompt: First, review the Final Project Scenario document and the accompanying Final Project Workbook. Follow the instructions below and complete the

workbook with the information provided in the scenario. Using your review of the scenario, develop a management analysis brief that addresses the critical

elements indicated below. Use information from your accounting workbook to support your claims in the management analysis brief.

Note: Milestone One is a draft of some critical elements of the final project. Note that the management analysis brief corresponds to the management analysis

memo in the final project.

Specifically, the following critical elements must be addressed:

1.

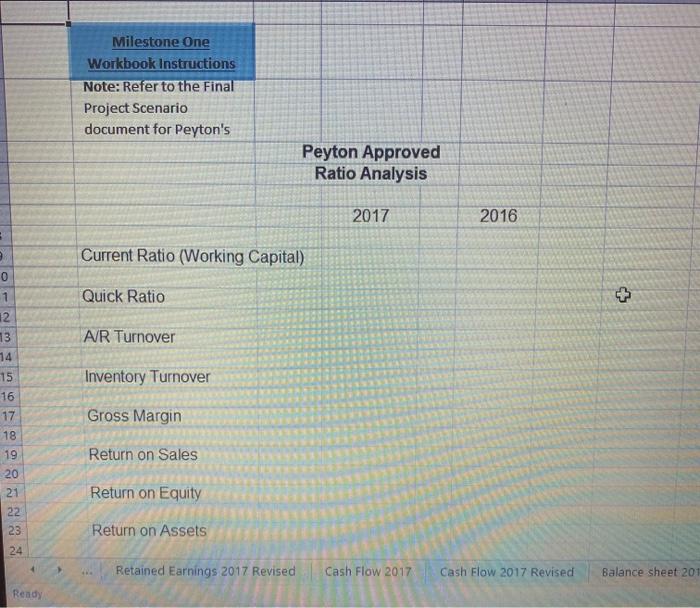

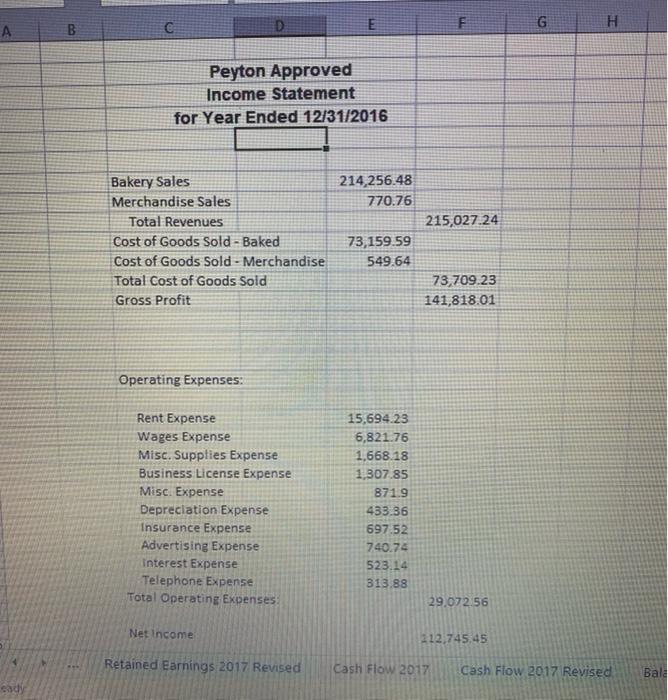

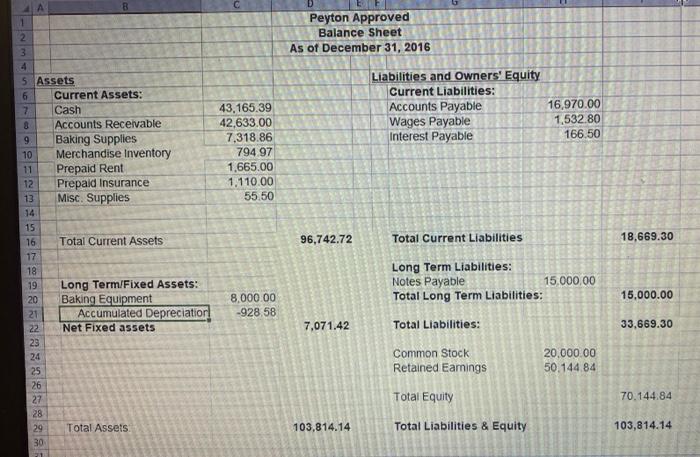

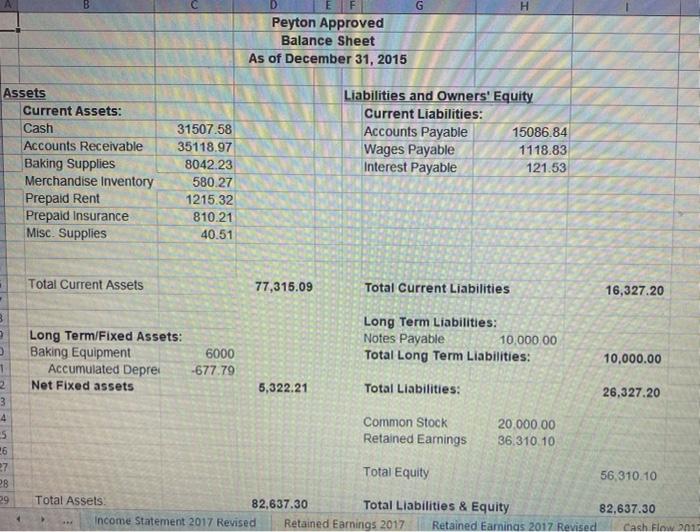

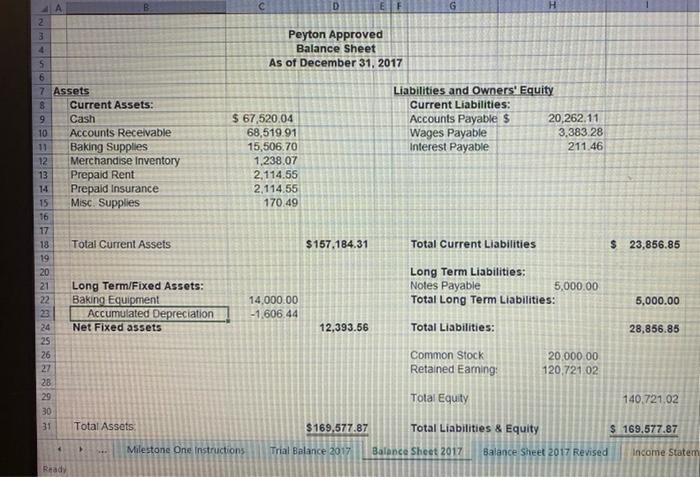

Accounting Workbook: Your accounting workbook must include appropriate calculations, ratios, and notes:

A. Create adjusting entries for financial statement preparation.

B.

Create an adjusted trial balance for financial statement preparation.

C.

Prepare financial statements for determining the company's financial position.

D.

Calculate ratios for determining the company's financial health. Refer to the Final Project Scenario for the ratio formulas.

Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your

accounting workbook to support your ideas when applicable.

A. Assess the company's financial health based on ratio analyses presented in the accounting workbook.

B. Compare ratio analysis to trends in financial ratios over time for illustrating their impact, providing examples to support your claims.

C.

Summarize the effects of different compounding periods and interest rates on future value of money.

D. Explain how alignment to relevant regulations and ethical reporting influenced your accounting practices and notes, providing examples to

support your claims.

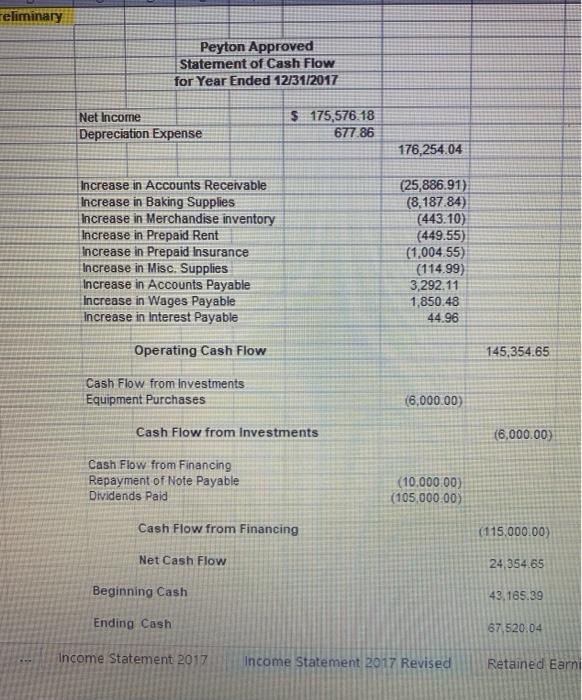

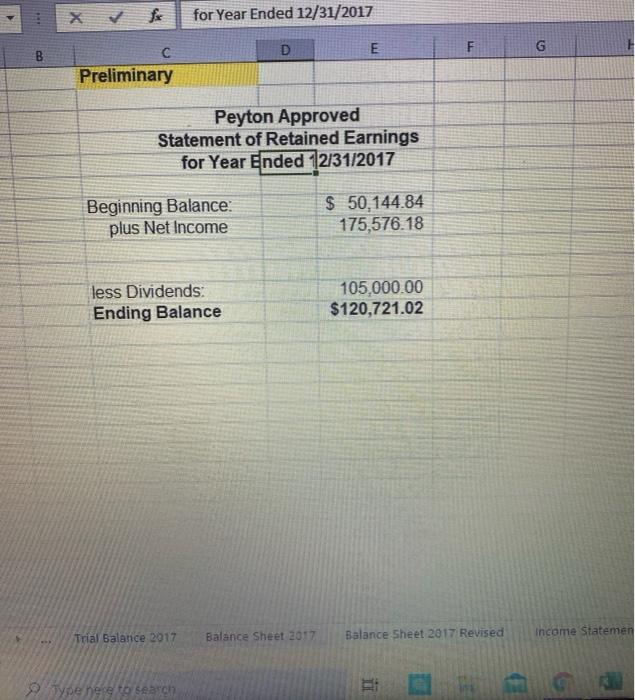

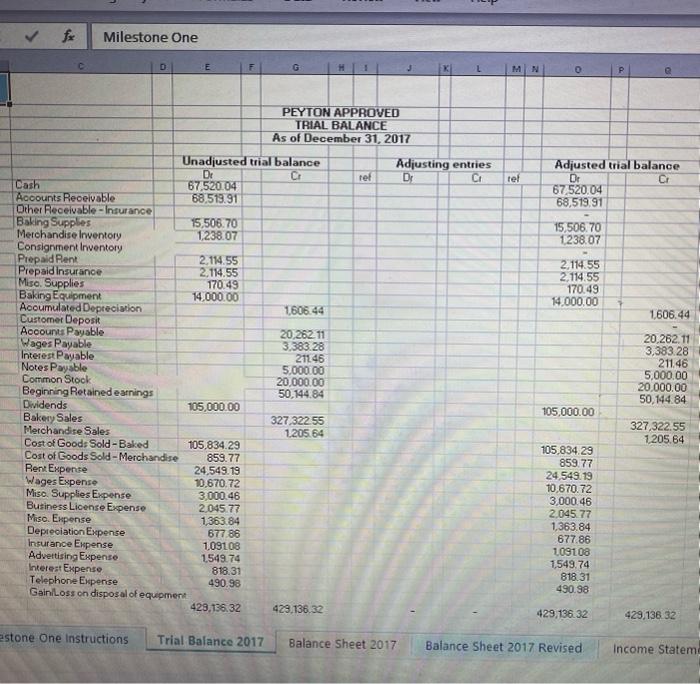

Milestone One Workbook Instructions Note: Refer to the Final Project Scenario document for Peyton's Peyton Approved Ratio Analysis 2017 2016 3 Current Ratio (Working Capital) 0 1 Quick Ratio + A/R Turnover Inventory Turnover 12 13 14 15 16 17 18 19 20 21 22 Gross Margin Return on Sales Return on Equity 23 Return on Assets 24 Retained Earnings 2017 Revised Cash Flow 2017 Cash Flow 2017 Revised Balance sheet 201 Rendy E F G H A B Peyton Approved Income Statement for Year Ended 12/31/2016 214,256.48 770.76 215,027.24 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold - Baked Cost of Goods Sold - Merchandise Total Cost of Goods Sold Gross Profit 73,159.59 549.64 73,709.23 141,818.01 Operating Expenses: Rent Expense Wages Expense Misc. Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses 15,694.23 6,82 1,668.18 1.307.85 871.9 433.36 697.52 740.74 523.14 313.88 29,072.56 Net Income 112,745.45 Retained Earnings 2017 Revised Cash Flow 2017 Cash Flow 2017 Revised Ball cacy Peyton Approved Balance Sheet As of December 31, 2016 Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable 16,970.00 1,532.80 166.50 43,165.39 42,633.00 7.318.86 794 97 1,665.00 1.110.00 55.50 B 1 2 3 4 5 Assets 6 Current Assets: 7 Cash 8 Accounts Receivable 9 Baking Supplies 10 Merchandise Inventory 11 Prepaid Rent 12 Prepaid Insurance 13 Misc. Supplies 14 15 16 Total Current Assets 17 18 19 Long Term/Fixed Assets: 20 Baking Equipment 21 Accumulated Depreciation! 22 Net Fixed assets 23 24 25 26 27 28 96,742.72 Total Current Liabilities 18,669.30 Long Term Liabilities: Notes Payable 15,000.00 Total Long Term Liabilities: 15,000.00 8,000.00 -928 58 7,071.42 Total Liabilities: 33.669.30 Common Stock Retained Earnings 20.000.00 50.144.84 Total Equity 70.144.84 29 Total Assets 103,814.14 Total Liabilities & Equity o 103,814.14 30 H D G Peyton Approved Balance Sheet As of December 31, 2015 Assets Current Assets: Cash Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Liabilities and Owners' Equity Current Liabilities: Accounts Payable 15086.84 Wages Payable 1118.83 Interest Payable 121.53 31507.58 35118.97 8042.23 580.27 1215.32 810.21 40.51 Total Current Assets 77,315.09 Total Current Liabilities 16,327.20 Long Term/Fixed Assets: Baking Equipment Accumulated Depre Net Fixed assets Long Term Liabilities: Notes Payable 10,000.00 Total Long Term Liabilities: 6000 -677.79 10,000.00 5,322.21 Total Liabilities: 26,327.20 1 2 3 4 5 26 7 28 29 Common Stock Retained Earnings 20.000.00 36.310 10 Total Equity 56,310.10 Total Assets 82,637.30 Total Liabilities & Equity 82,637.30 Income Statement 2017 Revised Retained Earnings 2017 Retained Earnings 2017 Revised Cash Flow1 reliminary Peyton Approved Statement of Cash Flow for Year Ended 12/31/2017 Net Income Depreciation Expense $ 175,576.18 677.86 176,254.04 Increase in Accounts Receivable Increase in Baking Supplies Increase in Merchandise inventory Increase in Prepaid Rent Increase in Prepaid Insurance Increase in Misc. Supplies Increase in Accounts Payable increase in Wages Payable Increase in Interest Payable (25,886.91) (8,187.84) (443.10) (449.55) (1,004.55) (114.99) 3,292.11 1,850.48 44.96 Operating Cash Flow 145,354.65 Cash Flow from Investments Equipment Purchases (6.000.00) Cash Flow from Investments (6.000.00) Cash Flow from Financing Repayment of Note Payable Dividends Paid (10.000.00) (105,000.00) Cash Flow from Financing (115,000.00) Net Cash Flow 24,354.65 Beginning Cash 43,165.39 Ending Cash 67,520.04 Income Statement 2017 Income Statement 2017 Revised Retained Earni for Year Ended 12/31/2017 D E F G C Preliminary Peyton Approved Statement of Retained Earnings for Year Ended 12/31/2017 Beginning Balance: plus Net Income $ 50,144.84 175,576.18 less Dividends: Ending Balance 105,000.00 $120,721.02 Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statemen Type here to search fx Milestone One D E H 1 MN PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Adjusting entries D CA tel tel Adjusted trial balance Dr 67.520.04 68,519.91 15,506.70 1238.07 2.114.55 2.114.55 170.49 14.000.00 1606.44 Unadjusted trial balance Dr Cash 67.520.04 Accounts Receivable 68,513.91 Other Receivable Insurance Baking Supplies 15,506.70 Merchandise Inventory 1.238.07 Consignment Inwentory Prepaid Rent 2,114.55 Prepaid Insurance 2.114.55 Miso. Supplies 170.49 Baking Equipment 14,000.00 Acoumulated Depreciation 1,606.44 Customer Deposit Accounts Payable 20,26211 Wages Payable 3,383.28 Interest Payable 21146 Notes Payable 5.000.00 Common Stock 20,000.00 Beginning Retained earnings 50,144.84 Dividends 105,000.00 Bakery Sales 327 32255 Merchandise Sales 1205.64 Cost of Good: Sold-Baked 105,834.29 Cost of Goods Sold - Merchandise 859.77 Rent Expense 24,549.19 Wages Expense 10,670.72 Miso. Supplies Expense 3,000 46 Business License Expense 2,045.77 Miso. Expense 1,363.84 Depreciation Expense 677 86 Insurance Expense 1.09108 Advertising Expense 1,549.74 Interest Expense 818.31 Telephone Expense 490.98 Gain Loss on disposal of equipment 429,136.32 429.136.32 20.262.11 3,383 28 211.46 5,000.00 20.000.00 50.144.84 105,000.00 327,322.55 1205.64 105,834.29 859.77 24,549.19 10,670.72 3,000.46 2045.77 1,363.84 677.86 108108 1,549.74 818.31 490.98 429,136.32 429,136.32 estone One Instructions Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statem G H AA 2 3 Peyton Approved Balance Sheet As of December 31, 2017 Liabilities and Owners' Equity Current Liabilities: Accounts Payable $ 20,262.11 Wages Payable 3.383.28 Interest Payable 211.46 $ 67 520.04 68,519.91 15,506.70 1,238.07 2,114.55 2,114.55 170.49 5 6 7 Assets 8 Current Assets: 9 Cash 10 Accounts Receivable 11 Baking Supplies 12 Merchandise Inventory 13 Prepaid Rent 14 Prepaid Insurance 15 Misc. Supplies 16 17 18 Total Current Assets 19 20 21 Long Term/Fixed Assets: 22 Baking Equipment 23 Accumulated Depreciation 24 Net Fixed assets 25 26 27 28 29 30 31 Total Assets $157,184.31 Total Current Liabilities $ 23,856.85 14,000.00 -1.606.44 Long Term Liabilities: Notes Payable 5,000.00 Total Long Term Liabilities: Total Liabilities: 5,000.00 ! 12,393.56 28,856.85 Common Stock Retained Earning: 20.000.00 120,721 02 Total Equity 140.721.02 $ 169,577.87 Total Liabilities & Equity $ 169.577.87 Milestone One Instructions Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statem Ready Milestone One Workbook Instructions Note: Refer to the Final Project Scenario document for Peyton's Peyton Approved Ratio Analysis 2017 2016 3 Current Ratio (Working Capital) 0 1 Quick Ratio + A/R Turnover Inventory Turnover 12 13 14 15 16 17 18 19 20 21 22 Gross Margin Return on Sales Return on Equity 23 Return on Assets 24 Retained Earnings 2017 Revised Cash Flow 2017 Cash Flow 2017 Revised Balance sheet 201 Rendy E F G H A B Peyton Approved Income Statement for Year Ended 12/31/2016 214,256.48 770.76 215,027.24 Bakery Sales Merchandise Sales Total Revenues Cost of Goods Sold - Baked Cost of Goods Sold - Merchandise Total Cost of Goods Sold Gross Profit 73,159.59 549.64 73,709.23 141,818.01 Operating Expenses: Rent Expense Wages Expense Misc. Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses 15,694.23 6,82 1,668.18 1.307.85 871.9 433.36 697.52 740.74 523.14 313.88 29,072.56 Net Income 112,745.45 Retained Earnings 2017 Revised Cash Flow 2017 Cash Flow 2017 Revised Ball cacy Peyton Approved Balance Sheet As of December 31, 2016 Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable 16,970.00 1,532.80 166.50 43,165.39 42,633.00 7.318.86 794 97 1,665.00 1.110.00 55.50 B 1 2 3 4 5 Assets 6 Current Assets: 7 Cash 8 Accounts Receivable 9 Baking Supplies 10 Merchandise Inventory 11 Prepaid Rent 12 Prepaid Insurance 13 Misc. Supplies 14 15 16 Total Current Assets 17 18 19 Long Term/Fixed Assets: 20 Baking Equipment 21 Accumulated Depreciation! 22 Net Fixed assets 23 24 25 26 27 28 96,742.72 Total Current Liabilities 18,669.30 Long Term Liabilities: Notes Payable 15,000.00 Total Long Term Liabilities: 15,000.00 8,000.00 -928 58 7,071.42 Total Liabilities: 33.669.30 Common Stock Retained Earnings 20.000.00 50.144.84 Total Equity 70.144.84 29 Total Assets 103,814.14 Total Liabilities & Equity o 103,814.14 30 H D G Peyton Approved Balance Sheet As of December 31, 2015 Assets Current Assets: Cash Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Liabilities and Owners' Equity Current Liabilities: Accounts Payable 15086.84 Wages Payable 1118.83 Interest Payable 121.53 31507.58 35118.97 8042.23 580.27 1215.32 810.21 40.51 Total Current Assets 77,315.09 Total Current Liabilities 16,327.20 Long Term/Fixed Assets: Baking Equipment Accumulated Depre Net Fixed assets Long Term Liabilities: Notes Payable 10,000.00 Total Long Term Liabilities: 6000 -677.79 10,000.00 5,322.21 Total Liabilities: 26,327.20 1 2 3 4 5 26 7 28 29 Common Stock Retained Earnings 20.000.00 36.310 10 Total Equity 56,310.10 Total Assets 82,637.30 Total Liabilities & Equity 82,637.30 Income Statement 2017 Revised Retained Earnings 2017 Retained Earnings 2017 Revised Cash Flow1 reliminary Peyton Approved Statement of Cash Flow for Year Ended 12/31/2017 Net Income Depreciation Expense $ 175,576.18 677.86 176,254.04 Increase in Accounts Receivable Increase in Baking Supplies Increase in Merchandise inventory Increase in Prepaid Rent Increase in Prepaid Insurance Increase in Misc. Supplies Increase in Accounts Payable increase in Wages Payable Increase in Interest Payable (25,886.91) (8,187.84) (443.10) (449.55) (1,004.55) (114.99) 3,292.11 1,850.48 44.96 Operating Cash Flow 145,354.65 Cash Flow from Investments Equipment Purchases (6.000.00) Cash Flow from Investments (6.000.00) Cash Flow from Financing Repayment of Note Payable Dividends Paid (10.000.00) (105,000.00) Cash Flow from Financing (115,000.00) Net Cash Flow 24,354.65 Beginning Cash 43,165.39 Ending Cash 67,520.04 Income Statement 2017 Income Statement 2017 Revised Retained Earni for Year Ended 12/31/2017 D E F G C Preliminary Peyton Approved Statement of Retained Earnings for Year Ended 12/31/2017 Beginning Balance: plus Net Income $ 50,144.84 175,576.18 less Dividends: Ending Balance 105,000.00 $120,721.02 Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statemen Type here to search fx Milestone One D E H 1 MN PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Adjusting entries D CA tel tel Adjusted trial balance Dr 67.520.04 68,519.91 15,506.70 1238.07 2.114.55 2.114.55 170.49 14.000.00 1606.44 Unadjusted trial balance Dr Cash 67.520.04 Accounts Receivable 68,513.91 Other Receivable Insurance Baking Supplies 15,506.70 Merchandise Inventory 1.238.07 Consignment Inwentory Prepaid Rent 2,114.55 Prepaid Insurance 2.114.55 Miso. Supplies 170.49 Baking Equipment 14,000.00 Acoumulated Depreciation 1,606.44 Customer Deposit Accounts Payable 20,26211 Wages Payable 3,383.28 Interest Payable 21146 Notes Payable 5.000.00 Common Stock 20,000.00 Beginning Retained earnings 50,144.84 Dividends 105,000.00 Bakery Sales 327 32255 Merchandise Sales 1205.64 Cost of Good: Sold-Baked 105,834.29 Cost of Goods Sold - Merchandise 859.77 Rent Expense 24,549.19 Wages Expense 10,670.72 Miso. Supplies Expense 3,000 46 Business License Expense 2,045.77 Miso. Expense 1,363.84 Depreciation Expense 677 86 Insurance Expense 1.09108 Advertising Expense 1,549.74 Interest Expense 818.31 Telephone Expense 490.98 Gain Loss on disposal of equipment 429,136.32 429.136.32 20.262.11 3,383 28 211.46 5,000.00 20.000.00 50.144.84 105,000.00 327,322.55 1205.64 105,834.29 859.77 24,549.19 10,670.72 3,000.46 2045.77 1,363.84 677.86 108108 1,549.74 818.31 490.98 429,136.32 429,136.32 estone One Instructions Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statem G H AA 2 3 Peyton Approved Balance Sheet As of December 31, 2017 Liabilities and Owners' Equity Current Liabilities: Accounts Payable $ 20,262.11 Wages Payable 3.383.28 Interest Payable 211.46 $ 67 520.04 68,519.91 15,506.70 1,238.07 2,114.55 2,114.55 170.49 5 6 7 Assets 8 Current Assets: 9 Cash 10 Accounts Receivable 11 Baking Supplies 12 Merchandise Inventory 13 Prepaid Rent 14 Prepaid Insurance 15 Misc. Supplies 16 17 18 Total Current Assets 19 20 21 Long Term/Fixed Assets: 22 Baking Equipment 23 Accumulated Depreciation 24 Net Fixed assets 25 26 27 28 29 30 31 Total Assets $157,184.31 Total Current Liabilities $ 23,856.85 14,000.00 -1.606.44 Long Term Liabilities: Notes Payable 5,000.00 Total Long Term Liabilities: Total Liabilities: 5,000.00 ! 12,393.56 28,856.85 Common Stock Retained Earning: 20.000.00 120,721 02 Total Equity 140.721.02 $ 169,577.87 Total Liabilities & Equity $ 169.577.87 Milestone One Instructions Trial Balance 2017 Balance Sheet 2017 Balance Sheet 2017 Revised Income Statem Ready