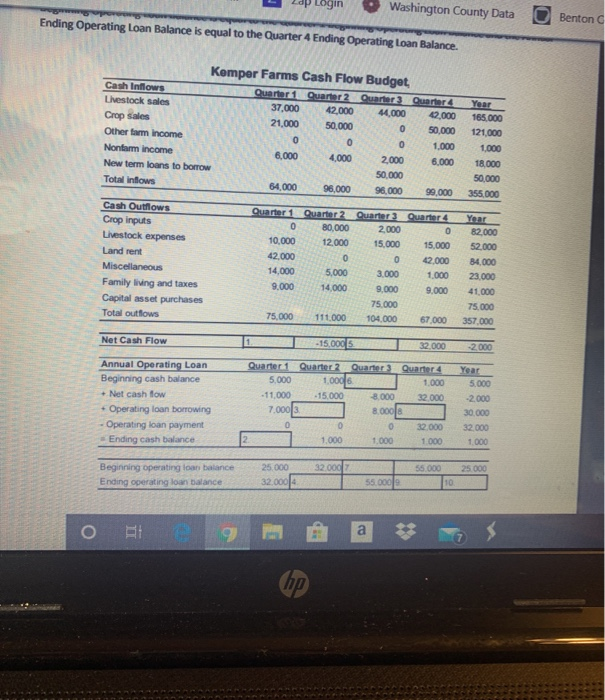

Overview. Kemper Farms need to find out how much operating capital they will need to borrow this year. As the new farm manager you are tasked with completing the cash flow budget. Kemper Farms organizes their cash flow budget by quarter. They have a good handle on projections for cash coming into and going out of the business (cash inflows and outfows). However, they have yet to complete the budget and need your help. 1. Ending Cash . ance. The owners instruct you to ensure that there is always an ending cash balance of $1,000 eachquarter when you calculate the required borrowing needs for each quarter make sure you remember that you will need to borrow enough funds to have $1,000 minimum in the account (if borrowing is in fact needed). Opercing Loan Calculate how much Kemper Farms will need to borrow each quarter (if borrowing is needed) and how much they can repay each quarter. Do not worry about interest payments on the operating loan. If you ate that the farm can repay a portion of the loan during one or more of the quarters, simply apply the nent as if it were going towards principal alone. Don't forget to budget for an ending cash balance of $1,000 quarter 3. Beginning and Ending Loan Balances. On the bottom two lines of the cash flow budget, estimate the total amount of operating loan funds the farm will have borrowed at the end of each quarter. Note: The Annual Beginning Operating Loan Balance is equal to the Quarter 1 Beginning Operating Loan Balance and the Annual Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance 7:10 PM 67162 Search Login Washington County Data Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance. Benton Kemper Farms Cash Flow Budget Cash Inflows Quarter1 Quarter2_Quarter 3 Quarter Livestock sales 37.000 42,000 44,000 2,000 Crop sales 21,000 50,000 0 50.000 Other form Income 0 0 0 1.000 Nonfarm income 6.000 4.000 2.000 6,000 New term loans to borrow 50.000 Total inflows 64,000 96.000 96.000 99.000 165.000 121,000 1,000 18.000 50,000 355.000 Cash Outflows Crop inputs Livestock expenses Land rent Miscellaneous Family living and taxes Capital asset purchases Total outflows 0 10.000 42.000 14.000 9.000 Quarter2_Quarter 3 Quarter4 80,000 2.000 0 12.000 15.000 15,000 0 0 42,000 5.000 3.000 1.000 14,000 9,000 9,000 75.000 111.000 104.000 67.000 Year 82.000 52.000 84,000 23.000 41,000 75.000 357.000 75,000 Net Cash Flow -15.000 32.000 -2.000 Annual Operating Loan Beginning cash balance + Net cash fow + Operating loan borrowing - Operating loan payment - Ending cash balance Quarter 1 Quarter 2 Quarter 3 Quarter 4 5,000 1,000 6 1.000 -11,000 -15,000 8.000 32 000 7.0003 8.000 6 0 0 32.000 1.000 1,000 1.000 Year 5.000 -2.000 30.000 32.000 1.000 25.000 32.000 55.000 25.000 Beginning operating loan balance Ending operating loan balance 32.000 55.000 10 o 9 a hp