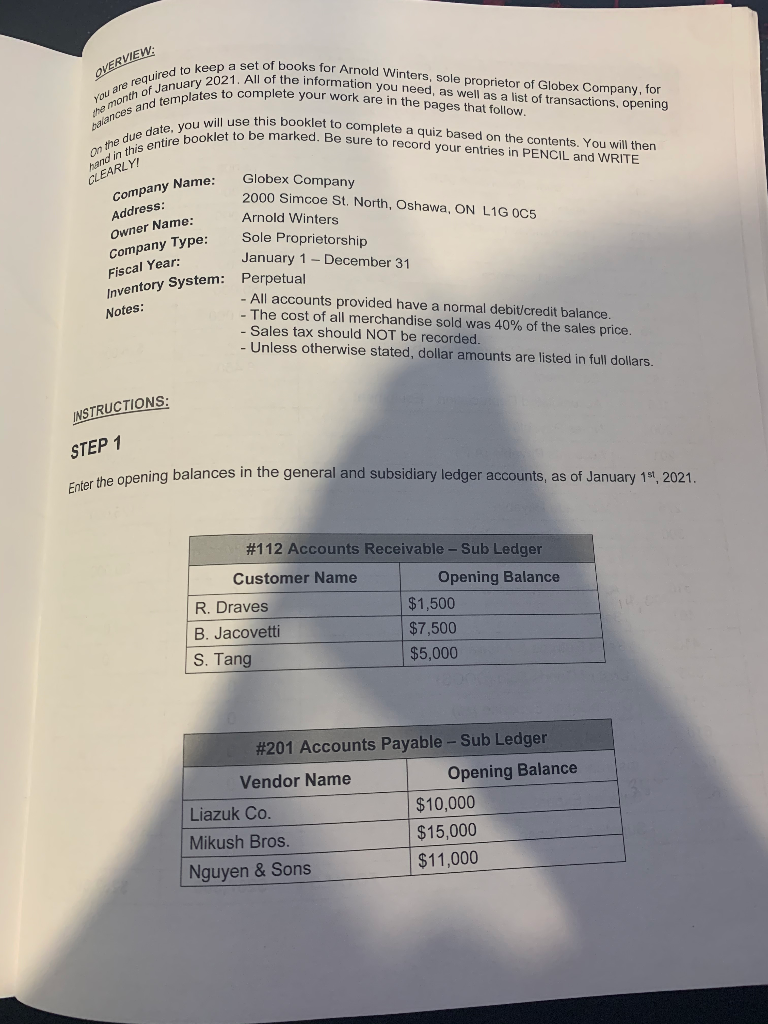

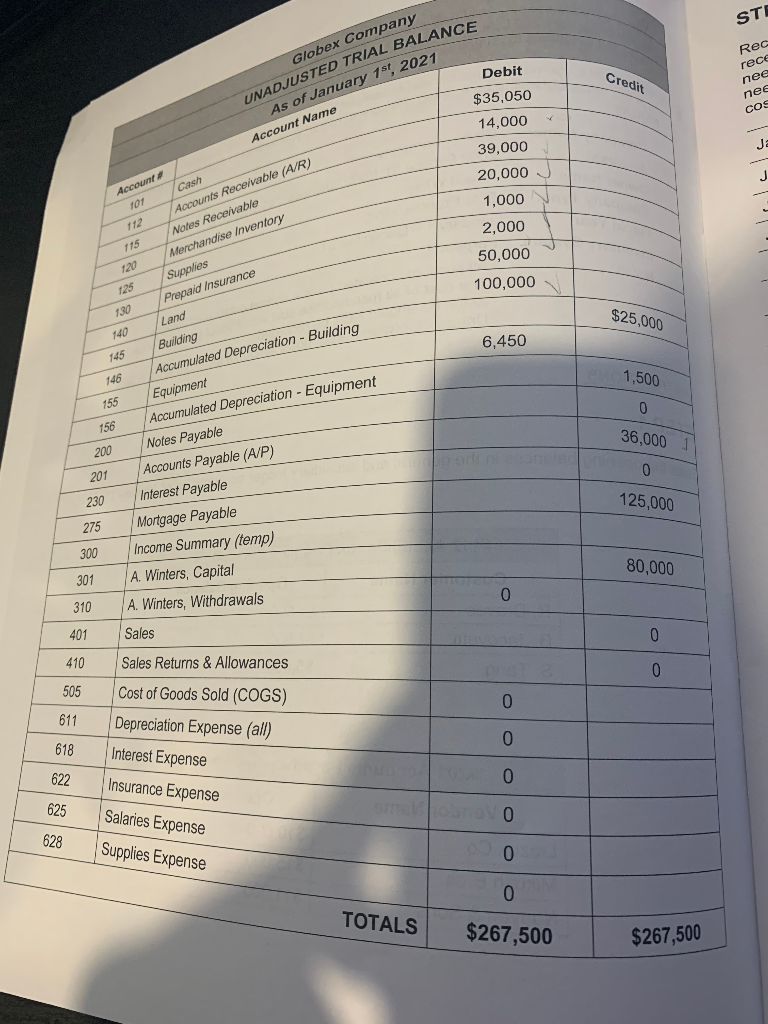

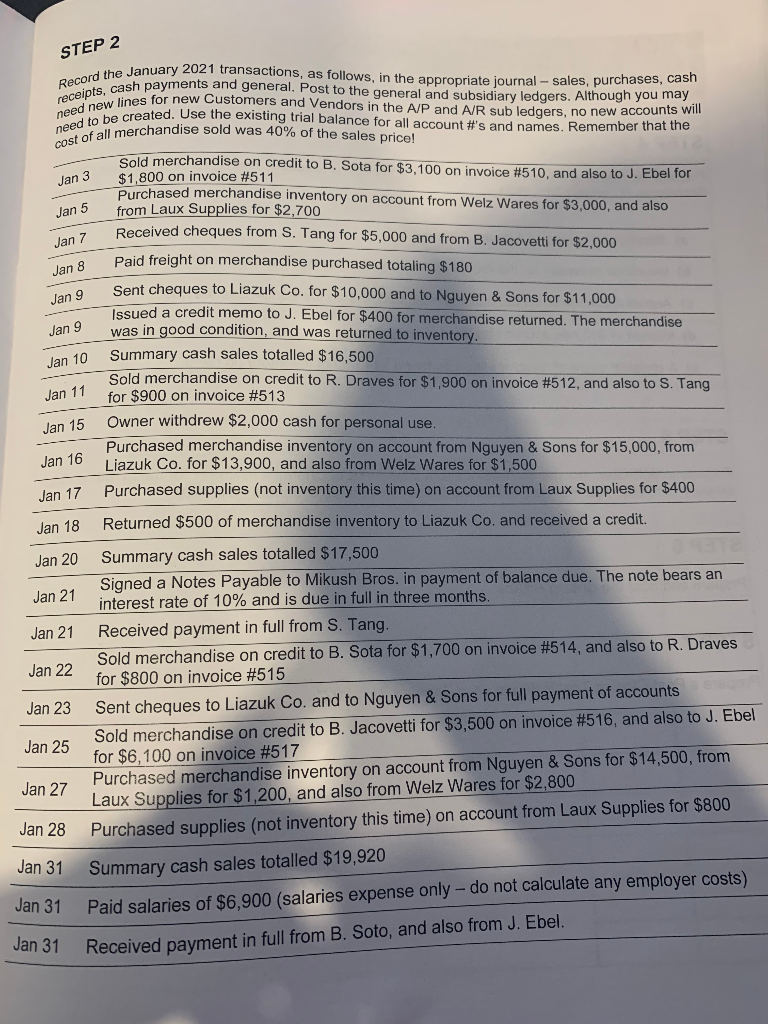

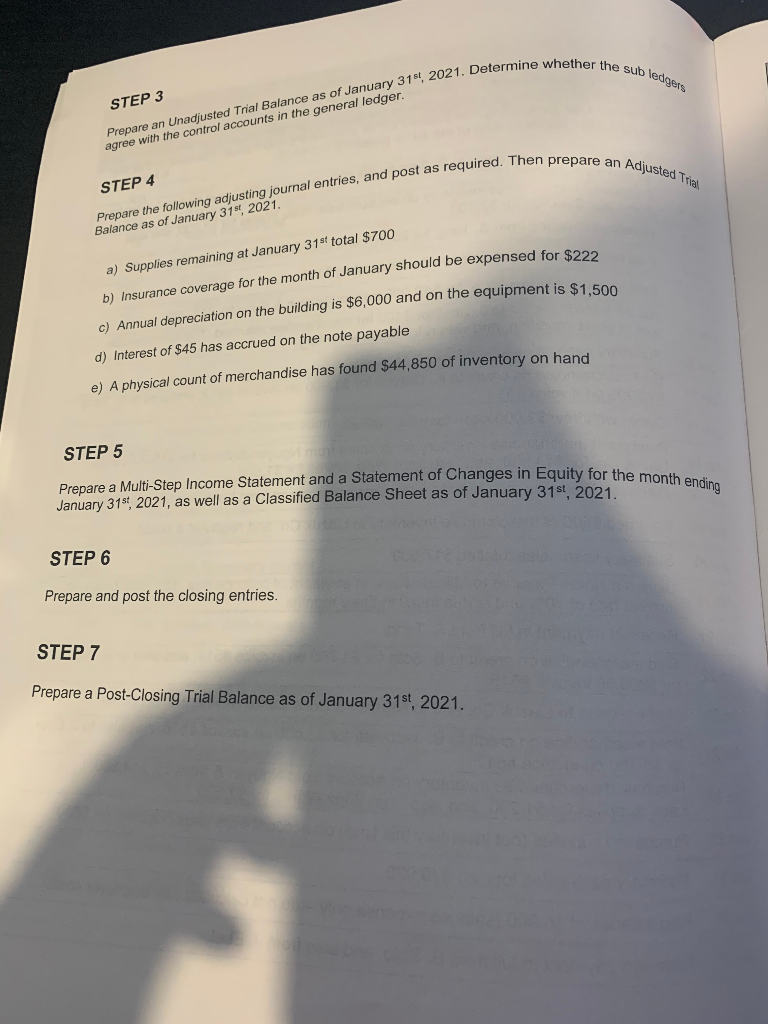

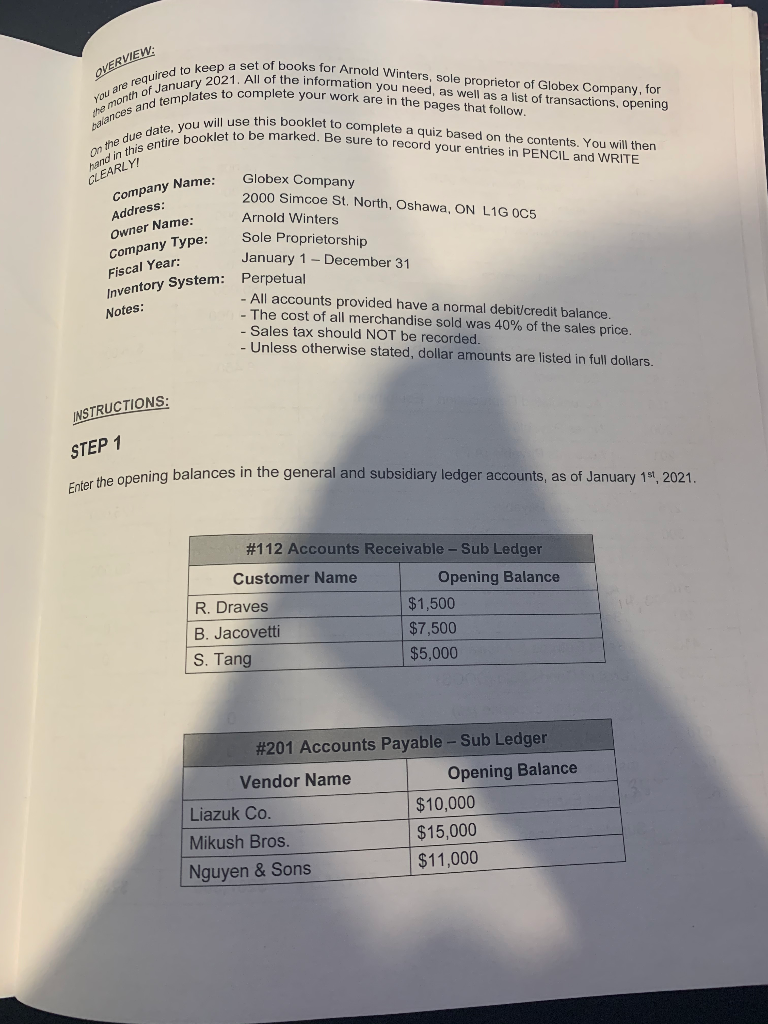

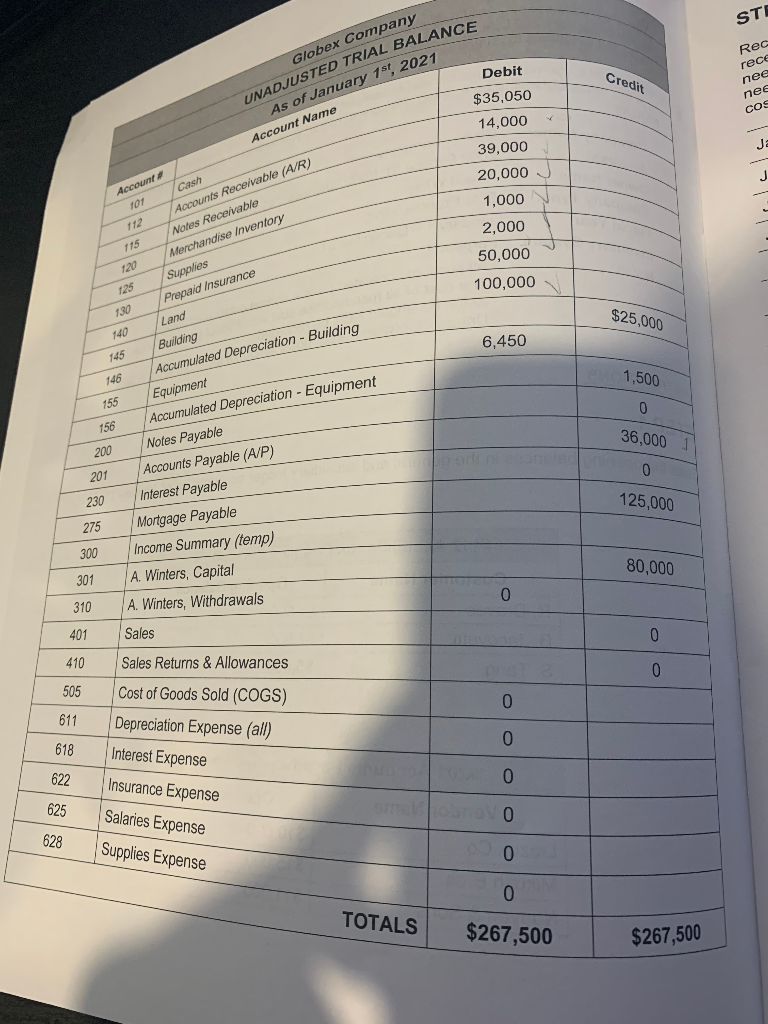

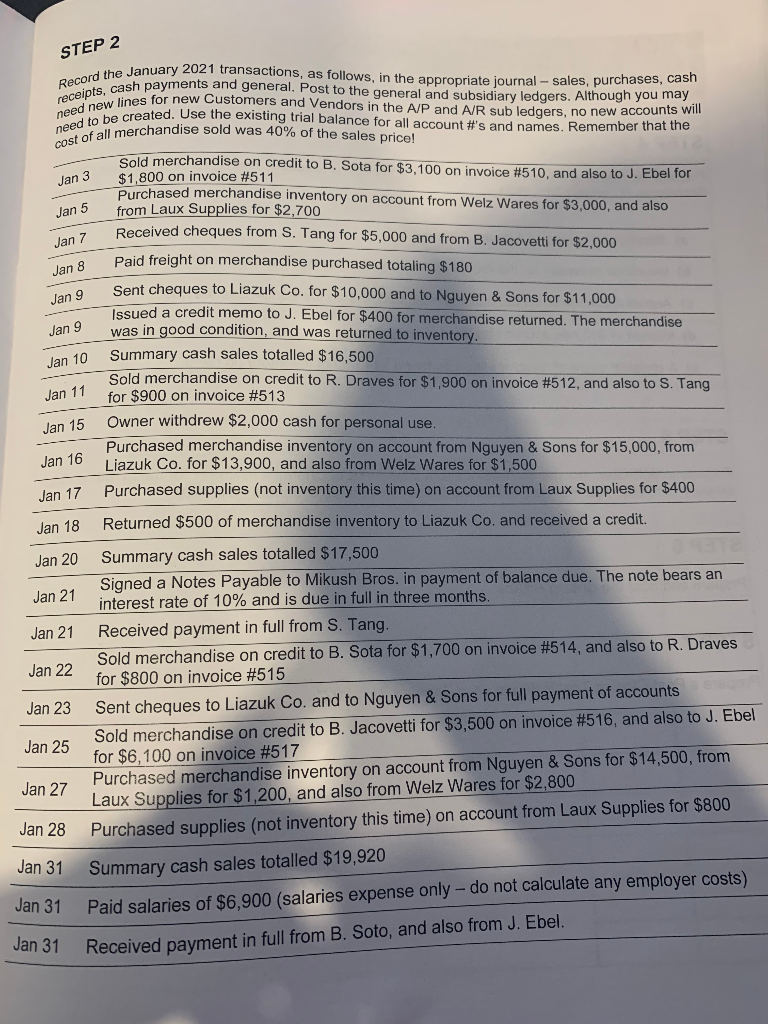

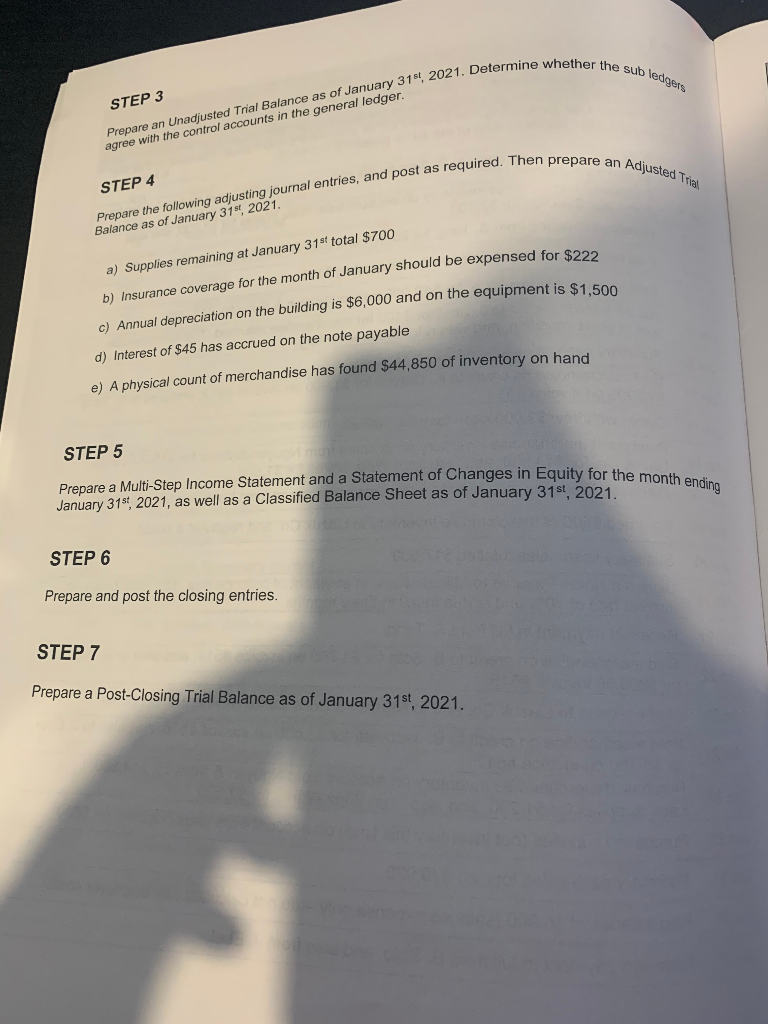

OVERVIEW op a set of books for Arnold Winters, sole proprietor of Globex Company, for 2021. All of the information you need, as well as a list of transactions, opening s to complete your work are in the pages that follow. You are rem the month of are required to keep as month of January 202 ances and templatest all use this booklet to complete a quiz based on the contents. You will then let to be marked. Be sure to record your entries in PENCIL and WRITE wie due date, you will in this entire booklet to Ar the dua hand in this CLEARLY Company Name: Address: Owner Name: Company Type: Fiscal Year: Inventory System: Notes: Globex Company 2000 Simcoe St. North, Oshawa, ON L1G 005 Arnold Winters Sole Proprietorship January 1 - December 31 Perpetual - All accounts provided have a normal debit/credit balance. - The cost of all merchandise sold was 40% of the sales price. - Sales tax should NOT be recorded. - Unless otherwise stated, dollar amounts are listed in full dollars. INSTRUCTIONS: STEP 1 opening balances in the general and subsidiary ledger accounts, as of January 11, 2021. Enter the opening balance #112 Accounts Receivable - Sub Ledger Customer Name Opening Balance R. Draves $1,500 B. Jacovetti $7,500 S. Tang $5,000 #201 Accounts Payable - Sub Ledger Vendor Name Opening Balance Liazuk Co. $10,000 Mikush Bros. $15,000 Nguyen & Sons $11,000 STE Credit Rec rece nee nec cos Globex Company UNADJUSTED TRIAL BALANCE As of January 11, 2021 Account Name Cash Accounts Receivable (A/R) Notes Receivable Merchandise Inventory Debit $35,050 14,000 39,000 20,000 J 1,000 2,000 Account 101 115 50,000 125 100,000 Supplies Prepaid Insurance Land 130 $25,000 140 145 6,450 146 Building Accumulated Depreciation - Building Equipment 1,500 155 156 Accumulated Depreciation - Equipment Nofes Payable 36,000 1 200 201 230 125,000 275 Accounts Payable (A/P) Interest Payable Mortgage Payable Income Summary (temp) A. Winters, Capital 300 80,000 301 310 401 410 505 611 A. Winters, Withdrawals Sales Sales Returns & Allowances Cost of Goods Sold (COGS) Depreciation Expense (all) 618 622 0 Interest Expense Insurance Expense Salaries Eynon Salaries Expense 625 628 Supplies Expense 0 0 0 TOTALS $267,500 $ 267,500 STEP 2 Record the Janu receipts, cash bavn need new lines for need to be crs ord the January 2021 transactions. 18, as follows, in the appropriate journal - sales, purchases, cash s. cash payments and general, Post to t st to the general and subsidiary ledgers. Although you may lines for new Customers and Vendors in the A/P and A/R sub ledgers, no new account created. Use the existing trial balance for all account #'s and names. Remember was il merchandise sold was 40% of the sales price! neet of all merchandise sold was 400 rial balance for all accano A/R sub ledgers, no new accounts will Jan 7 Paid Jan 8 Jan 9 Sent cheque Sold merchandise on credit to B. Sota for $3.100 on invoice #510, and also to J. Ebel for lan 3 $1,800 on invoice #511 Purchased merchandise inventory on account from Welz Wares for $3,000, and also Jan 5 from Laux Supplies for $2,700 Received cheques from S. Tang for $5,000 and from B. Jacovetti for $2.000 Paid freight on merchandise purchased totaling $180 Sent cheques to Liazuk Co. for $10,000 and to Nguyen & Sons for $11,000 Issued a credit memo to J. Ebel for $400 for merchandise returned. The merchandise Jan 9 was in good condition, and was returned to inventory. Jan 10 Summary cash sales totalled $16,500 Sold merchandise on credit to R. Draves for $1,900 on invoice #512, and also to S. Tang Jan 11 for $900 on invoice #513 lan 15 Owner withdrew $2,000 cash for personal use. Purchased merchandise inventory on account from Nguyen & Sons for $15,000, from Jan 16 Liazuk Co. for $13,900, and also from Welz Wares for $1,500 Jan 17 Purchased supplies (not inventory this time) on account from Laux Supplies for $400 lan 18 Returned $500 of merchandise inventory to Liazuk Co, and received a credit. Jan 20 Summary cash sales totalled $17,500 Signed a Notes Payable to Mikush Bros. in payment of balance due. The note bears an Jan 21 interest rate of 10% and is due in full in three months. Jan 21 Received payment in full from S. Tang. Sold merchandise on credit to B. Sota for $1,700 on invoice #514, and also to R. Draves wall 2 for $800 on invoice #515 Jan 23 Sent cheques to Liazuk Co. and to Nguyen & Sons for full payment of accounts Jan 25 Sold merchandise on credit to B. Jacovetti for $3,500 on invoice #516, and also to J. Ebel for $6,100 on invoice #517 Jan 27 Purchased merchandise inventory on account from Nguyen & Sons for $14,500, from Laux Supplies for $1.200, and also from Welz Wares for $2.800 Jan 28 Purchased supplies (not inventory this time) on account from Laux Supplies for $800 Jan 31 Summary cash sales totalled $19,920 Jan 31 Paid salaries of $6.900 (salaries expense only - do not calculate any employer costs) van 31 Received payment in full from B. Soto, and also from J. Ebel. er the sub ledgers ry 31, 2021. Determine whether th STEP 3 Prepare an Unadjusted Trial Balance as of January 3151 2021. Deter agree with the control accounts in the general ledger. Then prepare an Adjusted Adjusted Trial STEP 4 Prepare the following adjusting journal entries, and post as required. Ther Balance as of January 31, 2021. a) Supplies remaining at January 31sf total $700 b) Insurance coverage for the month of January should be expensed for so c) Annual depreciation on the building is $6,000 and on the equipment is d) Interest of $45 has accrued on the note payable e) A physical count of merchandise has found $44,850 of inventory on hand STEP 5 Equity for the month ending Prepare a Multi-Step Income Statement and a Statement of Changes in Equity for them January 31 2021, as well as a Classified Balance Sheet as of January 31st, 2021 STEP 6 Prepare and post the closing entries. STEP 7 Prepare a Post-Closing Trial Balance as of January 31st, 2021. : 2021