Answered step by step

Verified Expert Solution

Question

1 Approved Answer

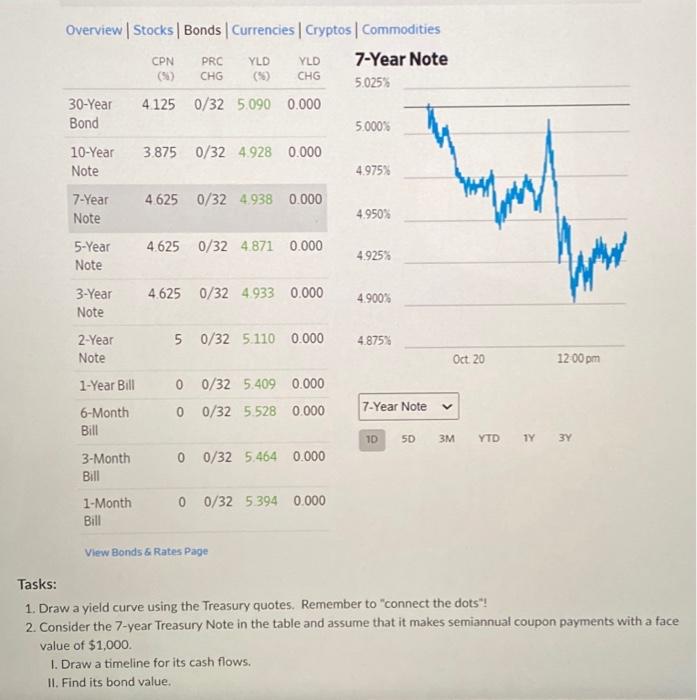

Overview | Stocks | Bonds | Currencies | Cryptos | Commodities 7-Year Note 5.025% 10-Year Note 7-Year Note 5-Year Note 30-Year 4.125 0/32 5.090 0.000

Overview | Stocks | Bonds | Currencies | Cryptos | Commodities 7-Year Note 5.025% 10-Year Note 7-Year Note 5-Year Note 30-Year 4.125 0/32 5.090 0.000 Bond 3-Year Note 2-Year Note 1-Year Bill 6-Month Bill 3-Month Bill CPN (%) 1-Month Bill PRC CHG YLD (%) YLD CHG 3.875 0/32 4.928 0.000 4.625 0/32 4.938 0.000 4.625 0/32 4.871 0.000 4.625 0/32 4.933 0.000 5 0/32 5.110 0.000 0 0/32 5.409 0.000 0 0/32 5.528 0.000 0 0/32 5.464 0.000 View Bonds & Rates Page 0 0/32 5.394 0.000 5.000% 4.975% 4.950% 4.925% 4.900% 4.875% 7-Year Note 1D 5D V Oct. 20 3M YTD 1Y 12:00 pm 3Y Tasks: 1. Draw a yield curve using the Treasury quotes. Remember to "connect the dots"! 2. Consider the 7-year Treasury Note in the table and assume that it makes semiannual coupon payments with a face value of $1,000. I. Draw a timeline for its cash flows. II. Find its bond value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started