Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) You are constructing a diversified portfolio. Among the companies you are considering are ABC Ltd (expected return 16.5%, standard deviation 30%, beta 1.5)

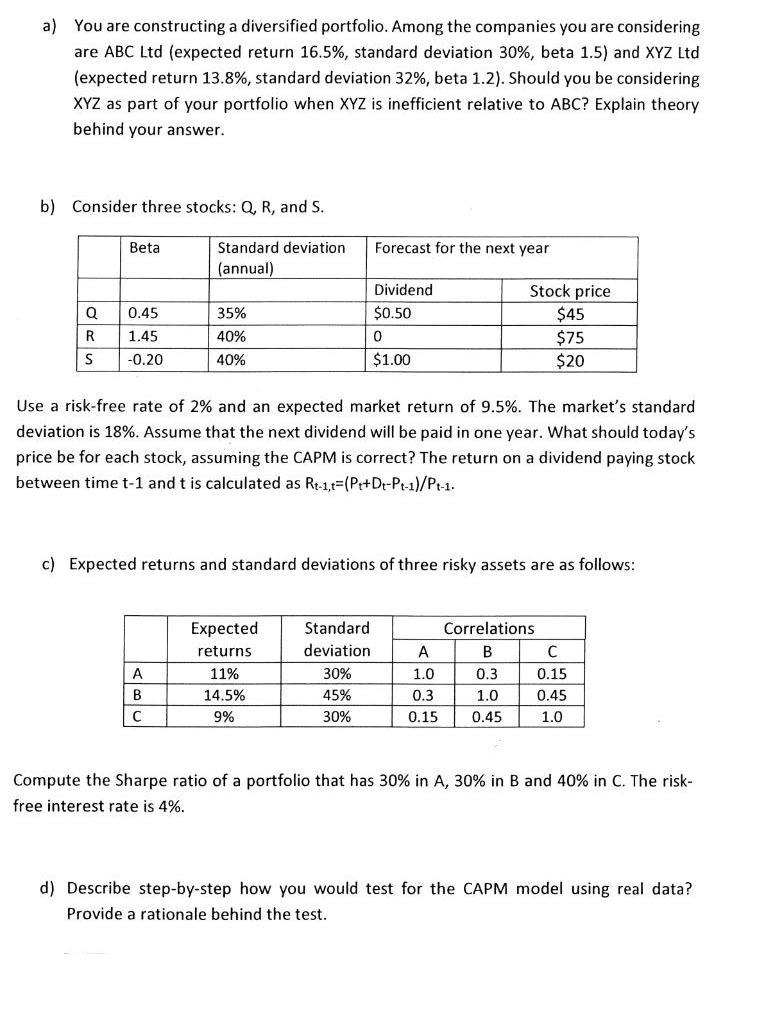

a) You are constructing a diversified portfolio. Among the companies you are considering are ABC Ltd (expected return 16.5%, standard deviation 30%, beta 1.5) and XYZ Ltd (expected return 13.8%, standard deviation 32%, beta 1.2). Should you be considering XYZ as part of your portfolio when XYZ is inefficient relative to ABC? Explain theory behind your answer. b) Consider three stocks: Q, R, and S. Standard deviation (annual) Q R S Beta 0.45 1.45 -0.20 35% 40% 40% A B C Expected returns 11% 14.5% 9% Forecast for the next year Use a risk-free rate of 2% and an expected market return of 9.5%. The market's standard deviation is 18%. Assume that the next dividend will be paid in one year. What should today's price be for each stock, assuming the CAPM is correct? The return on a dividend paying stock between time t-1 and t is calculated as Rt-1, (Pt+Dr-Pt-1)/Pt-1. Standard deviation Dividend $0.50 c) Expected returns and standard deviations of three risky assets are as follows: 30% 45% 30% 0 $1.00 Stock price $45 $75 $20 Correlations B 0.3 0.3 1.0 0.15 0.45 A 1.0 C 0.15 0.45 1.0 Compute the Sharpe ratio of a portfolio that has 30% in A, 30% in B and 40% in C. The risk- free interest rate is 4%. d) Describe step-by-step how you would test for the CAPM model using real data? Provide a rationale behind the test.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Yes XYZ should be considered as part of the portfolio when XYZ is inefficient relative to ABC The theory behind this is the Capital Asset Pricing Mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started