Question

Overview Your team works for a renowned FX trading company, Xhi-Trade. The company specializes in trading major currencies such as Australian dollar (AUD), United States

Overview

Your team works for a renowned FX trading company, Xhi-Trade. The company specializes in trading major currencies such as Australian dollar (AUD), United States dollar (USD), Japanese Yen (JPY), Euro (EUR) and Great British Pound (GBP). The company also trades various foreign exchange related derivatives for its clients. In addition, it provides general advice to other clients who trade for themselves. The firms chief trading executive, Bill Harrison, has requested your teams expertise in trading foreign currencies in order to improve firm's trading strategy and profits. You have been asked to prepare a detailed report in this regard. In your report you must address the following questions:

Question 1

You have been asked to select one of the three market views developed by your group in stage 1 (use AUD/JPY for this case). Using this market view, devise a speculation strategy that enables your organisation to take advantage of your predicted changes in the exchange rates. You should specify which currencies you will buy or sell. As part of your strategy you must create a portfolio as of 24th of April, 2020. This portfolio will comprise of the currency pair analysed in your market view.

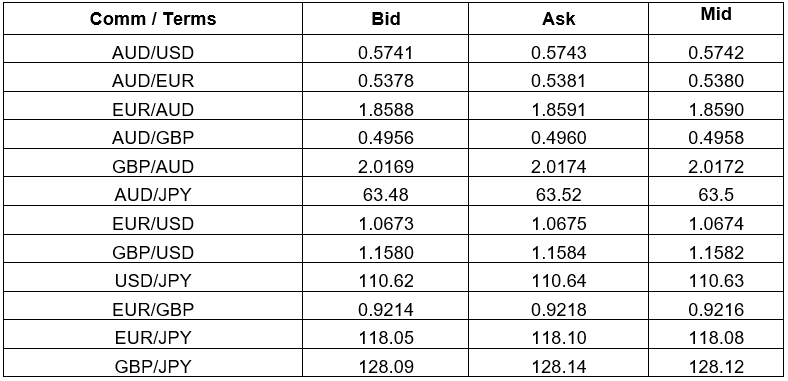

Table 1: Exchange rates for April 24, 2020. Mid rate = (bid rate + ask rate)/2

The senior management has allocated you 400,000,000 as the initial balance for your speculation strategy if you are speculating on AUD, USD, EUR or GBP and 25,000,000,000 if you are speculating on JPY. For instance, if you are speculating on AUD/EUR and decided to short the EUR then you have been allocated 400,000,000 EURs for this purpose. The corresponding long position should be calculated using bid/ask rates provided in Table 1. Please note that you have to speculate on only one currency pair (AUD/JPY). You must then take long and short positions as of 24th April, 2020 in the respective currencies in accordance with your market view as a price taker. These long and short positions will constitute your portfolios current opening position. Based on your initial position you must estimate the opening AUD value of your portfolio using the mid rates in Table 1 and update your position summary table below with your speculative position. Mid rate = (bid rate + ask rate)/2

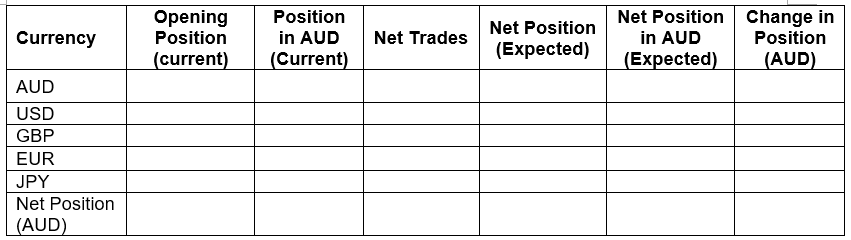

Table 2: FX portfolio position summary

Note: Indicate long positions with a positive sign and short positions with a negative sign (e.g. a short position of 45,000,000 GBP should be indicated as --45,000,000). Mid rate = (bid rate + ask rate)/2

Question 2

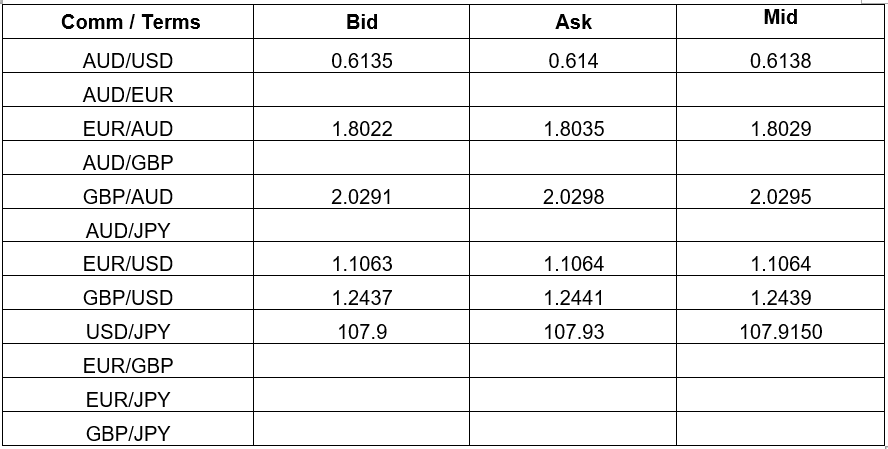

The senior management is concerned about the recent developments in the financial markets. There is a general belief that market volatility was relatively high, yet it might climb even higher than expected in the near future due to the current global health crisis. You have been asked to conduct a thorough risk assessment of your speculative positions undertaken in question 1. For this purpose, the firms foreign currency analyst has provided you with the following forecast for US dollar exchange rates as at the end of June 2020:

Table 3: Expected exchange rates for June, 2020. Mid rate = (bid rate + ask rate)/2

Using the estimated exchange rates above, calculate the implied expected bid, ask and mid rates for the remaining currency pairs in Table 3. You must then calculate the value of your FX portfolio at the end of June using the calculated bid/ask rates. Report the expected value of your position in each currency in the position summary in Table 2. Finally, you must calculate expected profit/loss (gain or loss over the opening position) on your portfolio in AUD. The AUD value of the net expected position must be calculated using the estimated mid rates.

Explain your final portfolio position to the senior manager. Given the expected exchange rates in June, discuss whether your speculative positions will generate profits for the company. You must explain ending positions for each currency (and its AUD value using mid rates) in your portfolio? Are there any exposure to exchange rate risk? What recommendations, if any, will you make to the senior management?

Comm / Terms Bid Ask Mid 0.5743 0.5741 0.5378 1.8588 AUD/USD AUD/EUR EUR/AUD AUD/GBP GBP/AUD AUD/JPY 0.5381 1.8591 0.4960 0.5742 0.5380 1.8590 0.4958 0.4956 2.0169 2.0172 2.0174 63.52 63.48 63.5 1.0675 1.0673 1.1580 110.62 1.0674 1.1582 1.1584 110.64 110.63 EUR/USD GBP/USD USD/JPY EUR/GBP EUR/JPY GBP/JPY 0.9218 0.9216 0.9214 118.05 118.10 128.14 118.08 128.12 128.09 Currency Opening Position (current) Position in AUD (Current) Net Trades Net Position (Expected) Net Position Change in in AUD Position (Expected) (AUD) AUD USD GBP EUR JPY Net Position (AUD) Comm / Terms Bid Ask Mid 0.6135 0.614 0.6138 AUD/USD AUD/EUR EUR/AUD 1.8022 1.8035 1.8029 AUD/GBP GBP/AUD 2.0291 2.0298 2.0295 AUD/JPY EUR/USD 1.1063 1.1064 1.1064 1.2437 1.2441 1.2439 GBP/USD USD/JPY 107.9 107.93 107.9150 EUR/GBP EUR/JPY GBP/JPY Comm / Terms Bid Ask Mid 0.5743 0.5741 0.5378 1.8588 AUD/USD AUD/EUR EUR/AUD AUD/GBP GBP/AUD AUD/JPY 0.5381 1.8591 0.4960 0.5742 0.5380 1.8590 0.4958 0.4956 2.0169 2.0172 2.0174 63.52 63.48 63.5 1.0675 1.0673 1.1580 110.62 1.0674 1.1582 1.1584 110.64 110.63 EUR/USD GBP/USD USD/JPY EUR/GBP EUR/JPY GBP/JPY 0.9218 0.9216 0.9214 118.05 118.10 128.14 118.08 128.12 128.09 Currency Opening Position (current) Position in AUD (Current) Net Trades Net Position (Expected) Net Position Change in in AUD Position (Expected) (AUD) AUD USD GBP EUR JPY Net Position (AUD) Comm / Terms Bid Ask Mid 0.6135 0.614 0.6138 AUD/USD AUD/EUR EUR/AUD 1.8022 1.8035 1.8029 AUD/GBP GBP/AUD 2.0291 2.0298 2.0295 AUD/JPY EUR/USD 1.1063 1.1064 1.1064 1.2437 1.2441 1.2439 GBP/USD USD/JPY 107.9 107.93 107.9150 EUR/GBP EUR/JPY GBP/JPYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started