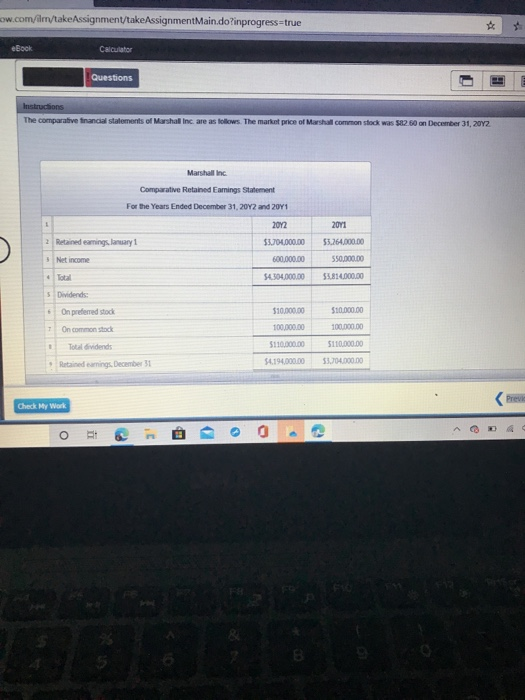

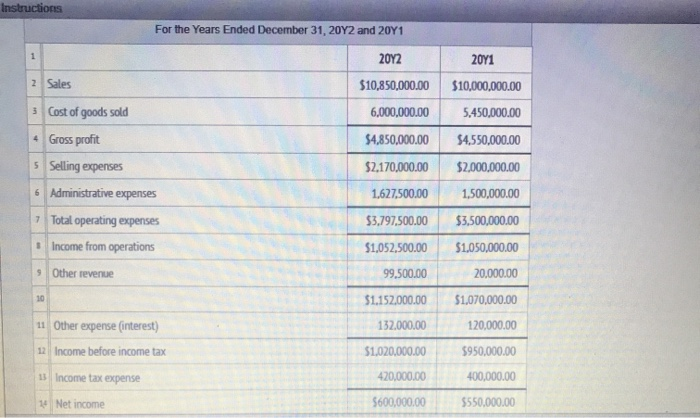

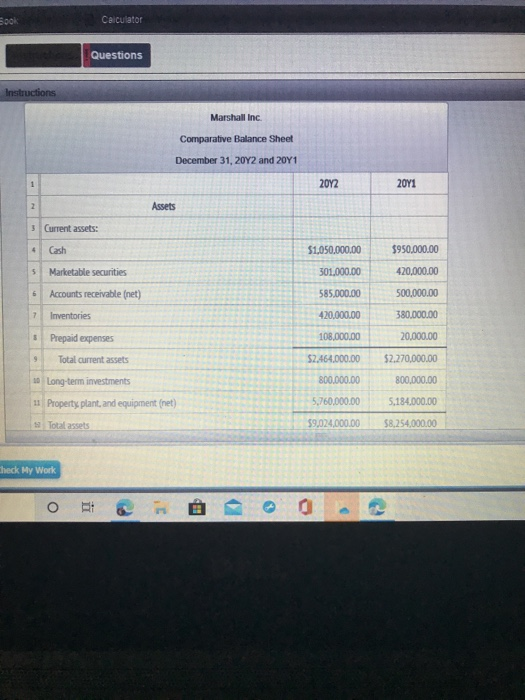

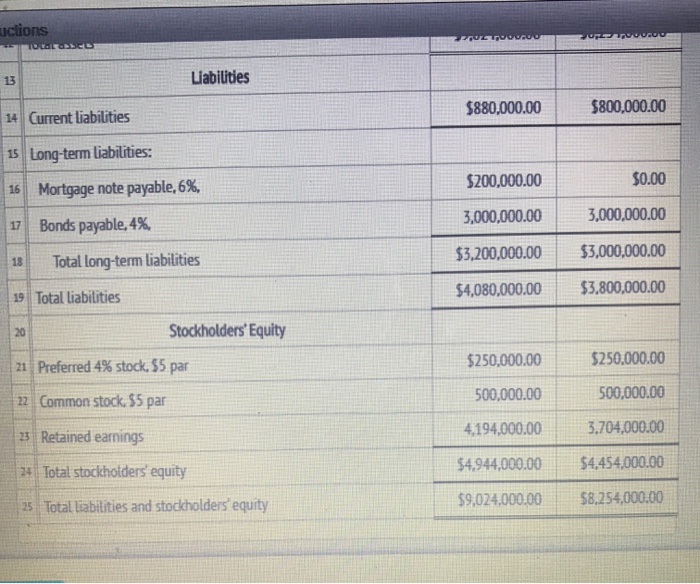

ow.com/ilm/takeAssignment/takeAssignmentMain.do?inprogress=true $ eBook Calculator Questions Instructions The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 2012 Marshall Inc Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2011 2072 . 2 Retained earnings January $3.704,000.00 55.264.000.00 550.000.00 3 Net income 600,000.00 54.304.000.00 53.810.000.00 5 Dividends: On preferred stock $10.000.00 100.000.00 T $10,000.00 100,000.00 $110.000.00 On common stock 1 $110.000.00 Total dividends Retained earnings, December 31 54.194.000.00 53.704.000.00 Prev Check My Work O > RE . C B Instructions For the Years Ended December 31, 2012 and 2041 1 2011 z Sales 20Y2 $10,850,000.00 6,000,000.00 $4,850,000.00 $2,170,000.00 $10,000,000.00 5.450,000.00 $4,550,000.00 $2,000,000.00 3 Cost of goods sold 4 Gross profit 5 Selling expenses 6 Administrative expenses 7 Total operating expenses Income from operations 9 Other revenue 1.627.500.00 1,500,000.00 $3.797,500.00 $3,500,000.00 $1,050,000.00 $1,052,500.00 99.500.00 20,000.00 10 $1.152,000.00 132,000.00 $1,070,000.00 120,000.00 11 Other expense (interest) 12 Income before income tax $1,020,000.00 $950,000.00 15 Income tax expense 420,000.00 400,000.00 14 Net income $600,000.00 $550,000.00 Sook Calculator Questions Instructions Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 1 2012 2011 2 Assets 3 Current assets: 4 Cash $950,000.00 $1,050,000.00 301,000.00 5 Marketable securities 420,000.00 6 585,000.00 500,000.00 Accounts receivable (net) 7 Inventories * Prepaid expenses 420,000.00 380,000.00 108,000.00 20.000,00 Total current assets 52.464.000.00 $2.270,000.00 800.000.00 800,000.00 10 Long-term investments 11 Property, plant, and equipment (net) 5,760,000.00 5.184.000.00 Total assets 59,024,000.00 $8.254,000.00 Check My Work o - 0 uctions ESTUVUUU pen TO LOCO 13 Liabilities $880,000.00 $800,000.00 14 Current liabilities 15 Long-term Liabilities: $200,000.00 $0.00 16 Mortgage note payable, 6%, Bonds payable, 4% 3,000,000.00 3,000,000.00 17 $3,200,000.00 $3,000,000.00 18 Total long-term liabilities $4,080,000.00 $3.800,000.00 19 Total liabilities 20 Stockholders' Equity 21 Preferred 4% stock, 55 par $250,000.00 $250,000.00 500,000.00 500,000.00 22 Common stock. $5 par 4,194,000.00 3.704,000.00 23 Retained earnings $4,944,000.00 $4,454,000.00 24 Total stockholders equity 25 Total liabilities and stockholders' equity $9,024,000.00 $8.254,000.00 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets %