Question

Owen bank wants estimate the probability of default of the firm Fizer. Fizer bonds have the following term structures as shown in the polt. Assume

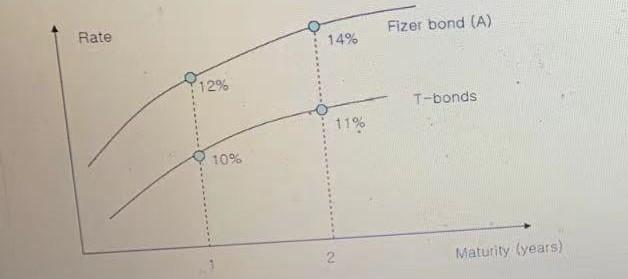

Owen bank wants estimate the probability of default of the firm Fizer. Fizer bonds have the following term structures as shown in the polt. Assume that if Fizer defaults, the recovery rate is 0. Answer the following questions.

Supposed during the financial crisis, the overall economy bears a higher unexpected risk. the higher risk implies the treasury bill should no longer be regarded as risk-free. Instead, treasury bills now have a default rate of 1% during year 1, and a default rate of 1.5% over the 2-year horizon. Assume that the term structures stays as same as the above plot. in this case, re-calculate the 1-year default probability of Fizer's bonds during year 1.

Rate 12% 10% 14% 11% Fizer bond (A) T-bonds Maturity (years)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To recalculate the 1year default probability of Fizers bonds during year 1 we need to consi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started