Answered step by step

Verified Expert Solution

Question

1 Approved Answer

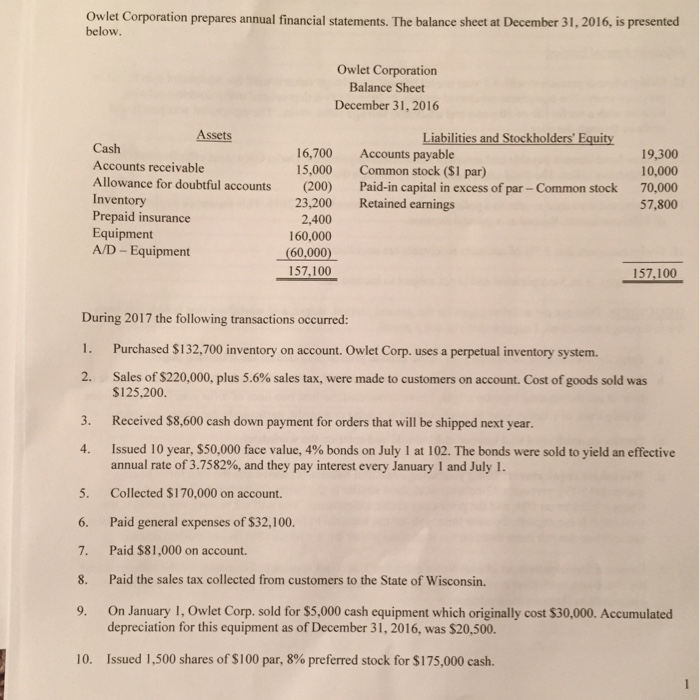

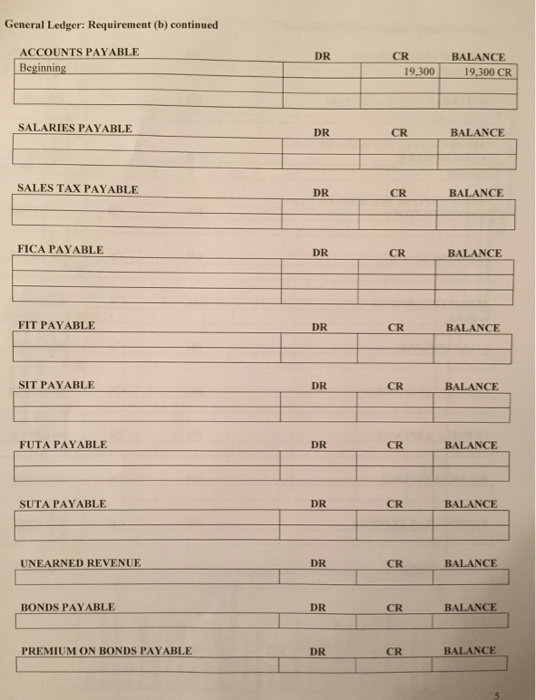

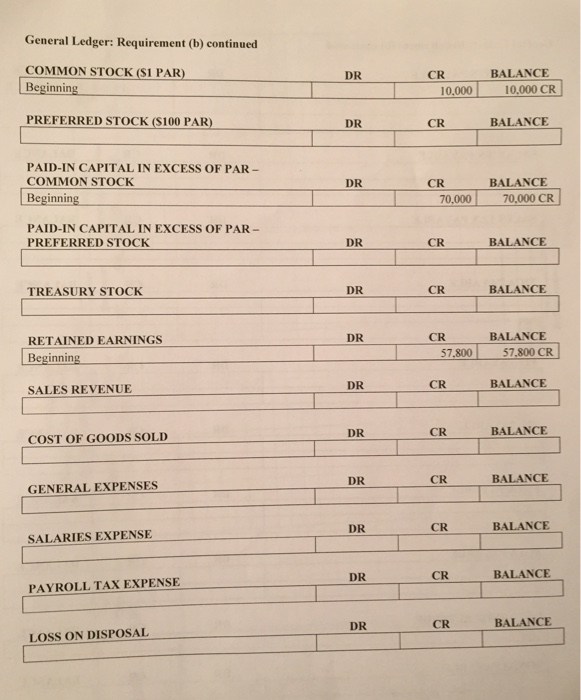

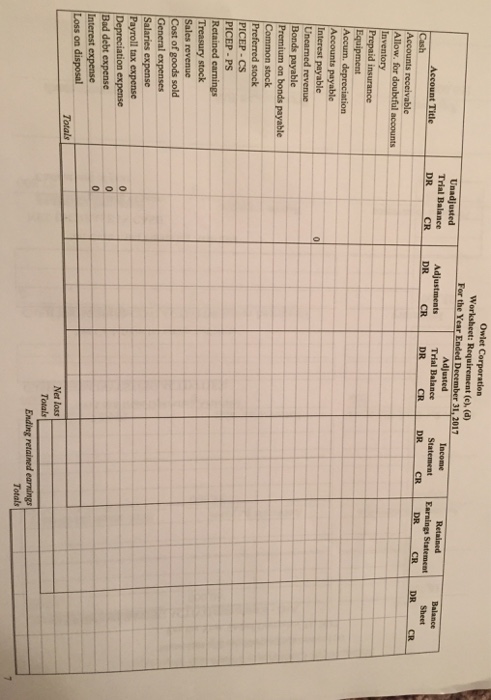

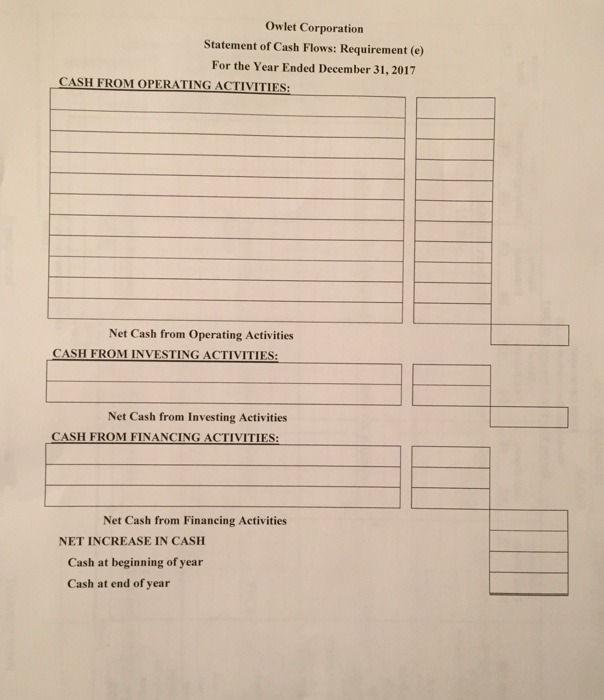

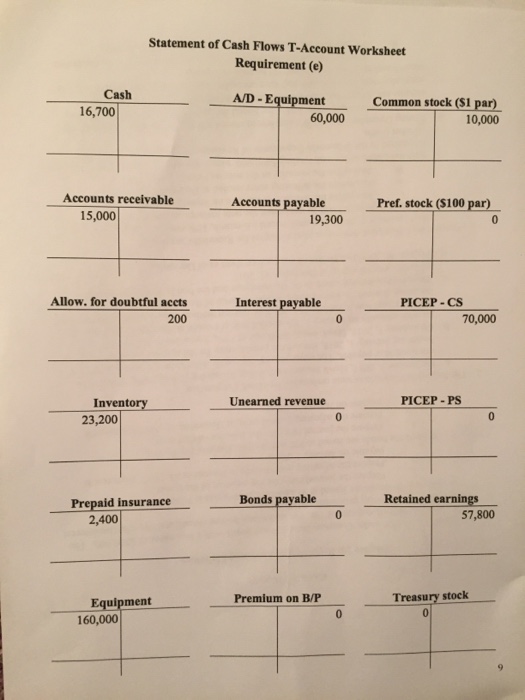

Owlet Corporation prepares annual financial statements. The balance sheet at December 31, 2016, is presented below. Owlet Corporation Balance Sheet December 31, 2016 Assets Liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started