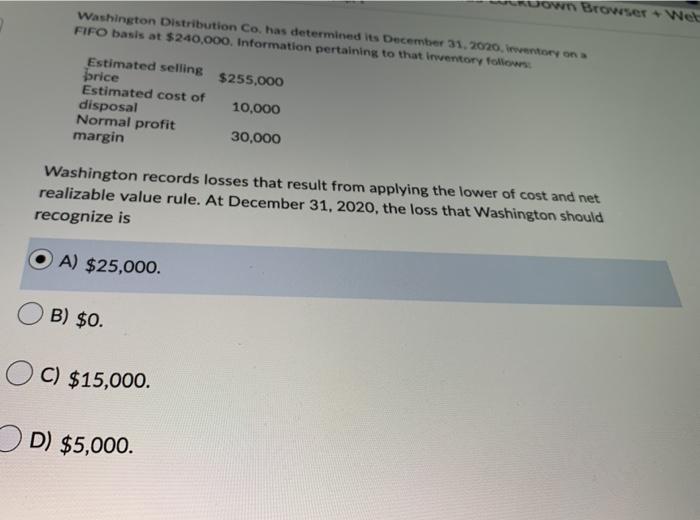

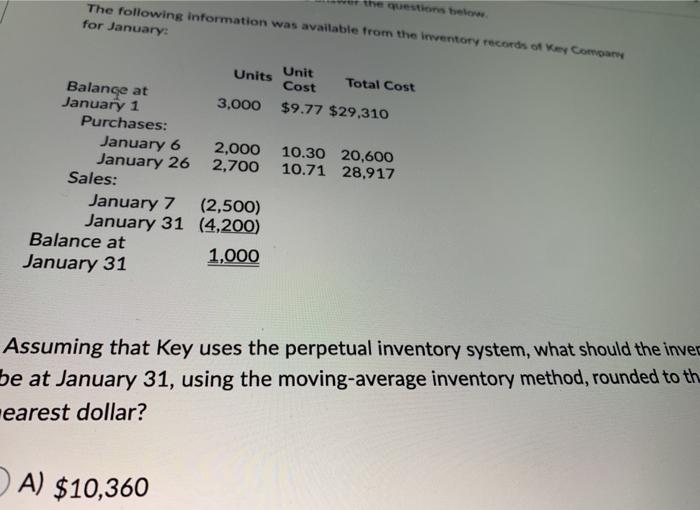

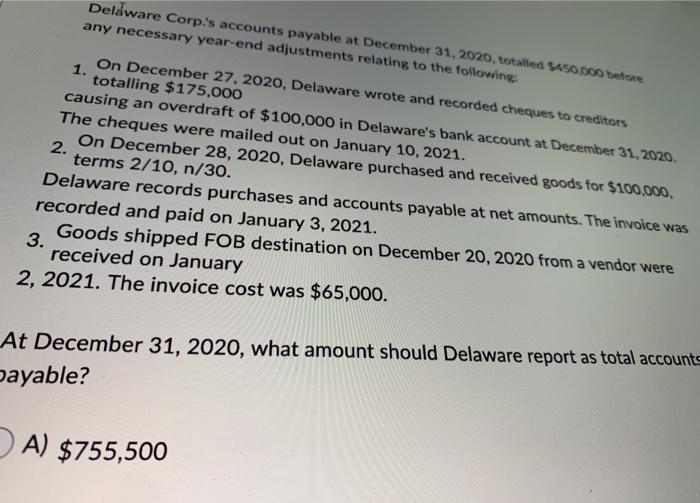

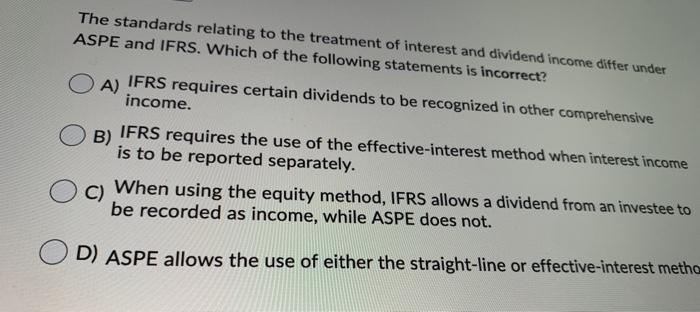

own Browser Wel Washington Distribution Co. has determined its December 31, 2020. vertory on FIFO basis at $240,000. Information pertaining to that Irwentory follows: $255,000 Estimated selling brice Estimated cost of disposal Normal profit margin 10,000 30,000 Washington records losses that result from applying the lower of cost and net realizable value rule. At December 31, 2020, the loss that Washington should recognize is A) $25,000. B) $0. OC) $15,000. D) $5,000. the question belo The following information was available from the inventory records of ey Company for January Units Unit Cost Total Cost Balange at January 1 3,000 $9.77 $29,310 Purchases: January 6 2,000 10.30 20,600 January 26 2,700 10.71 28.917 Sales: January 7 (2,500) January 31 (4.200) Balance at 1,000 January 31 Assuming that Key uses the perpetual inventory system, what should the inver be at January 31, using the moving-average inventory method, rounded to th earest dollar? A) $10,360 Deldware Corp.'s accounts payable at December 31, 2020. totalled $450.000 before any necessary year-end adjustments relating to the following On December 27, 2020, Delaware wrote and recorded cheques to creditors 1. totalling $175,000 causing an overdraft of $100,000 in Delaware's bank account at December 31, 2020. The cheques were mailed out on January 10, 2021. On December 28, 2020, Delaware purchased and received goods for $100,000 2. terms 2/10, n/30. Delaware records purchases and accounts payable at net amounts. The invoice was recorded and paid on January 3, 2021. Goods shipped FOB destination on December 20, 2020 from a vendor were received on January 2, 2021. The invoice cost was $65,000. 3. At December 31, 2020, what amount should Delaware report as total accounts Dayable? A) $755,500 The standards relating to the treatment of interest and dividend income differ under ASPE and IFRS. Which of the following statements is incorrect? OA) IFRS requires certain dividends to be recognized in other comprehensive income. B) IFRS requires the use of the effective-interest method when interest income is to be reported separately. C) When using the equity method, IFRS allows a dividend from an investee to be recorded as income, while ASPE does not. OD) ASPE allows the use of either the straight-line or effective-interest metho