Answered step by step

Verified Expert Solution

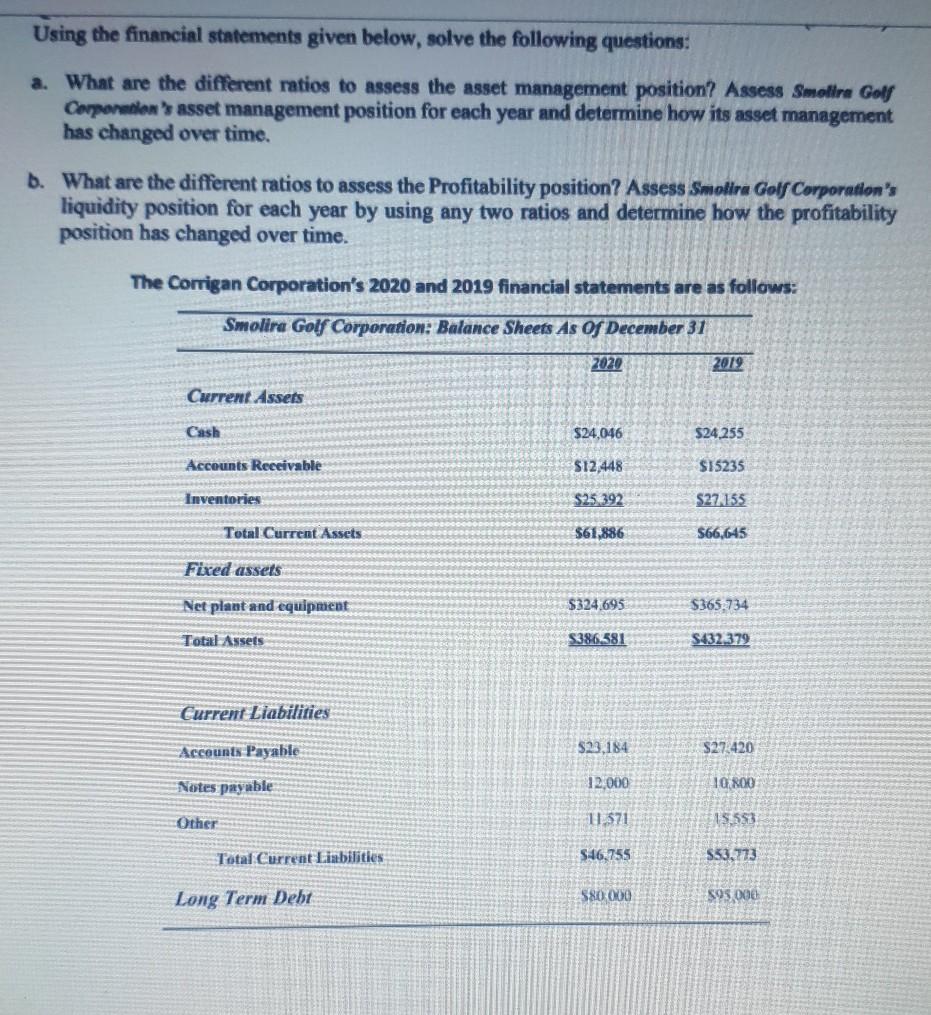

Question

1 Approved Answer

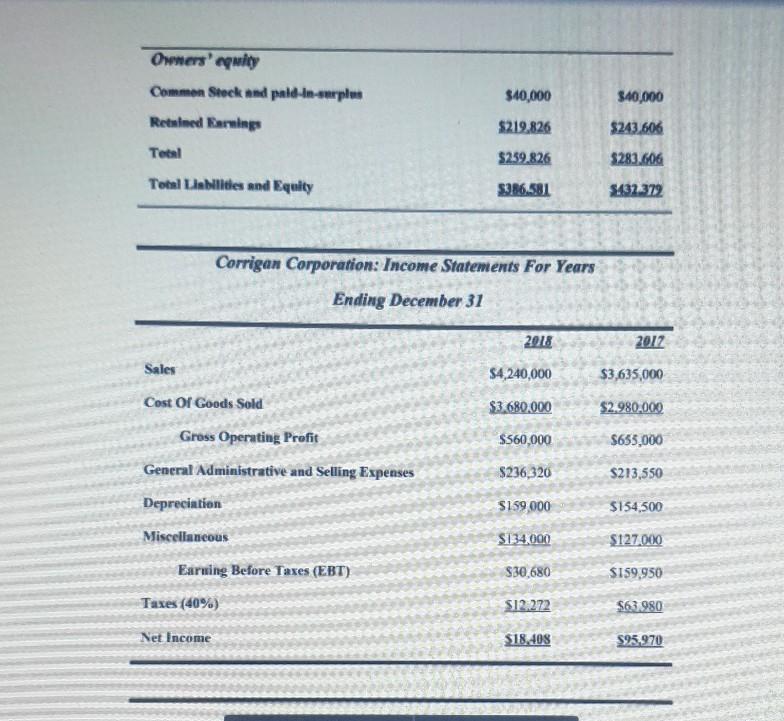

Owners' equity Commen Steck and pald-in-surplus $10,000 $40,000 $219,826 $243.606 Retaimed Earnings Tetail Total Lis Nilities and Equity $259,826 $283.606 $.386.581 $432.372 Corrigan Corporation: Income

Owners' equity Commen Steck and pald-in-surplus $10,000 $40,000 $219,826 $243.606 Retaimed Earnings Tetail Total Lis Nilities and Equity $259,826 $283.606 $.386.581 $432.372 Corrigan Corporation: Income Statements For Years Ending December 31 2018 2017 Sales $4,240,000 Cost Of Goods Sold $3.680,000 $3,635,000 $2.980.000 $655,000 $213,550 $360,000 5236,320 Gross Operating Profit General Administrative and Selling Expenses Depreciation Miscellaneous $199 000 $154,500 S134.000 $127.000 $159,950 Earwing Before Taxes (EBT) Taxes (40%) 530,680 S12.272 $63.980 Net Income $18.408 S95,970 Owners' equity Commen Steck and pald-in-surplus $10,000 $40,000 $219,826 $243.606 Retaimed Earnings Tetail Total Lis Nilities and Equity $259,826 $283.606 $.386.581 $432.372 Corrigan Corporation: Income Statements For Years Ending December 31 2018 2017 Sales $4,240,000 Cost Of Goods Sold $3.680,000 $3,635,000 $2.980.000 $655,000 $213,550 $360,000 5236,320 Gross Operating Profit General Administrative and Selling Expenses Depreciation Miscellaneous $199 000 $154,500 S134.000 $127.000 $159,950 Earwing Before Taxes (EBT) Taxes (40%) 530,680 S12.272 $63.980 Net Income $18.408 S95,970

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started