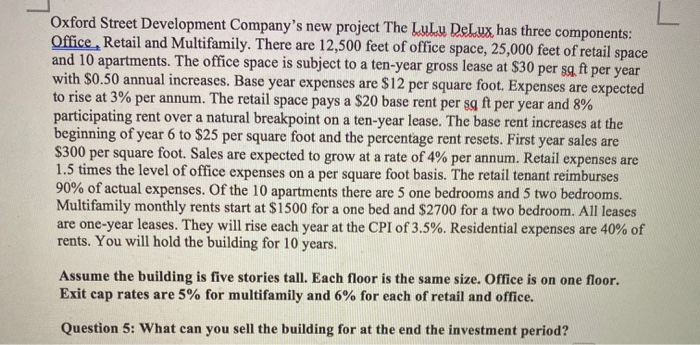

Oxford Street Development Company's new project The Lulu DeLux has three components: Office, Retail and Multifamily. There are 12,500 feet of office space, 25,000 feet of retail space and 10 apartments. The office space is subject to a ten-year gross lease at $30 per sq. ft per year with $0.50 annual increases. Base year expenses are $12 per square foot. Expenses are expected to rise at 3% per annum. The retail space pays a $20 base rent per sq ft per year and 8% participating rent over a natural breakpoint on a ten-year lease. The base rent increases at the beginning of year 6 to $25 per square foot and the percentage rent resets. First year sales are $300 per square foot. Sales are expected to grow at a rate of 4% per annum. Retail expenses are 1.5 times the level of office expenses on a per square foot basis. The retail tenant reimburses 90% of actual expenses. Of the 10 apartments there are 5 one bedrooms and 5 two bedrooms. Multifamily monthly rents start at $1500 for a one bed and $2700 for a two bedroom. All leases are one-year leases. They will rise each year at the CPI of 3.5%. Residential expenses are 40% of rents. You will hold the building for 10 years. Assume the building is five stories tall. Each floor is the same size. Office is on one floor. Exit cap rates are 5% for multifamily and 6% for each of retail and office. Question 5: What can you sell the building for at the end the investment period? Oxford Street Development Company's new project The Lulu DeLux has three components: Office, Retail and Multifamily. There are 12,500 feet of office space, 25,000 feet of retail space and 10 apartments. The office space is subject to a ten-year gross lease at $30 per sq. ft per year with $0.50 annual increases. Base year expenses are $12 per square foot. Expenses are expected to rise at 3% per annum. The retail space pays a $20 base rent per sq ft per year and 8% participating rent over a natural breakpoint on a ten-year lease. The base rent increases at the beginning of year 6 to $25 per square foot and the percentage rent resets. First year sales are $300 per square foot. Sales are expected to grow at a rate of 4% per annum. Retail expenses are 1.5 times the level of office expenses on a per square foot basis. The retail tenant reimburses 90% of actual expenses. Of the 10 apartments there are 5 one bedrooms and 5 two bedrooms. Multifamily monthly rents start at $1500 for a one bed and $2700 for a two bedroom. All leases are one-year leases. They will rise each year at the CPI of 3.5%. Residential expenses are 40% of rents. You will hold the building for 10 years. Assume the building is five stories tall. Each floor is the same size. Office is on one floor. Exit cap rates are 5% for multifamily and 6% for each of retail and office. Question 5: What can you sell the building for at the end the investment period